Time Magazine 2014 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

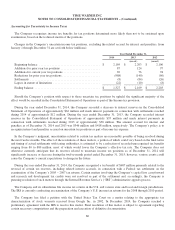

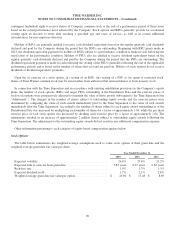

As of December 31, 2014, the tax years that remain subject to examination by significant jurisdiction are as follows:

U.S. federal ............................................................... 2002 and 2004 through 2014

California ................................................................. 2007 through 2014

New York State ............................................................ 2009 through 2014

New York City ............................................................ 2009 through 2014

10. SHAREHOLDERS’ EQUITY

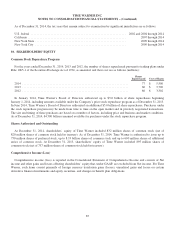

Common Stock Repurchase Program

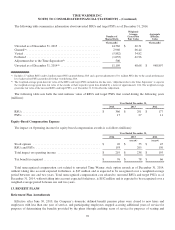

For the years ended December 31, 2014, 2013 and 2012, the number of shares repurchased pursuant to trading plans under

Rule 10b5-1 of the Securities Exchange Act of 1934, as amended, and their cost are as follows (millions):

Shares

Repurchased Cost of Shares

2014 ...................................................................... 77 $ 5,500

2013 ...................................................................... 60 $ 3,700

2012 ...................................................................... 80 $ 3,302

In January 2014, Time Warner’s Board of Directors authorized up to $5.0 billion of share repurchases beginning

January 1, 2014, including amounts available under the Company’s prior stock repurchase program as of December 31, 2013.

In June 2014, Time Warner’s Board of Directors authorized an additional $5.0 billion of share repurchases. Purchases under

the stock repurchase program may be made from time to time on the open market and in privately negotiated transactions.

The size and timing of these purchases are based on a number of factors, including price and business and market conditions.

As of December 31, 2014, $4.500 billion remained available for purchases under the stock repurchase program.

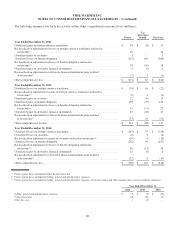

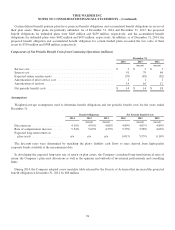

Shares Authorized and Outstanding

At December 31, 2014, shareholders’ equity of Time Warner included 832 million shares of common stock (net of

820 million shares of common stock held in treasury). As of December 31, 2014, Time Warner is authorized to issue up to

750 million shares of preferred stock, up to 8.33 billion shares of common stock and up to 600 million shares of additional

series of common stock. At December 31, 2013, shareholders’ equity of Time Warner included 895 million shares of

common stock (net of 757 million shares of common stock held in treasury).

Comprehensive Income (Loss)

Comprehensive income (loss) is reported in the Consolidated Statement of Comprehensive Income and consists of Net

income and other gains and losses affecting shareholders’ equity that, under GAAP, are excluded from Net income. For Time

Warner, such items consist primarily of foreign currency translation gains (losses), unrealized gains and losses on certain

derivative financial instruments and equity securities, and changes in benefit plan obligations.

87