Time Magazine 2014 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

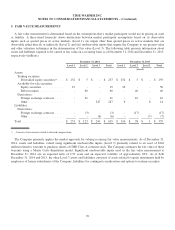

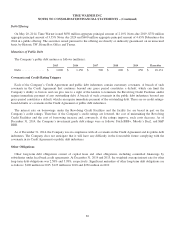

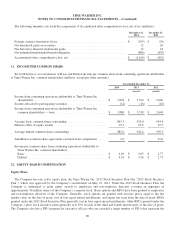

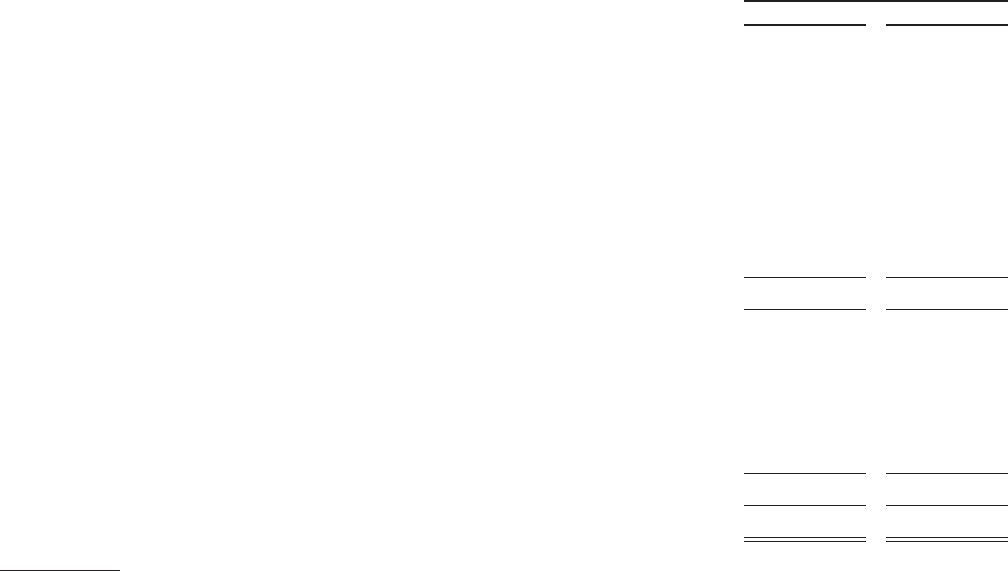

Significant components of Time Warner’s net deferred tax liabilities are as follows (millions):

December 31,

2014 2013

(recast)

Deferred tax assets:

Tax attribute carryforwards(a) .............................................. $ 305 $ 999

Receivable allowances and return reserves ................................... 168 199

Royalties, participations and residuals ....................................... 429 444

Investments ............................................................ 62 180

Equity-based compensation ............................................... 218 239

Amortization ........................................................... 231 184

Other ................................................................. 1,345 1,169

Valuation allowances(a) ................................................... (275) (504)

Total deferred tax assets .................................................. $ 2,483 $ 2,910

Deferred tax liabilities:

Assets acquired in business combinations .................................... $ 2,874 $ 2,939

Unbilled television receivables ............................................. 998 933

Unremitted earnings of foreign subsidiaries ................................... 41 241

Depreciation ........................................................... 264 220

Other ................................................................. 326 495

Total deferred tax liabilities ............................................... 4,503 4,828

Net deferred tax liability .................................................. $ 2,020 $ 1,918

(a) The Company has recorded valuation allowances for certain tax attribute carryforwards and other deferred tax assets due to uncertainty that exists

regarding future realizability. The tax attribute carryforwards consist of $21 million of tax credits, $58 million of capital losses and $226 million of net

operating losses that expire in varying amounts from 2015 through 2034. If, in the future, the Company believes that it is more likely than not that these

deferred tax benefits will be realized, the majority of the valuation allowances will be recognized in the Consolidated Statement of Operations.

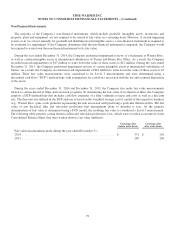

U.S. income and foreign withholding taxes have not been recorded on permanently reinvested earnings of certain foreign

subsidiaries aggregating approximately $1.1 billion at December 31, 2014. Determination of the amount of unrecognized

deferred U.S. income tax liability with respect to such earnings is not practicable.

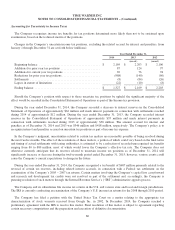

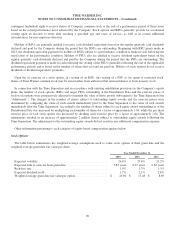

For accounting purposes, the Company records equity-based compensation expense and a related deferred tax asset for the

future tax deductions it may receive. For income tax purposes, the Company receives a tax deduction equal to the stock price

on the date that a restricted stock unit (or performance share unit) vests or the excess of the stock price over the exercise

price of an option upon exercise. The deferred tax asset consists of amounts relating to individual unvested and/or

unexercised equity-based compensation awards; accordingly, deferred tax assets related to certain equity awards may

currently be in excess of the tax benefit ultimately received. The applicable accounting rules require that the deferred tax

asset related to an equity-based compensation award be reduced only at the time the award vests (in the case of a restricted

stock unit or performance share unit), is exercised (in the case of a stock option) or otherwise expires or is cancelled. This

reduction is recorded as an adjustment to Additional paid-in capital (“APIC”), to the extent that the realization of excess tax

deductions on prior equity-based compensation awards were recorded directly to APIC. The cumulative amount of such

excess tax deductions is referred to as the Company’s “APIC Pool.” Any shortfall balance recognized in excess of the

Company’s APIC Pool is charged to Income tax provision in the Consolidated Statement of Operations. The Company’s

APIC Pool was sufficient to absorb any shortfalls such that no shortfalls were charged to the Income tax provision during the

years ended December 31, 2014, 2013 and 2012.

85