Time Magazine 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

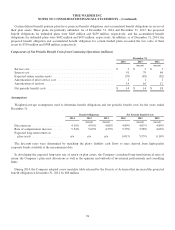

9. INCOME TAXES

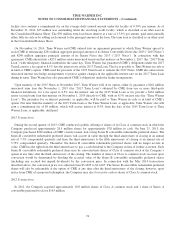

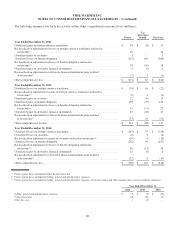

Domestic and foreign income before income taxes and discontinued operations are as follows (millions):

Year Ended December 31,

2014 2013 2012

(recast) (recast)

Domestic ................................................ $ 4,296 $ 4,836 $ 4,097

Foreign ................................................. 383 132 (64)

Total ................................................... $ 4,679 $ 4,968 $ 4,033

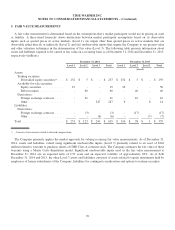

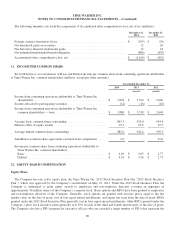

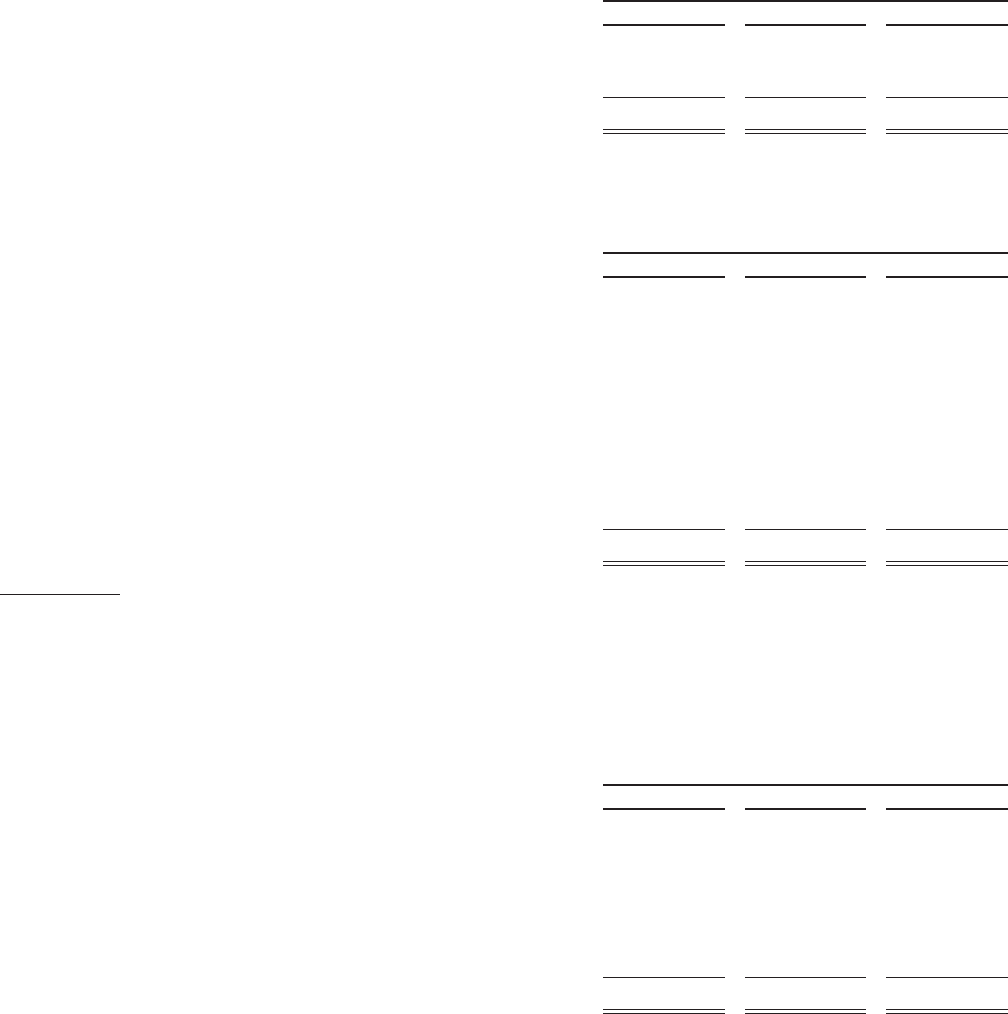

Current and Deferred income taxes (tax benefits) provided on Income from continuing operations are as follows

(millions):

Year Ended December 31,

2014 2013 2012

(recast) (recast)

Federal:

Current ............................................... $ 128 $ 494 $ 1,066

Deferred .............................................. 152 802 (147)

Foreign:

Current(a) .............................................. 466 348 350

Deferred .............................................. - (21) 6

State and Local:

Current ............................................... 25 13 115

Deferred .............................................. 14 (22) (20)

Total(b) ................................................ $ 785 $ 1,614 $ 1,370

(a) Includes foreign withholding taxes of $279 million in 2014, $273 million in 2013 and $244 million in 2012.

(b) Excludes excess tax benefits from equity awards allocated directly to contributed capital of $179 million in 2014, $179 million in 2013 and $83 millionin

2012.

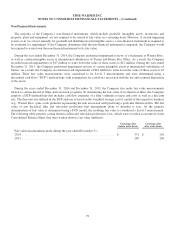

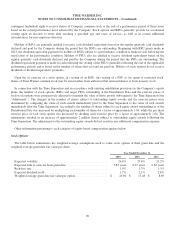

The differences between income taxes expected at the U.S. federal statutory income tax rate of 35% and income taxes

provided are as set forth below (millions):

Year Ended December 31,

2014 2013 2012

(recast) (recast)

Taxes on income at U.S. federal statutory rate ................... $ 1,638 $ 1,739 $ 1,412

State and local taxes, net of federal tax effects .................. 64 72 43

Domestic production activities deduction ...................... (114) (133) (152)

Federal Tax Settlement ..................................... (687) - -

Valuation Allowances ...................................... (226) 3 (6)

Other ................................................... 110 (67) 73

Total ................................................... $ 785 $ 1,614 $ 1,370

84