Time Magazine 2014 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

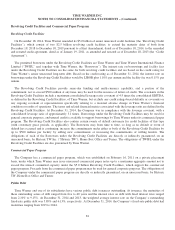

facility also contains a commitment fee on the average daily unused amount under the facility of 0.50% per annum. As of

December 31, 2014, $25 million was outstanding under the revolving credit facility, which is classified as an other asset in

the Consolidated Balance Sheet. The $30 million term loan bears interest at a rate of 15.0% per annum, paid semi-annually

either fully in cash or by adding such amount to the principal amount of the loan. The term loan is classified as an other asset

in the Consolidated Balance Sheet.

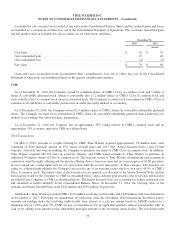

On November 14, 2014, Time Warner and CME entered into an agreement pursuant to which Time Warner agreed to

assist CME in refinancing $261 million aggregate principal amount of its Senior Convertible Notes due 2015 (“2015 Notes”)

and €240 million aggregate principal amount of its Senior Notes due 2017 (“2017 Notes”). In connection with this

agreement, CME entered into a €251 million senior unsecured term loan that matures on November 1, 2017 (the “2017 Term

Loan”) with third-party financial institutions the same day. Time Warner has guaranteed CME’s obligations under the 2017

Term Loan for a fee equal to 8.5% less the interest rate on the 2017 Term Loan. The fee is payable to Time Warner in cash or

in kind at CME’s option. CME used the proceeds of the 2017 Term Loan to redeem the 2017 Notes. CME also entered into

unsecured interest rate hedge arrangements to protect against changes in the applicable interest rate on the 2017 Term Loan

during its term. Time Warner has also guaranteed CME’s obligations under the hedge arrangements.

Upon maturity of the 2015 Notes in November 2015, Time Warner will, at its option, either (i) guarantee a $261 million

unsecured term loan due November 1, 2019 (the “2015 Term Loan”) obtained by CME from one or more third-party

financial institutions, for a fee equal to 8.5% less the interest rate on the 2015 Term Loan or (ii) provide a $261 million

senior secured term loan that matures on November 1, 2019 directly to CME, with an 8.5% interest rate (the “Time Warner

Loan”). The guarantee fee or interest payments, as applicable, will be paid to Time Warner in cash or in kind at CME’s

option. Not later than the maturity of the 2015 Term Loan or the Time Warner Loan, as applicable, Time Warner also will

earn a commitment fee of $9 million, which will accrue interest at 8.5% from the date of the 2015 Term Loan or Time

Warner Loan, as applicable, until paid.

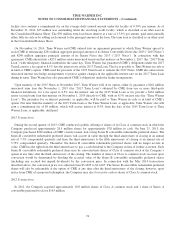

2013 Transactions

During the second quarter of 2013, CME conducted a public offering of shares of its Class A common stock in which the

Company purchased approximately 28.5 million shares for approximately $78 million in cash. On June 25, 2013, the

Company purchased $200 million of CME’s newly-issued, non-voting Series B convertible redeemable preferred shares. The

Series B convertible redeemable preferred shares will accrete in value through the third anniversary of closing at an annual

rate of 7.5% compounded quarterly and from the third anniversary to the fifth anniversary of closing at an annual rate of

3.75% compounded quarterly. Thereafter, the Series B convertible redeemable preferred shares will no longer accrete in

value. CME has the right from the third anniversary to pay a cash dividend to the Company in lieu of further accretion. Each

Series B convertible redeemable preferred share may be converted into shares of Class A common stock at the Company’s

option at any time after the third anniversary of the closing. The number of shares of Class A common stock received upon

conversion would be determined by dividing the accreted value of the Series B convertible redeemable preferred shares

(including any accrued but unpaid dividends) by the conversion price. In connection with the May 2014 transactions

described above, the conversion price was adjusted from $3.1625 to $2.4167. The Series B convertible redeemable preferred

shares will also be redeemable at the option of CME at any time after the third anniversary of the closing; however, upon

notice from CME of a proposed redemption, the Company may elect to receive cash or shares of Class A common stock.

2012 Transactions

In 2012, the Company acquired approximately 10.8 million shares of Class A common stock and 1 share of Series A

convertible preferred stock for $165 million.

74