Time Magazine 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The following is a description of the Company’s contingent commitments at December 31, 2014:

• Guarantees consist of guarantees the Company has provided on certain operating commitments entered into by entities

formerly owned by the Company, including Time Inc., as well as the Six Flags arrangement described below, and a

guarantee of certain debt issued by CME, an equity method investee.

Six Flags

In connection with the Company’s former investment in the Six Flags theme parks located in Georgia and Texas

(collectively, the “Parks”), in 1997, certain subsidiaries of the Company (including Historic TW and, in connection with

the separation of Time Warner Cable Inc. in 2009, Warner Bros. Entertainment Inc.) agreed to guarantee (the “Six Flags

Guarantee”) certain obligations of the partnerships that hold the Parks (the “Partnerships”) for the benefit of the limited

partners in such Partnerships, including: annual payments made at the Parks or to the limited partners and additional

obligations at the end of the respective terms for the Partnerships in 2027 and 2028 (the “Guaranteed Obligations”). The

aggregate undiscounted estimated future cash flow requirements covered by the Six Flags Guarantee over the remaining

term (through 2028) are $935 million (for a net present value of $418 million). To date, no payments have been made by

the Company pursuant to the Six Flags Guarantee.

Six Flags Entertainment Corporation (formerly known as Six Flags, Inc. and Premier Parks Inc.) (“Six Flags”), which

has the controlling interest in the Parks, has agreed, pursuant to a subordinated indemnity agreement (the “Subordinated

Indemnity Agreement”), to guarantee the performance of the Guaranteed Obligations when due and to indemnify

Historic TW, among others, if the Six Flags Guarantee is called upon. If Six Flags defaults in its indemnification

obligations, Historic TW has the right to acquire control of the managing partner of the Parks. Six Flags’ obligations to

Historic TW are further secured by its interest in all limited partnership units held by Six Flags.

Because the Six Flags Guarantee existed prior to December 31, 2002 and no modifications to the arrangements have

been made since the date the guarantee came into existence, the Company is required to continue to account for the

Guaranteed Obligations as a contingent liability. Based on its evaluation of the current facts and circumstances

surrounding the Guaranteed Obligations and the Subordinated Indemnity Agreement, the Company is unable to predict

the loss, if any, that may be incurred under the Guaranteed Obligations, and no liability for the arrangements has been

recognized at December 31, 2014. Because of the specific circumstances surrounding the arrangements and the fact that

no active or observable market exists for this type of financial guarantee, the Company is unable to determine a current

fair value for the Guaranteed Obligations and related Subordinated Indemnity Agreement.

• Other contingent commitments primarily include contingent payments for post-production term advance obligations on

certain co-financing arrangements, as well as letters of credit, bank guarantees and surety bonds, which generally

support performance and payments for a wide range of global contingent and firm obligations, including insurance,

litigation appeals, real estate leases and other operational needs.

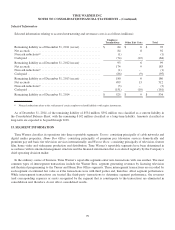

Programming Licensing Backlog

Programming licensing backlog represents the amount of future revenues not yet recorded from cash contracts for the

licensing of theatrical and television product for pay cable, basic cable, network and syndicated television exhibition.

Because backlog generally relates to contracts for the licensing of theatrical and television product that have already been

produced, the recognition of revenue for such completed product is principally dependent on the commencement of the

availability period for telecast under the terms of the related licensing agreement. Cash licensing fees are collected

periodically over the term of the related licensing agreements. Backlog was approximately $6.5 billion and $5.5 billion at

December 31, 2014 and 2013, respectively. Included in these amounts is licensing of film product from the Warner Bros.

segment to the Home Box Office segment in the amount of $788 million and $749 million at December 31, 2014 and 2013,

respectively, and to the Turner segment in the amount of $700 million and $477 million at December 31, 2014 and 2013,

103