Time Magazine 2014 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

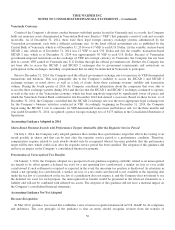

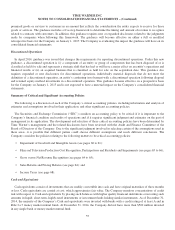

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

value, an impairment loss is recognized for the difference. Significant judgments in this area involve determining the

appropriate asset group level at which to test, determining whether a triggering event has occurred, determining the future

cash flows for the assets involved and selecting the appropriate discount rate to be applied in determining estimated fair

value. For more information, see Note 2.

Accounting for Pension Plans

The Company and certain of its subsidiaries have both funded and unfunded defined benefit pension plans, the substantial

majority of which are noncontributory, covering a majority of domestic employees and, to a lesser extent, have various

defined benefit plans, primarily noncontributory, covering certain international employees. Pension benefits are based on

formulas that reflect the participating employees’ years of service and compensation. Time Warner’s largest defined benefit

pension plan is closed for new employees and frozen to future benefit accruals. Time Warner uses a December 31st

measurement date for its plans. The pension expense recognized by the Company is determined using certain assumptions,

including the expected long-term rate of return on plan assets, the interest factor implied by the discount rate and the rate of

compensation increases. For more information, see Note 13.

Equity-Based Compensation

The Company measures the cost of employee services received in exchange for an award of equity instruments based on

the grant-date fair value of the award. That cost is recognized in Costs of revenues or Selling, general and administrative

expenses depending on the job function of the grantee on a straight-line basis (net of estimated forfeitures) from the date of

grant over the period during which an employee is required to provide services in exchange for the award. The total grant-

date fair value of an equity award granted to an employee who has reached a specified age and years of service as of the

grant date is recognized as compensation expense immediately upon grant as there is no required service period.

The grant-date fair value of a restricted stock unit (“RSU”) is determined based on the closing sale price of the Company’s

common stock on the NYSE Composite Tape on the date of grant.

Performance stock units (“PSUs”) are subject to a performance condition such that the number of PSUs that ultimately

vest generally depends on the adjusted earnings per share (“Adjusted EPS”) achieved by the Company during a three-year

performance period compared to targets established at the beginning of the period. The PSUs are also subject to a market

condition and the number of PSUs that vest can be increased or decreased based on the Company’s cumulative total

shareholder return (“TSR”) relative to the TSR of the other companies in the S&P 500 Index for the performance period.

Because the terms of the PSUs provide discretion to make certain adjustments to the performance calculation, the service

inception date of these awards precedes the grant date. Accordingly, the Company recognizes compensation expense

beginning on the service inception date and remeasures the fair value of the PSU until a grant date occurs, which is typically

after the completion of the required service period. PSUs, as well as RSUs granted to certain senior executives beginning in

2012, also are subject to a performance condition based on an adjusted net income target for a one-year period that, if not

achieved, will result in the forfeiture of the awards.

The grant-date fair value of a stock option is estimated using the Black-Scholes option-pricing model.Because the Black-

Scholes option-pricing model requires the use of subjective assumptions, changes in these assumptions can materially affect

the fair value of the stock options. The Company determines the volatility assumption for these stock options using implied

volatilities data from its traded options. The expected term, which represents the period of time that stock options granted are

expected to be outstanding, is estimated based on the historical exercise behavior of Time Warner employees. Groups of

employees that have similar historical exercise behavior are considered separately for valuation purposes. The risk-free rate

assumed in valuing the options is based on the U.S. Treasury yield curve in effect at the time of grant for the expected term

of the option. The Company determines the expected dividend yield percentage by dividing the expected annual dividend by

the market price of Time Warner common stock at the date of grant. For more information, see Note 12.

62