Time Magazine 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

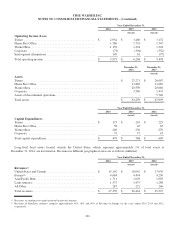

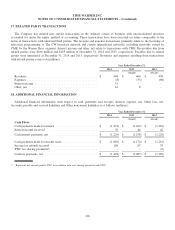

Selected Information

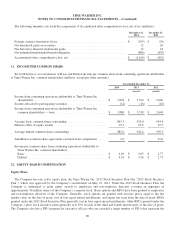

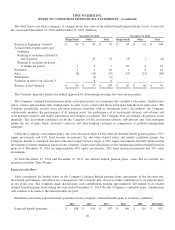

Selected information relating to accrued restructuring and severance costs is as follows (millions):

Employee

Terminations Other Exit Costs Total

Remaining liability as of December 31, 2011 (recast) ............. $ 84 $ 8 $ 92

Net accruals .............................................. 84 8 92

Noncash reductions(a) ....................................... (1) - (1)

Cash paid ................................................ (74) (10) (84)

Remaining liability as of December 31, 2012 (recast) ............. 93 6 99

Net accruals .............................................. 174 9 183

Noncash reductions(a) ....................................... (1) - (1)

Cash paid ................................................ (86) (9) (95)

Remaining liability as of December 31, 2013 (recast) ............. 180 6 186

Net accruals .............................................. 499 13 512

Noncash reductions(a) ....................................... (3) - (3)

Cash paid ................................................ (151) (10) (161)

Remaining liability as of December 31, 2014 .................... $ 525 $ 9 $ 534

(a) Noncash reductions relate to the settlement of certain employee-related liabilities with equity instruments.

As of December 31, 2014, of the remaining liability of $534 million, $392 million was classified as a current liability in

the Consolidated Balance Sheet, with the remaining $142 million classified as a long-term liability. Amounts classified as

long-term are expected to be paid through 2018.

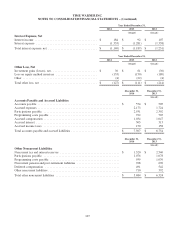

15. SEGMENT INFORMATION

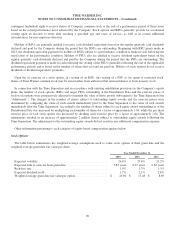

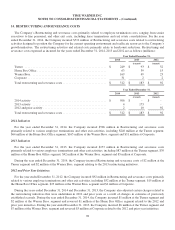

Time Warner classifies its operations into three reportable segments: Turner: consisting principally of cable networks and

digital media properties; Home Box Office: consisting principally of premium pay television services domestically and

premium pay and basic tier television services internationally; and Warner Bros.: consisting principally of television, feature

film, home video and videogame production and distribution. Time Warner’s reportable segments have been determined in

accordance with its internal management structure and the financial information that is evaluated regularly by the Company’s

chief operating decision maker.

In the ordinary course of business, Time Warner’s reportable segments enter into transactions with one another. The most

common types of intersegment transactions include the Warner Bros. segment generating revenues by licensing television

and theatrical programming to the Turner and Home Box Office segments. These intersegment transactions are recorded by

each segment at estimated fair value as if the transactions were with third parties and, therefore, affect segment performance.

While intersegment transactions are treated like third-party transactions to determine segment performance, the revenues

(and corresponding expenses or assets recognized by the segment that is counterparty to the transaction) are eliminated in

consolidation and, therefore, do not affect consolidated results.

99