Time Magazine 2014 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

activities intended to retain existing subscribers and acquire new subscribers may also impact revenue earned. Home Box

Office also derives subscription revenues from the distribution by international affiliates of country-specific HBO and

Cinemax premium pay and basic tier television services to their local subscribers. HBO GO is available to HBO premium

pay television subscribers in a number of countries outside the U.S. Additional sources of revenues for Home Box Office are

(i) the home entertainment sales of its original programming, including Game of Thrones,True Blood,True Detective and

Boardwalk Empire, on DVDs and Blu-ray Discs and via electronic sell-through (“EST”) and (ii) the licensing of its original

programming to international and domestic television networks and SVOD services.

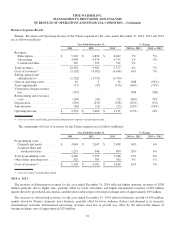

Warner Bros. Time Warner’s Warner Bros. segment consists of businesses managed by Warner Bros. Entertainment

Inc. (“Warner Bros.”) that principally produce and distribute television shows, feature films and videogames. During the year

ended December 31, 2014, the Warner Bros. segment recorded Revenues of $12.526 billion (43% of the Company’s total

Revenues) and Operating Income of $1.159 billion.

Warner Bros. is a leader in the television content industry. For the 2014/2015 season, Warner Bros. has produced over 60

series in the U.S., including (i) at least two series for each of the five broadcast networks (including 2 Broke Girls,Arrow,

The Bachelor,The Big Bang Theory,The Flash,The Following,Forever,Gotham, The Middle,Mike & Molly,Mom,Person

of Interest,Stalker,Vampire Diaries and The Voice), (ii) original series for cable television networks (including Major

Crimes,Pretty Little Liars and Rizzoli & Isles), (iii) series for premium pay television services (The Leftovers and

Shameless), (iv) series for first-run syndication (including The Ellen DeGeneres Show,Extra and TMZ) and (v) animated

series for cable television networks. Warner Bros. also licenses many of its series internationally. In 16 countries (located

across Europe and South America and in Australia and New Zealand), Warner Bros. operates a group of local television

production companies that focus on developing non-scripted programs and formats that can be sold internationally and

adapted for sale in the U.S. In addition, Warner Bros. produces local versions of programs it created in the U.S. as well as

original local television programming for international territories.

Warner Bros. is also a leader in the feature film industry and produces feature films under its Warner Bros. and New Line

Cinema banners. The Warner Bros. segment’s theatrical product revenues are generated principally through rental fees from

theatrical exhibition of feature films, including the following recently released films: Annabelle,American Sniper, Edge of

Tomorrow,Godzilla,The Hobbit: The Battle of the Five Armies,Interstellar,The LEGO Movie and Tammy, and

subsequently through licensing fees received from the distribution of films on premium pay television, television broadcast

and cable networks and SVOD services. Television product revenues are generated principally from the licensing of

programs to broadcast and cable television networks and premium pay television and SVOD services.

The segment also generates television and theatrical product revenues from the distribution of television and theatrical

product in various digital formats (e.g., EST and video-on-demand) and on DVDs and Blu-ray Discs for home entertainment.

In addition, the segment generates revenues through the development and distribution of videogames. Warner Bros.’

television and film businesses benefit from a shared infrastructure, including shared production, distribution, marketing and

administrative functions and resources.

The distribution and sale of physical discs is one of the largest contributors to the segment’s revenues and profits. In

recent years, sales of physical discs have declined as the home entertainment industry has been undergoing significant

changes as it transitions from the physical distribution of film and television content via DVDs and Blu-ray Discs to the

electronic delivery of such content. Several factors have contributed to this decline, including consumers shifting

to subscription rental services and discount rental kiosks, which generate significantly less revenue per transaction for the

Company than physical disc sales; changing retailer initiatives and strategies (e.g., reduction of floor space devoted to

physical discs); retail store closures; increasing competition for consumer discretionary time and spending; and piracy. The

electronic delivery of film and television content is growing and becoming more important to the Warner Bros. segment,

which has helped to offset some of the decline in sales of physical discs. During 2014, across the home entertainment

industry, consumer spending on physical discs continued to decline and consumer spending on electronic delivery continued

to increase.

22