Time Magazine 2014 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

Restructuring Activities

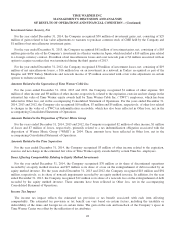

During 2014, the Company incurred $512 million of Restructuring and severance costs primarily related to headcount

reductions associated with restructuring activities designed to position the Company for the current operating environment

and reallocate resources to the Company’s growth initiatives. The Restructuring and severance costs by operating segment

and at Corporate are as follows: $249 million at Turner, $63 million at Home Box Office, $169 million at Warner Bros. and

$31 million at Corporate. Headcount reductions associated with these restructuring activities were approximately 4,000.

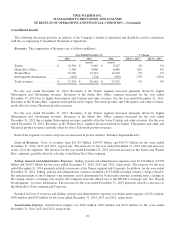

In addition to the restructuring activities noted above, during 2014, Turner conducted a strategic evaluation of its

programming, and, as a result of such evaluation decided to no longer air certain programming, which consisted principally

of licensed programming. In connection with that decision, the Company incurred $388 million of programming impairments

related to programming that will no longer be aired, reflecting $526 million of charges at the Turner segment, partially offset

by $138 million of intercompany eliminations primarily related to intercompany profits on programming licensed by the

Warner Bros. segment to the Turner segment. Such charges have been classified as Costs of revenues in the Consolidated

Statement of Operations.

Tax Matter

During the third quarter of 2014, the Company recognized a tax benefit of $687 million primarily related to the reversal of

certain tax reserves, including related interest accruals, in connection with a Federal tax settlement on the examination of the

Company’s 2005-2007 tax returns. Certain matters addressed in the examination were not resolved and, accordingly, the

Company is pursuing resolution of such matters through the Internal Revenue Service’s administrative appeals process.

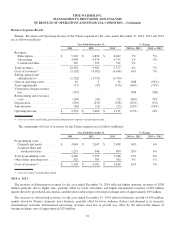

NBA Agreement

On October 3, 2014, Turner entered into a nine-year agreement with the National Basketball Association (“NBA”), which

extends Turner’s relationship with the NBA through the 2024/2025 season and increases TNT’s regular season coverage

from 52 live games annually to 64 live games annually beginning with the 2016/2017 season. The agreement also provides

Turner with enhanced digital rights during the extension period. The aggregate cash commitment for the programming rights

under the new agreement is approximately $10.5 billion.

2014 Debt Offering

On May 20, 2014, Time Warner issued $2.0 billion aggregate principal amount of debt securities in a public offering. See

“Financial Condition and Liquidity – Outstanding Debt and Other Financing Arrangements” for more information.

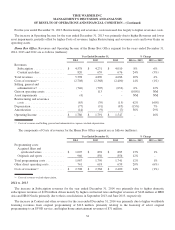

Central European Media Enterprises Ltd.

On May 2, 2014, pursuant to a rights offering by Central European Media Enterprises Ltd. (“CME”), Time Warner

acquired approximately 2.8 million units, each consisting of $100 principal amount of 15% senior secured notes due 2017

and 21 unit warrants, with each unit warrant entitling the Company to purchase one share of CME Class A common stock. In

addition, Time Warner acquired 581,533 units in a private offering, and CME issued warrants to Time Warner to purchase an

additional 30 million shares of Class A common stock. The warrants issued to Time Warner, including the unit warrants in

connection with the rights offering and the private offering, have a four-year term and an exercise price of $1.00 per share,

do not contain any voting rights and are not exercisable until the second anniversary of their issuance. The warrants are

subject to a limited right whereby the Company can exercise any of its warrants earlier solely to own up to 49.9% of CME’s

Class A common stock.

Additionally, Time Warner provided CME a $115 million revolving credit facility and a $30 million term loan that mature

on December 1, 2017. Following an amendment in connection with the November 2014 transactions described below,

24