Time Magazine 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

On January 16, 2014, Time Warner sold the space it owned in Time Warner Center for approximately $1.3 billion and

agreed to lease space in Time Warner Center from the buyer until early 2019. In connection with these transactions, the

Company recognized a pretax gain of $441 million and a tax benefit of $58 million during 2014. Additionally, a pretax gain

of approximately $325 million has been deferred and is being recognized ratably over the lease period. In February 2015, the

Company entered into agreements relating to the construction and development of office and studio space in the Hudson

Yards development on the west side of Manhattan in order to consolidate its Corporate headquarters and its New York City-

based employees. Based on current construction cost and space projections, the Company expects to invest approximately

$1.7 billion in the Hudson Yards development project over the next five years.

Cash Flows

Cash and equivalents increased by $802 million, including $190 million of Cash used by discontinued operations, for the

year ended December 31, 2014. Cash and equivalents decreased by $944 million, including $468 million of Cash provided

by discontinued operations for the year ended December 31, 2013. Components of these changes are discussed below in

more detail.

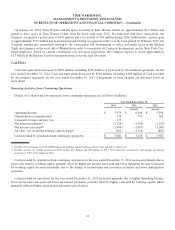

Operating Activities from Continuing Operations

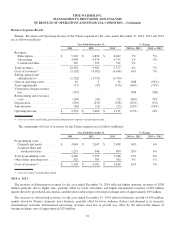

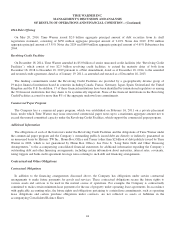

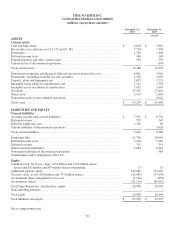

Details of Cash provided by operations from continuing operations are as follows (millions):

Year Ended December 31,

2014 2013 2012

(recast) (recast)

Operating Income .......................................... $ 5,975 $ 6,268 $ 5,498

Depreciation and amortization ................................ 733 759 765

Venezuela foreign currency loss ............................... 173 - -

Net interest payments(a) ...................................... (1,224) (1,158) (1,220)

Net income taxes paid(b) ..................................... (1,494) (1,087) (1,189)

All other, net, including working capital changes ................. (482) (1,524) (867)

Cash provided by operations from continuing operations ........... $ 3,681 $ 3,258 $ 2,987

(a) Includes interest income received of $50 million, $44 million and $42 million in 2014, 2013 and 2012, respectively.

(b) Includes income tax refunds received of $108 million, $87 million and $78 million in 2014, 2013 and 2012, respectively, and income tax sharing

payments to TWC of $6 million in 2012.

Cash provided by operations from continuing operations for the year ended December 31, 2014 increased primarily due to

lower cash used by working capital, partially offset by higher net income taxes paid and lower Operating Income. Cash used

by working capital decreased primarily due to the timing of restructuring and severance payments and lower participation

payments.

Cash provided by operations for the year ended December 31, 2013 increased primarily due to higher Operating Income,

lower net income taxes paid and lower net interest payments, partially offset by higher cash used by working capital, which

primarily reflected higher participation payments and advances.

41