Time Magazine 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Time Magazine annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TIME WARNER INC.

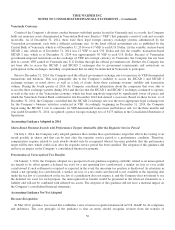

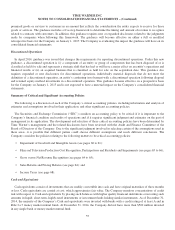

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

Revenue

The Company generates revenue primarily from content production and distribution (i.e., Content Revenue), providing

programming to cable system operators, satellite distribution services, telephone companies and other distributors

(collectively, “affiliates”) that have contracted to receive and distribute this programming to their subscribers (i.e.,

Subscription Revenue) and the sale of advertising on the Company’s television networks and websites and the websites it

manages and/or operates for others (i.e., Advertising Revenue).

Content Revenue

Feature films typically are produced or acquired for initial exhibition in theaters, followed by distribution, generally

commencing within three years of such initial exhibition, through home video, electronic sell-through, video-on-demand,

subscription video-on-demand services, premium cable, basic cable and broadcast networks. Revenues from film rentals by

theaters are recognized as the films are exhibited. Revenues from home video sales are recognized at the later of the delivery

date or the date that the DVDs or Blu-ray Discs are made widely available for sale or rental by retailers based on gross sales

less a provision for estimated returns. Revenues from the licensing of feature films for electronic sell-through or video-on-

demand are recognized when the product has been purchased by and made available to the consumer to either download or

stream. Revenues from the distribution of theatrical product through subscription video-on-demand services, premium cable,

basic cable and broadcast networks are recognized when the films are available to the licensee.

Television programs and series are initially produced for broadcast networks, cable networks or first-run television

syndication and may be subsequently licensed for international or domestic cable, syndicated television and subscription

video-on-demand services, as well as sold on home video and via electronic delivery. Revenues from the distribution of

television programming through broadcast networks, cable networks, first-run syndication and subscription video-on-demand

services are recognized when the programs or series are available to the licensee, except for advertising barter agreements,

where the revenue is valued and recognized when the related advertisements are exhibited. In certain circumstances, pursuant

to the terms of the applicable contractual arrangements, the availability dates granted to customers may precede the date the

Company may bill the customers for these sales. Unbilled accounts receivable, which primarily relate to the distribution of

television product at Warner Bros., totaled $3.780 billion and $3.418 billion at December 31, 2014 and December 31, 2013,

respectively. Included in the unbilled accounts receivable at December 31, 2014 was $2.462 billion that is to be billed in the

next twelve months. Similar to theatrical home video sales, revenues from home video sales of television programming are

recognized at the later of the delivery date or the date that the DVDs or Blu-ray Discs are made widely available for sale or

rental by retailers based on gross sales less a provision for estimated returns. Revenues from the licensing of television

programs and series for electronic sell-through or video-on-demand are recognized when the product has been purchased by

and made available to the consumer to either download or stream. Revenues from the distribution of television programming

through subscription video-on-demand services are recognized when the television programs or series are available to the

licensee.

Upfront or guaranteed payments for the licensing of intellectual property are recognized as revenue when (i) an

arrangement has been signed with a customer, (ii) the customer’s right to use or otherwise exploit the intellectual property

has commenced and there is no requirement for significant continued performance by the Company, (iii) licensing fees are

either fixed or determinable and (iv) collectability of the fees is reasonably assured. In the event any significant continued

performance is required in these arrangements, revenue is allocated to each applicable element and recognized when the

related services are performed.

Revenues from the sales of videogames are recognized at the later of the delivery date or the date that the product is made

widely available for sale or rental by retailers based on gross sales less a provision for estimated returns.

Subscription Revenue

Subscription revenues are recognized as programming services are provided to affiliates based on negotiated contractual

programming rates. When a distribution contract with an affiliate has expired and a new distribution contract has not been

63