Time Magazine 2014 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

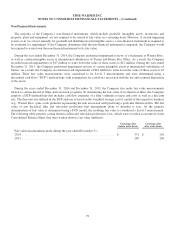

Discontinued Operations

In determining whether a group of assets disposed (or to be disposed) of should be presented as a discontinued operation,

for periods prior to January 1, 2015 the Company made a determination of whether the group of assets being disposed of

comprised a component of the entity; that is, whether it had historic operations and cash flows that were clearly distinguished

(both operationally and for financial reporting purposes). The Company also determined whether the cash flows associated

with the group of assets had been significantly (or will be significantly) eliminated from the ongoing operations of the

Company as a result of the disposal transaction and whether the Company had no significant continuing involvement in the

operations of the group of assets after the disposal transaction. If so, the results of operations of the group of assets disposed

of (as well as any gain or loss on the disposal transaction) were aggregated for separate presentation, if material, apart from

continuing operating results of the Company in the consolidated financial statements.

In connection with the Time Separation, the Company has recast its financial information to present the financial position

and results of operations of its former Time Inc. segment as discontinued operations in the accompanying consolidated

financial statements for all periods presented. For more information on the Time Separation, see Note 3.

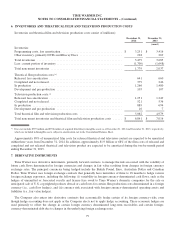

2. GOODWILL AND INTANGIBLE ASSETS

Time Warner has a significant number of intangible assets, acquired film and television libraries and other copyrighted

products and tradenames. Certain intangible assets are deemed to have finite lives and, accordingly, are amortized over their

estimated useful lives, while others are deemed to be indefinite-lived and therefore are not amortized. Goodwill and

indefinite-lived intangible assets, primarily certain tradenames, are tested annually for impairment during the fourth quarter,

or earlier upon the occurrence of certain events or substantive changes in circumstances.

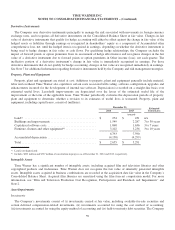

Goodwill

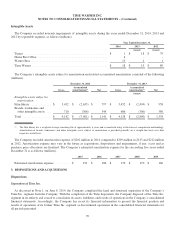

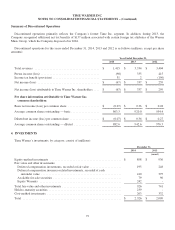

The following summary of changes in the Company’s Goodwill during the years ended December 31, 2014 and 2013, by

reportable segment, is as follows (millions):

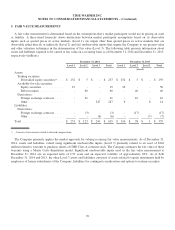

Turner Home Box Office Warner Bros. Total

Balance at December 31, 2012 (recast) .......... $ 13,991 $ 7,309 $ 5,996 $ 27,296

Acquisitions, dispositions and

adjustments .............................. 7 122 (9) 120

Translation adjustments ...................... (18) - 3 (15)

Balance at December 31, 2013 (recast) .......... $ 13,980 $ 7,431 $ 5,990 $ 27,401

Acquisitions, dispositions and

adjustments .............................. (6) 2 206 202

Translation adjustments ...................... (18) - (20) (38)

Balance at December 31, 2014 ................. $ 13,956 $ 7,433 $ 6,176 $ 27,565

The carrying amount of goodwill for all periods presented was net of accumulated impairments of $13.338 billion and

$4.091 billion at the Turner segment and the Warner Bros. segment, respectively.

The performance of the Company’s annual impairment analysis did not result in any impairments of Goodwill for any of

the years in the three-year period ended December 31, 2014. Refer to Note 1 for a discussion of the 2014 annual impairment

test.

The increase in Goodwill at the Warner Bros. segment for the year ended December 31, 2014 is primarily related to the

acquisition of the operations outside the U.S. of Eyeworks Group and the increase at the Home Box Office segment for the

year ended December 31, 2013 is primarily related to the acquisition of its former partner’s interests in HBO Asia and HBO

South Asia (see Note 3 for additional information).

69