Time Magazine 2014 Annual Report Download - page 71

Download and view the complete annual report

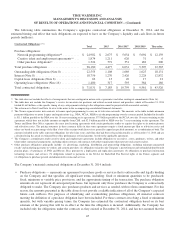

Please find page 71 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION AND SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

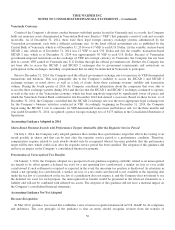

Description of Business

Time Warner Inc. (“Time Warner” or the “Company”) is a leading media and entertainment company, whose businesses

include television networks, and film and TV entertainment. Time Warner classifies its operations into three reportable

segments: Turner: consisting principally of cable networks and digital media properties; Home Box Office: consisting

principally of premium pay television services domestically and premium pay and basic tier television services

internationally; and Warner Bros.: consisting principally of television, feature film, home video and videogame production

and distribution.

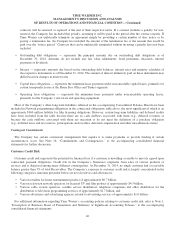

Separation of Time Inc.

On June 6, 2014 (the “Distribution Date”), the Company completed the legal and structural separation of the Company’s

Time Inc. segment from the Company (the “Time Separation”). The Time Separation was effected as a pro rata dividend of

all shares of Time Inc. common stock held by Time Warner in a spin-off to Time Warner stockholders. With the completion

of the Time Separation, the Company disposed of the Time Inc. segment in its entirety and ceased to consolidate its assets,

liabilities and results of operations in the Company’s consolidated financial statements. Accordingly, the Company has recast

its financial information to present the financial position and results of operations of its former Time Inc. segment as

discontinued operations in the consolidated financial statements for all periods presented. For a summary of discontinued

operations, see Note 3.

In connection with the Time Separation, the Company received $1.4 billion from Time Inc., consisting of proceeds

relating to Time Inc.’s acquisition of the IPC publishing business in the U.K. from a wholly-owned subsidiary of Time

Warner and a special dividend.

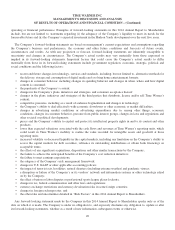

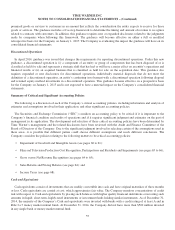

Basis of Presentation

Basis of Consolidation

The consolidated financial statements include all of the assets, liabilities, revenues, expenses and cash flows of entities in

which Time Warner has a controlling interest (“subsidiaries”). Intercompany accounts and transactions between consolidated

entities have been eliminated in consolidation.

Changes in Basis of Presentation

The 2013 and 2012 financial information has been recast so that the basis of presentation is consistent with that of the

2014 financial information. This recast reflects the financial position and results of operations of the Company’s former Time

Inc. segment as discontinued operations for all periods presented.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”)

requires management to make estimates, judgments and assumptions that affect the amounts reported in the consolidated

financial statements and footnotes thereto. Actual results could differ from those estimates.

Significant estimates and judgments inherent in the preparation of the consolidated financial statements include

accounting for asset impairments, multiple-element transactions, allowances for doubtful accounts, depreciation and

amortization, the determination of ultimate revenues as it relates to amortization of capitalized film and programming costs

and participations and residuals, home video and videogames product returns, business combinations, pension and other

postretirement benefits, equity-based compensation, income taxes, contingencies, litigation matters, reporting revenue for

certain transactions on a gross versus net basis, and the determination of whether the Company should consolidate certain

entities.

55