Time Magazine 2014 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

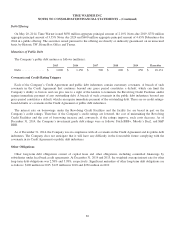

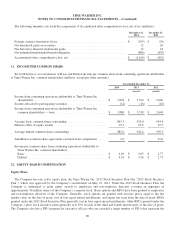

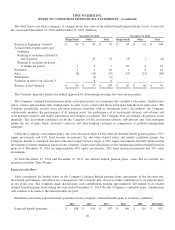

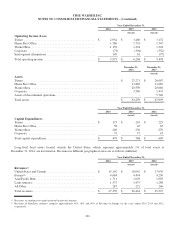

The following table summarizes information about unvested RSUs and target PSUs as of December 31, 2014:

Number of

Shares/Units

Weighted-

Average

Grant Date

Fair Value

Aggregate

Intrinsic

Value

(thousands) (thousands)

Unvested as of December 31, 2013 ........................... 14,566 $ 40.31

Granted(a) ................................................ 2,960 66.44

Vested .................................................. (5,882) 34.82

Forfeited ................................................ (1,035) 42.96

Adjustment due to the Time Separation(b) ...................... 500

Unvested as of December 31, 2014(b) .......................... 11,109 48.68 $ 948,897

(a) Includes 2.7 million RSUs and 0.2 million target PSUs granted during 2014 and a payout adjustment of 0.1 million PSUs due to the actual performance

level achieved for PSUs granted in 2011 that vested during 2014.

(b) The weighted-average grant date fair value of the RSUs and target PSUs included in the line item “Adjustment due to the Time Separation” is equal to

the weighted-average grant date fair value of the awards at their respective grant date divided by a factor of approximately 1.04. The weighted-average

grant date fair value of the unvested RSUs and target PSUs as of December 31, 2014 reflect the Adjustment.

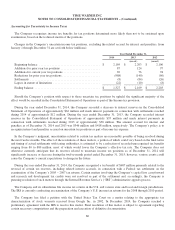

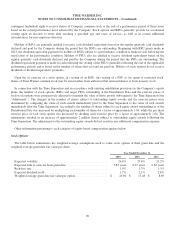

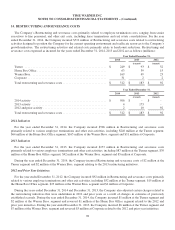

The following table sets forth the total intrinsic value of RSUs and target PSUs that vested during the following years

(millions):

Year Ended December 31,

2014 2013 2012

RSUs ................................................... $ 366 $ 291 $ 177

PSUs ................................................... 17 27 11

Equity-Based Compensation Expense

The impact on Operating income for equity-based compensation awards is as follows (millions):

Year Ended December 31,

2014 2013 2012

(recast) (recast)

Stock options ............................................ $ 26 $ 33 $ 45

RSUs and PSUs .......................................... 193 205 150

Total impact on operating income ............................ $ 219 $ 238 $ 195

Tax benefit recognized ..................................... $ 76 $ 78 $ 66

Total unrecognized compensation cost related to unvested Time Warner stock option awards as of December 31, 2014,

without taking into account expected forfeitures, is $47 million and is expected to be recognized over a weighted-average

period between one and two years. Total unrecognized compensation cost related to unvested RSUs and target PSUs as of

December 31, 2014, without taking into account expected forfeitures, is $182 million and is expected to be recognized over a

weighted-average period between one and two years.

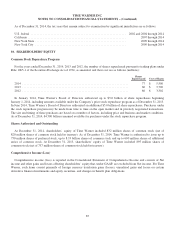

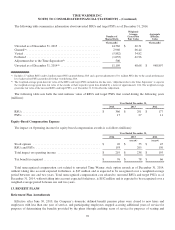

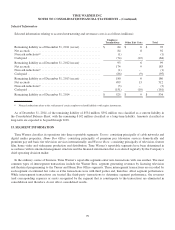

13. BENEFIT PLANS

Retirement Plan Amendments

Effective after June 30, 2010, the Company’s domestic defined benefit pension plans were closed to new hires and

employees with less than one year of service, and participating employees stopped accruing additional years of service for

purposes of determining the benefits provided by the plans (though crediting years of service for purposes of vesting and

92