Time Magazine 2014 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

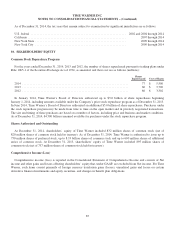

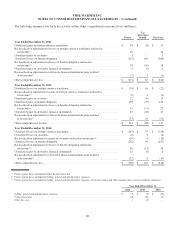

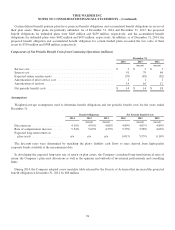

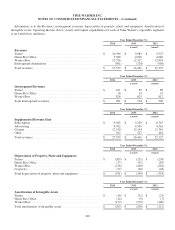

The following table summarizes information about stock options outstanding as of December 31, 2014:

Number

of Options

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value

(thousands) (in years) (thousands)

Outstanding as of December 31, 2013 ............. 36,493 $ 33.41

Granted ..................................... 3,129 76.96

Exercised ................................... (10,214) 32.99

Forfeited or expired ........................... (947) 43.75

Adjustment due to the Time Separation(a) .......... 1,360

Outstanding as of December 31, 2014(a) ........... 29,821 36.27 4.88 $ 1,470,001

Exercisable as of December 31, 2014(a) ............ 22,454 30.22 3.83 $ 1,239,551

(a) The weighted-average exercise price of the stock options included in the line item “Adjustment due to the Time Separation” is equal to the weighted-

average exercise price of the stock options at their grant date divided by a factor of approximately 1.04. The weighted-average exercise price of the stock

options outstanding and exercisable as of December 31, 2014 reflect the Adjustment.

As of December 31, 2014, the number, weighted-average exercise price, aggregate intrinsic value and weighted-average

remaining contractual term of the aggregate Time Warner stock options that either had vested or are expected to vest

approximate the corresponding amounts for options outstanding. As of December 31, 2014, approximately 30 million shares

of Time Warner common stock were available for future grants of stock options under the Company’s equity plan.

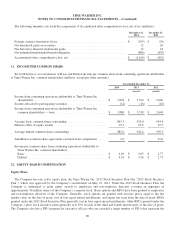

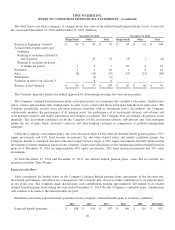

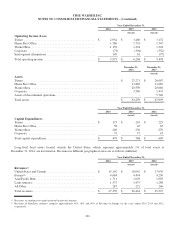

The following table summarizes information about stock options exercised (millions):

Year Ended December 31,

2014 2013 2012

Total intrinsic value ......................................... $ 402 $ 491 $ 342

Cash received .............................................. 338 674 1,107

Tax benefits realized ........................................ 143 178 127

Restricted Stock Units and Target Performance Stock Units

The following table sets forth the weighted-average grant date fair value of RSUs and target PSUs. For certain PSUs, the

service inception date precedes the grant date and requires the Company to apply mark-to-market accounting that is reflected

in the grant date fair values presented:

Year Ended December 31,

2014 2013 2012

RSUs .................................................... $ 65.56 $ 54.04 $ 37.52

PSUs .................................................... 93.45 101.14 85.42

91