The Hartford 2010 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

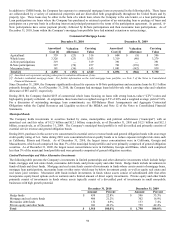

Financial Services

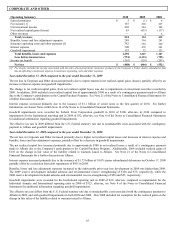

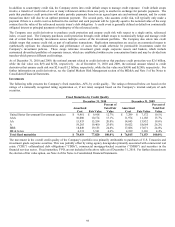

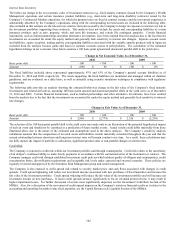

The Company’ s exposure to the financial services sector is predominantly through banking institutions. The following table presents

the Company’ s exposure to the financial services sector included in the Securities by Type table above.

December 31, 2010 December 31, 2009

Amortized

Cost

Fair Value

Net

Unrealized Amortized

Cost

Fair Value

Net

Unrealized

AAA $ 302 $ 309 $ 7 $ 299 $ 290

$(9)

AA 2,085 2,095 10 1,913 1,867 (46)

A 3,760 3,599 (161) 4,510 3,987 (523)

BBB 1,677 1,518 (159) 1,664 1,379 (285)

BB & below 290 253 (37) 509 416 (93)

Total $ 8,114 $ 7,774 $ (340) $ 8,895 $ 7,939 $ (956)

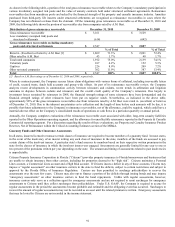

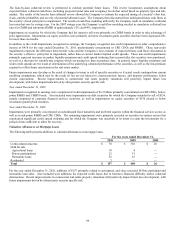

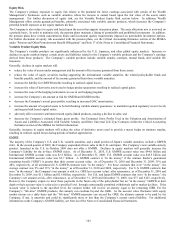

The improvement in the net unrealized loss position was attributed to improved security valuations resulting from increasing confidence

in this sector. During the second half of 2010, companies within the financial sectors generally continued to stabilize with improved

earnings performance, positive credit trends and strengthened capital and liquidity positions. Both the Dodd-Frank Act and clarification

around Basel III capital requirements will strengthen capital standards prospectively. Despite these positive impacts, the financial sector

remains vulnerable to ongoing stress in the real estate markets including mortgage put-back and foreclosure risks, high unemployment

and global economic uncertainty, which could potentially result in declines in the Company’ s net unrealized position. In 2011, the

Company expects a continuation of stabilizing trends seen in 2010 as the regulatory landscape becomes more visible, credit quality

continues on an improving path, although likely at a slower rate, and capital and liquidity management remains conservative.

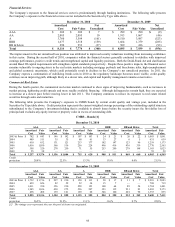

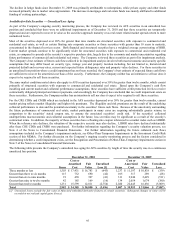

Commercial Real Estate

During the fourth quarter, the commercial real estate market continued to show signs of improving fundamentals, such as increases in

market pricing, tightening credit spreads and more readily available financing. Although delinquencies remain high, they are expected

to increase at a slower pace before moving lower in late 2011. The Company continues to reduce its exposure to real estate related

securities through sales and maturities.

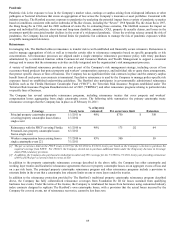

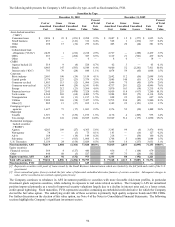

The following table presents the Company’ s exposure to CMBS bonds by current credit quality and vintage year, included in the

Securities by Type table above. Credit protection represents the current weighted average percentage of the outstanding capital structure

subordinated to the Company’ s investment holding that is available to absorb losses before the security incurs the first dollar loss of

principal and excludes any equity interest or property value in excess of outstanding debt.

CMBS – Bonds [1]

December 31, 2010

AAA AA A BBB

BB and Below Total

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

2003 & Prior $ 782 $ 803 $ 146 $ 142 $ 107 $ 103 $ 24 $ 21 $ 26 $ 22 $ 1,085 $ 1,091

2004 489 511 35 35 68 61 33 27 6 5 631 639

2005 610 632 131 121 213 177 182 147 123 96 1,259 1,173

2006 1,016 1,050 566 536 256 224 496 416 436 339 2,770 2,565

2007 305 320 278 250 71 55 253 200 278 198 1,185 1,023

2008 55 58 — — — — — — — — 55 58

Total $ 3,257 $ 3,374 $ 1,156 $ 1,084 $ 715 $ 620 $ 988 $ 811 $ 869 $ 660 $ 6,985 $ 6,549

Credit

protection 28.8% 22.5% 13.3% 13.8% 8.0% 21.5%

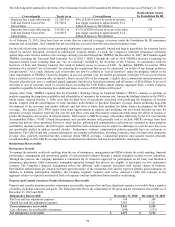

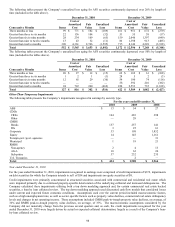

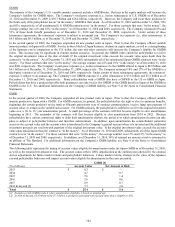

December 31, 2009

AAA AA A BBB

BB and Below Total

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

Amortized

Cost

Fair

Value

2003 & Prior $ 1,732 $ 1,716 $ 297 $ 230 $ 150 $ 113 $ 20 $ 17 $ 11 $ 7 $ 2,210 $ 2,083

2004 639 626 82 52 52 34 15 7 — — 788 719

2005 1,011 930 356 230 228 123 100 64 89 54 1,784 1,401

2006 1,945 1,636 430 275 536 247 323 132 231 83 3,465 2,373

2007 498 408 139 101 169 68 346 160 201 98 1,353 835

Total $ 5,825 $ 5,316 $ 1,304 $ 888 $ 1,135 $ 585 $ 804 $ 380 $ 532 $ 242 $ 9,600 $ 7,411

Credit

protection 26.5% 21.2% 13.1% 11.6% 8.7% 22.0%

[1] The vintage year represents the year the pool of loans was originated.