Time Magazine 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

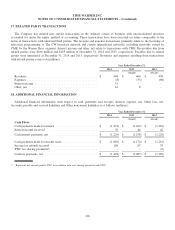

17. RELATED PARTY TRANSACTIONS

The Company has entered into certain transactions in the ordinary course of business with unconsolidated investees

accounted for under the equity method of accounting. These transactions have been executed on terms comparable to the

terms of transactions with unrelated third parties. The revenue and expense transactions primarily relate to the licensing of

television programming to The CW broadcast network and certain international networks, including networks owned by

CME, by the Warner Bros. segment. Interest income and other, net relate to transactions with CME. Receivables due from

related parties were $166 million and $185 million at December 31, 2014 and 2013, respectively. Payables due to related

parties were immaterial at December 31, 2014 and 2013, respectively. Revenues and expenses resulting from transactions

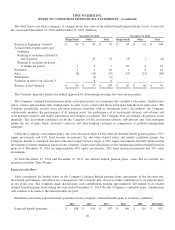

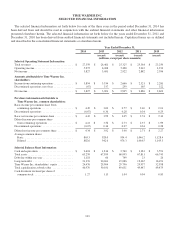

with related parties consist of (millions):

Year Ended December 31,

2014 2013 2012

(recast) (recast)

Revenues .............................................. $ 404 $ 464 $ 498

Expenses .............................................. (8) (35) (60)

Interest income ......................................... 51 - -

Other, net ............................................. 16 8 -

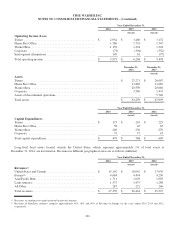

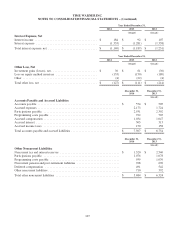

18. ADDITIONAL FINANCIAL INFORMATION

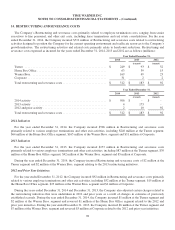

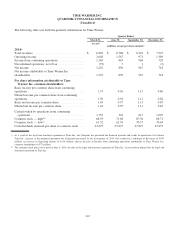

Additional financial information with respect to cash payments and receipts, Interest expense, net, Other loss, net,

Accounts payable and accrued liabilities and Other noncurrent liabilities is as follows (millions):

Year Ended December 31,

2014 2013 2012

(recast) (recast)

Cash Flows

Cash payments made for interest ........................... $ (1,274) $ (1,202) $ (1,262)

Interest income received .................................. 50 44 42

Cash interest payments, net ............................... $ (1,224) $ (1,158) $ (1,220)

Cash payments made for income taxes ....................... $ (1,602) $ (1,174) $ (1,261)

Income tax refunds received ............................... 108 87 78

TWC tax sharing payments(a) .............................. - - (6)

Cash tax payments, net ................................... $ (1,494) $ (1,087) $ (1,189)

(a) Represents net amounts paid to TWC in accordance with a tax sharing agreement with TWC.

106