Time Magazine 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

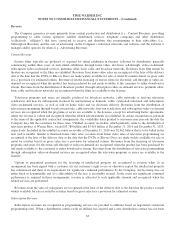

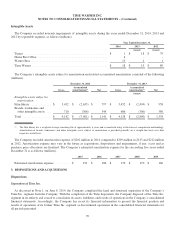

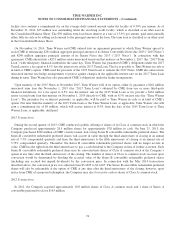

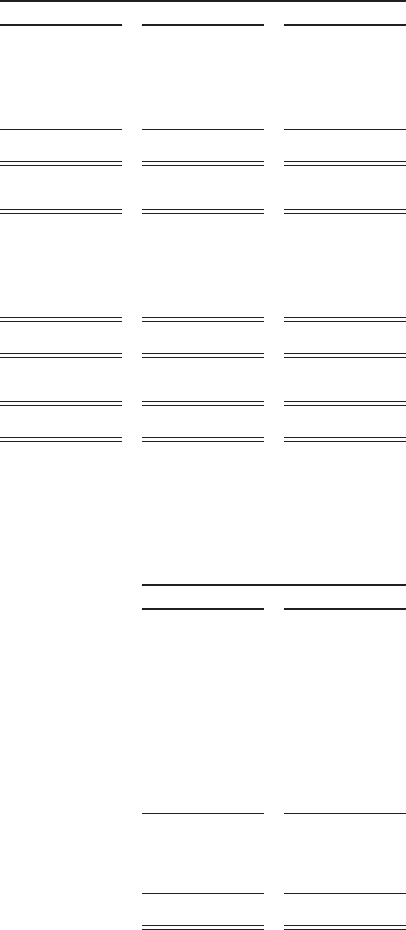

Summary of Discontinued Operations

Discontinued operations primarily reflects the Company’s former Time Inc. segment. In addition, during 2013, the

Company recognized additional net tax benefits of $137 million associated with certain foreign tax attributes of the Warner

Music Group, which the Company disposed of in 2004.

Discontinued operations for the years ended December 31, 2014, 2013 and 2012 is as follows (millions, except per share

amounts):

Year Ended December 31,

2014 2013 2012

Total revenues ........................................... $ 1,415 $ 3,334 $ 3,404

Pretax income (loss) ....................................... (98) 335 415

Income tax benefit (provision) ............................... 31 2 (156)

Net income (loss) ......................................... $ (67) $ 337 $ 259

Net income (loss) attributable to Time Warner Inc. shareholders .... $ (67) $ 337 $ 259

Per share information attributable to Time Warner Inc.

common shareholders:

Basic net income (loss) per common share ..................... $ (0.07) $ 0.36 $ 0.28

Average common shares outstanding — basic ................... 863.3 920.0 954.4

Diluted net income (loss) per common share .................... $ (0.07) $ 0.36 $ 0.27

Average common shares outstanding — diluted ................. 882.6 942.6 976.3

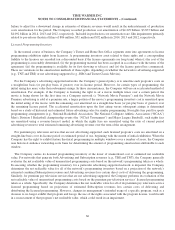

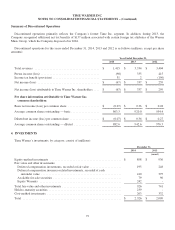

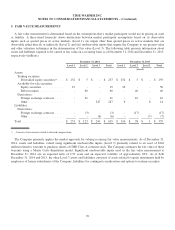

4. INVESTMENTS

Time Warner’s investments, by category, consist of (millions):

December 31,

2014 2013

(recast)

Equity-method investments ............................................... $ 898 $ 936

Fair-value and other investments:

Deferred compensation investments, recorded at fair value ..................... 195 248

Deferred compensation insurance-related investments, recorded at cash

surrender value ..................................................... 410 397

Available-for-sale securities ............................................. 79 96

Equity Warrants ...................................................... 242 -

Total fair-value and other investments ....................................... 926 741

Held-to-maturity securities ................................................ 239 -

Cost-method investments ................................................. 263 332

Total ................................................................. $ 2,326 $ 2,009

72