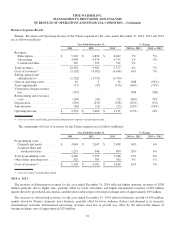

Time Magazine 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

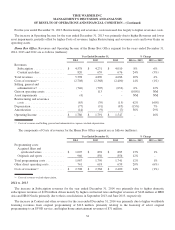

Refer to “Transactions and Other Items Affecting Comparability” for a discussion of Asset impairments, Gain (loss) on

operating assets and external costs related to mergers, acquisitions and dispositions for the years ended December 31, 2013

and 2012, which affected the comparability of the Warner Bros. segment’s results.

The increase in Restructuring and severance costs for the year ended December 31, 2013 was primarily related to

executive severance costs.

The increase in Operating Income for the year ended December 31, 2013 was primarily due to higher Revenues, partially

offset by higher Costs of revenues and higher Restructuring and severance costs.

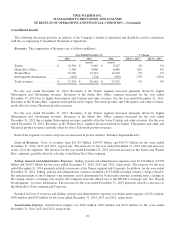

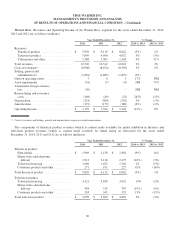

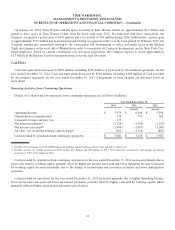

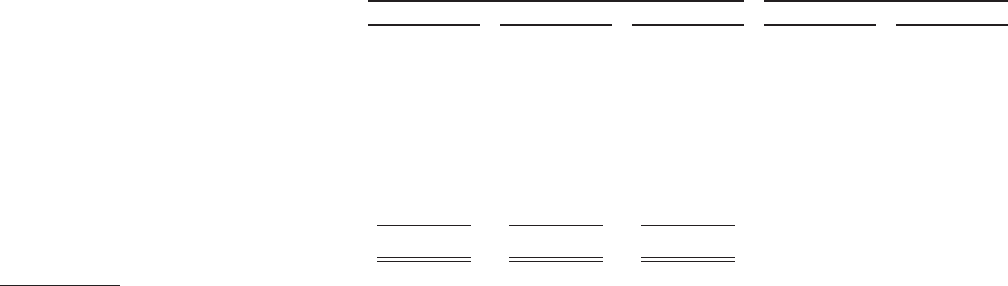

Corporate. Operating Loss at Corporate for the years ended December 31, 2014, 2013 and 2012 was as follows

(millions):

Year Ended December 31, % Change

2014 2013 2012 2014 vs. 2013 2013 vs. 2012

Selling, general and

administrative(a) ................. $ (449) $ (403) $ (332) 11% 21%

Curtailment ...................... - 38 - (100%) -

Gain on operating assets ............ 441 8 10 NM (20%)

Asset impairments ................. (7) (7) - - -

Restructuring and severance

costs .......................... (31) (2) (2) NM -

Depreciation ...................... (27) (28) (28) (4%) -

Operating Loss ................... $ (73) $ (394) $ (352) (81%) 12%

(a) Selling, general and administrative expenses exclude depreciation.

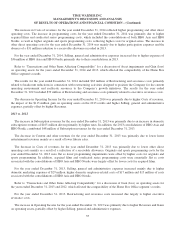

2014 vs. 2013

Refer to “Transactions and Other Items Affecting Comparability” for a discussion of Asset impairments, Gain on

operating assets, the Curtailment and external costs related to mergers, acquisitions and dispositions for the years ended

December 31, 2014 and 2013, which affected the comparability of Corporate’s results.

The results for the year ended December 31, 2014 included $31 million of Restructuring and severance costs primarily

related to headcount reductions in connection with restructuring activities designed to position the Company for the current

operating environment and reallocate resources to the Company’s growth initiatives.

Excluding the transactions noted above, Operating Loss for the year ended December 31, 2014 increased primarily due to

the absence of a benefit associated with a reduction in certain accrued employee benefit plan liabilities in 2013.

Selling, general and administrative expenses included costs related to enterprise efficiency initiatives of $43 million and

$49 million for the years ended December 31, 2014 and 2013, respectively. The enterprise efficiency initiatives involve the

centralization of certain administrative functions to generate cost savings or other benefits for the Company.

2013 vs. 2012

Refer to “Transactions and Other Items Affecting Comparability” for a discussion of Asset impairments, Gain (loss) on

operating assets, the Curtailment and external costs related to mergers, acquisitions and dispositions for the years ended

December 31, 2013 and 2012, which affected the comparability of Corporate’s results.

For the year ended December 31, 2013, Operating Loss increased due primarily to higher equity-based compensation

expense of $26 million, which mainly reflected higher expenses for performance stock units due to an increase in the

Company’s stock price and the Company’s expected performance relative to the award performance targets, higher external

39