Time Magazine 2014 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

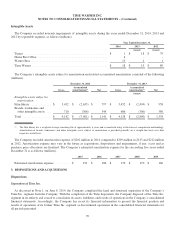

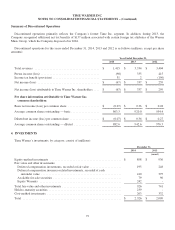

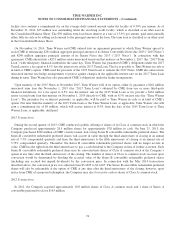

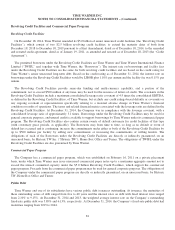

Available-for-sale securities are recorded at fair value in the Consolidated Balance Sheet, and the realized gains and losses

are included as a component of Other loss, net in the Consolidated Statement of Operations. The cost basis, unrealized gains

and fair market value of available-for-sale securities are set forth below (millions):

December 31,

2014 2013

(recast)

Cost basis .............................................................. $ 59 $ 53

Gross unrealized gain ..................................................... 22 46

Gross unrealized loss ..................................................... (2) (3)

Fair value .............................................................. $ 79 $ 96

Gains and losses reclassified from Accumulated other comprehensive loss, net to Other loss, net in the Consolidated

Statement of Operations are determined based on the specific identification method.

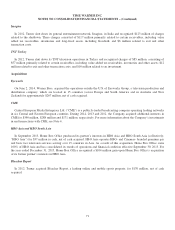

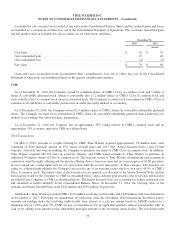

CME

As of December 31, 2014, the Company owned 61.4 million shares of CME’s Class A common stock and 1 share of

Series A convertible preferred stock, which is convertible into 11.2 million shares of CME’s Class A common stock and

votes with the Class A common stock on an as-converted basis. The Company accounts for its investment in CME’s Class A

common stock and Series A convertible preferred stock under the equity method of accounting.

As of December 31, 2014, the Company owned 92.4 million shares of CME’s Series B convertible redeemable preferred

shares. The Company accounts for its investment in CME’s Series B convertible redeemable preferred shares under the cost

method of accounting. See below for more information.

As of December 31, 2014, the Company has an approximate 49% voting interest in CME’s common stock and an

approximate 75% economic interest in CME on a diluted basis.

2014 Transactions

On May 2, 2014, pursuant to a rights offering by CME, Time Warner acquired approximately 2.8 million units, each

consisting of $100 principal amount of 15% senior secured notes due 2017 (the “Senior Secured Notes”) and 21 unit

warrants, with each unit warrant entitling the Company to purchase one share of CME Class A common stock. In addition,

Time Warner acquired 581,533 units in a private offering, and CME issued warrants to Time Warner to purchase an

additional 30 million shares of Class A common stock. The warrants issued to Time Warner, including the unit warrants in

connection with the rights offering and the private offering, have a four-year term and an exercise price of $1.00 per share,

do not contain any voting rights and are not exercisable until the second anniversary of their issuance. The warrants are

subject to a limited right whereby the Company can exercise any of its warrants earlier solely to own up to 49.9% of CME’s

Class A common stock. The initial value of the warrants was recognized as a discount to the Senior Secured Notes and the

term loan provided by the Company to CME (as described below) and a deferred gain related to the revolving credit facility

provided by the Company to CME (as described below). The Senior Secured Notes are accounted for at their amortized cost

and classified as held-to-maturity in the Consolidated Balance Sheet. At December 31, 2014, the carrying value of the

warrants and Senior Secured Notes were $242 million and $239 million, respectively.

Additionally, Time Warner provided CME a $115 million revolving credit facility and a $30 million term loan that mature

on December 1, 2017. Following an amendment in connection with the November 2014 transactions described below,

amounts outstanding under the revolving credit facility bear interest at a rate per annum based on LIBOR (subject to a

minimum rate of 1.00%) plus 9%. CME can pay accrued interest for an applicable quarterly interest period either fully in

cash or by adding such amount to the outstanding principal amount of the revolving credit facility. The revolving credit

73