Time Magazine 2014 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION – (Continued)

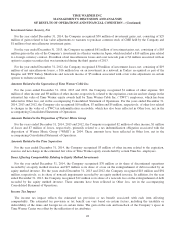

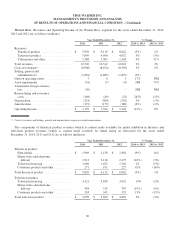

Gain (Loss) on Operating Assets, Net

For the year ended December 31, 2014, the Company recognized net gains on operating assets of $464 million, including

$16 million of net gains at the Turner segment, consisting of a $13 million gain related to the sale of Zite, Inc., a news

content aggregation and recommendation platform, a $4 million gain related to the sale of certain fixed assets, a $3 million

loss related to the shutdown of a business and a $2 million gain primarily related to the sale of a building in South America, a

$7 million gain at the Warner Bros. segment primarily related to the sale of certain fixed assets and a $441 million gain at

Corporate in connection with the sale and leaseback of the Company’s space in Time Warner Center.

For the year ended December 31, 2013, the Company recognized net gains on operating assets of $129 million, including

a $2 million gain at the Turner segment on the sale of a building, a $104 million gain at the Home Box Office segment upon

Home Box Office’s acquisition of its former partner’s interests in HBO Asia and HBO South Asia (collectively, “HBO

Asia”), a $9 million gain at the Home Box Office segment upon Home Box Office’s acquisition of its former partner’s

interest in HBO Nordic, a $6 million gain at the Warner Bros. segment related to miscellaneous operating assets and an $8

million gain at Corporate on the disposal of certain corporate assets.

For the year ended December 31, 2012, the Company recognized net gains on operating assets of $45 million, including a

$34 million gain at the Turner segment on the settlement of an indemnification obligation related to the Company’s 2007 sale

of the Atlanta Braves baseball franchise, $1 million of noncash income at the Warner Bros. segment related to a fair value

adjustment on certain contingent consideration arrangements and a $10 million gain at Corporate on the disposal of certain

corporate assets.

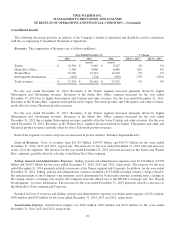

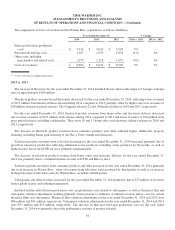

Venezuelan Foreign Currency Loss

For the year ended December 31, 2014, the Company recognized a pretax foreign exchange loss of $173 million,

consisting of $137 million at the Turner segment and $36 million at the Warner Bros. segment, related to the remeasurement

of the Company’s net monetary assets denominated in Venezuelan currency resulting from a change in the foreign currency

exchange rate used by the Company from the official rate to the SICAD 2 exchange rate. See “Recent Developments” for

more information.

Other

Other reflects external costs related to mergers, acquisitions or dispositions of $80 million, $33 million and $27 million

for the years ended December 31, 2014, 2013 and 2012 respectively. External costs related to mergers, acquisitions or

dispositions for the year ended December 31, 2014 consisted of $14 million at the Turner segment primarily related to exit

costs in connection with the shutdown of CNN Latino, $19 million at the Warner Bros. segment primarily related to the

Eyeworks Acquisition and $47 million at Corporate primarily related to the Time Separation. External costs related to

mergers, acquisitions or dispositions for the year ended December 31, 2013 were primarily related to the Time Separation.

External costs related to mergers, acquisitions or dispositions for the year ended December 31, 2012 included $18 million

related to the Imagine and TNT Turkey Shutdowns.

For the year ended December 31, 2013, other includes a gain of $38 million related to the curtailment of post-retirement

benefits (the “Curtailment”).

For the year ended December 31, 2012, other includes legal and other professional fees related to the defense of securities

litigation matters for former employees of $3 million.

External costs related to mergers, acquisitions or dispositions, the gain related to the Curtailment and the amounts related

to securities litigation and government investigations are included in Selling, general and administrative expenses in the

accompanying Consolidated Statement of Operations.

27