Time Magazine 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

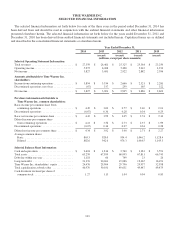

2014 FINANCIAL HIGHLIGHTS – RECONCILIATIONS AND OTHER INFORMATION

Set forth below are definitions of the non-GAAP financial measures that are used in the 2014 Financial Highlights pages

of this Annual Report to Shareholders and reconciliations of such non-GAAP financial measures to the most directly

comparable financial measures calculated in accordance with generally accepted accounting principles. On June 6, 2014, the

Company completed the legal and structural separation of Time Inc. from the Company. Accordingly, the financial

information for periods prior to 2014 set forth below has been recast to present the financial position and results of operations

of the Company’s former Time Inc. segment as discontinued operations.

“Adjusted Operating Income” is Operating Income excluding the impact of noncash impairments of goodwill,

intangible and fixed assets; gains and losses on operating assets (other than deferred gains on sale-leasebacks); gains and

losses recognized in connection with pension and other postretirement benefit plan curtailments or settlements; external costs

related to mergers, acquisitions or dispositions, as well as contingent consideration related to such transactions, to the extent

such costs are expensed; amounts related to securities litigation and government investigations; and the foreign currency loss

during the three months ended December 31, 2014, related to the translation of net monetary assets denominated in

Venezuelan currency resulting from the Company’s change to begin using the SICAD 2 exchange rate.

“Adjusted EPS” is Diluted Income per Common Share from Continuing Operations attributable to Time Warner Inc.

common shareholders with the following items excluded from Income from Continuing Operations attributable to Time

Warner Inc. common shareholders: noncash impairments of goodwill, intangible and fixed assets and investments; gains and

losses on operating assets (other than deferred gains on sale-leasebacks), liabilities and investments; gains and losses

recognized in connection with pension and other postretirement benefit plan curtailments or settlements; external costs

related to mergers, acquisitions, investments or dispositions, as well as contingent consideration related to such transactions,

to the extent such costs are expensed; amounts related to securities litigation and government investigations; the foreign

currency loss during the three months ended December 31, 2014 related to the translation of net monetary assets

denominated in Venezuelan currency resulting from the Company’s change to begin using the SICAD 2 exchange rate; and

amounts attributable to businesses classified as discontinued operations; as well as the impact of taxes and noncontrolling

interests on the above items and the Company’s share of the above items with respect to equity method investments.

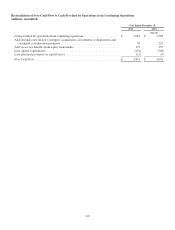

“Free Cash Flow” is Cash Provided by Operations from Continuing Operations plus payments related to securities

litigation and government investigations (net of any insurance recoveries), external costs related to mergers, acquisitions,

investments or dispositions, to the extent such costs are expensed, contingent consideration payments made in connection

with acquisitions, and excess tax benefits from equity instruments, less capital expenditures, principal payments on capital

leases and partnership distributions, if any.

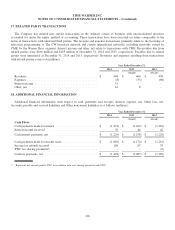

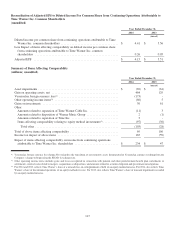

Reconciliation of Adjusted Operating Income to Operating Income

(millions; unaudited)

Year Ended December 31,

2014 2013 2009

(recast) (recast)

Adjusted Operating Income ................................. $ 5,833 $ 6,195 $ 4,339

Asset impairments ........................................ (69) (61) (52)

Gain (loss) on operating assets, net ........................... 464 129 (33)

Venezuelan foreign currency loss(1) ........................... (173) - -

Other(2) ................................................. (80) 5 (30)

Operating Income ......................................... $ 5,975 $ 6,268 $ 4,224

(1) Venezuelan foreign currency loss during 2014 related to the translation of net monetary assets denominated in Venezuelan currency resulting from the

Company’s change to begin using the SICAD 2 exchange rate.

(2) For 2014 and 2013, Other includes gains and losses recognized in connection with pension and other postretirement benefit plan curtailments or

settlements; external costs related to mergers, acquisitions or dispositions; and amounts related to securities litigation and government investigations. For

2009, Other includes only amounts related to securities litigation and government investigations.

116