Time Magazine 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

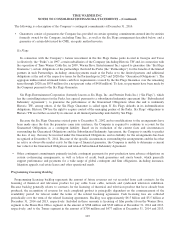

16. COMMITMENTS AND CONTINGENCIES

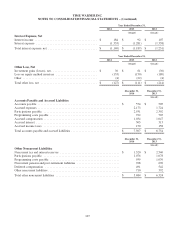

Commitments

Time Warner has commitments under certain network programming, film licensing, creative talent, employment and other

agreements aggregating $33.577 billion at December 31, 2014.

The Company also has commitments for office space, studio facilities and operating equipment. Time Warner’s net rent

expense was $358 million in 2014, $316 million in 2013 and $319 million in 2012. Included in such amounts was sublease

income of $33 million for 2014, $41 million for 2013 and $40 million for 2012.

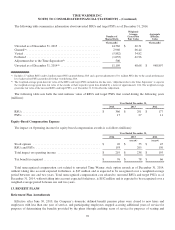

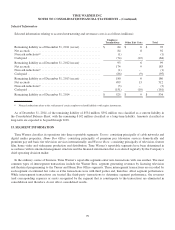

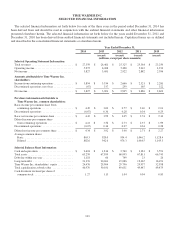

The commitments under certain programming, film licensing, talent and other agreements (“Programming and Other”)

and minimum rental commitments under noncancelable long-term operating leases (“Operating Leases”) payable during the

next five years and thereafter are as follows (millions):

Programming

and Other

Operating

Leases

2015 .................................................................... $ 5,207 $ 317

2016 .................................................................... 3,660 309

2017 .................................................................... 3,626 284

2018 .................................................................... 3,379 259

2019 .................................................................... 3,148 125

Thereafter ................................................................ 14,557 186

Total .................................................................... $ 33,577 $ 1,480

Additionally, as of December 31, 2014, the Company has future sublease income arrangements of $29 million, which are

not included in Operating Leases in the table above.

Contingent Commitments

The Company also has certain contractual arrangements that would require it to make payments or provide funding if

certain circumstances occur (“contingent commitments”). Contingent commitments principally include amounts to be paid in

connection with acquisitions, dispositions and post-production term advance obligations on certain co-financing

arrangements.

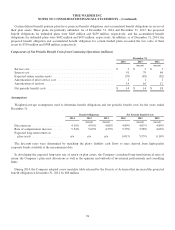

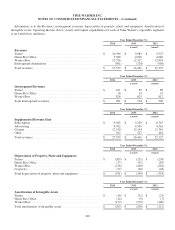

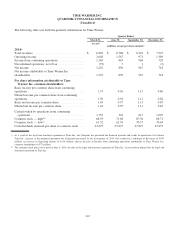

The following table summarizes the Company’s contingent commitments at December 31, 2014. For post-production term

advances where payment obligations are outside the Company’s control, the timing of amounts presented in the table

represents the earliest period in which the payment could be requested. For other contingent commitments, the timing of

amounts presented in the table represents when the maximum contingent commitment will expire, but does not mean that the

Company expects to incur an obligation to make any payments within that time period. In addition, amounts presented do not

reflect the effects of any indemnification rights the Company might possess (millions).

Nature of Contingent Commitments Total 2015 2016-2017 2018-2019 Thereafter

Guarantees ........................... $ 1,536 $ 131 $ 589 $ 85 $ 731

Letters of credit and other contingent

commitments ....................... 817 37 201 12 567

Total contingent commitments ........... $ 2,353 $ 168 $ 790 $ 97 $ 1,298

102