The Hartford 2010 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

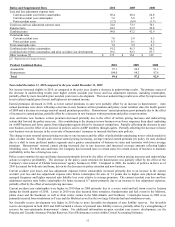

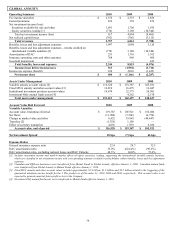

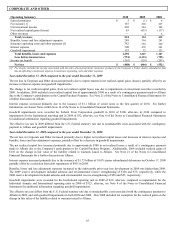

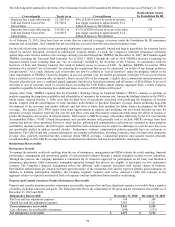

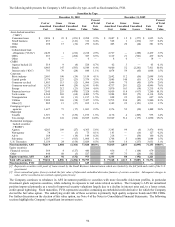

CORPORATE AND OTHER

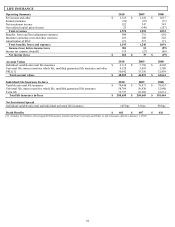

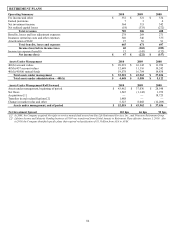

Operating Summary 2010 2009 2008

Earned premiums $ 3 $ (1) $ 8

Fee income [1] 187 220 227

Net investment income 268 344 308

Net realized capital gains (losses) 83 (433) (137)

Other revenues — 4 6

Total revenues 541 134 412

Benefits, losses and loss adjustment expenses 249 394 281

Insurance operating costs and other expenses [1] 382 365 220

Interest expense 508 476 343

Goodwill impairment 153 32 323

Total benefits, losses and expenses 1,292 1,267 1,167

Loss before income taxes (751) (1,133) (755)

Income tax benefit (263) (329) (203)

Net loss $ (488) $ (804) $ (552)

[1] Fee income includes the income associated with the sales of non-proprietary insurance products in the Company’s broker-dealer subsidiaries that

has an offsetting commission expense in insurance operating costs and other expenses.

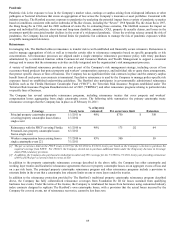

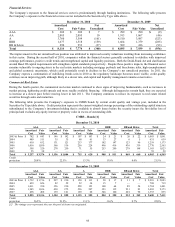

Year ended December 31, 2010 compared to the year ended December 31, 2009

The net loss in Corporate and Other decreased primarily due to improvements in net realized capital gains (losses), partially offset by an

increase in interest expense and goodwill impairments.

The change to net realized capital gains, from net realized capital losses was due to impairments on investment securities recorded in

2009. In addition, 2009 included a net realized capital loss of approximately $300 as a result of a contingency payment made to Allianz

due to the Company’ s participation in the Capital Purchase Program. See Note 21 of the Notes to Consolidated Financial Statements for

a further discussion on Allianz.

Interest expense increased primarily due to the issuance of $1.1 billion of senior notes in the first quarter of 2010. For further

information, see Senior Notes within Note 14 of the Notes to Consolidated Financial Statements.

Goodwill impairments were recorded for Federal Trust Corporation goodwill in 2010 of $100, after-tax, in 2010 compared to

impairments for the Institutional reporting unit in 2009 of $32, after-tax, see Note 8 of the Notes to Consolidated Financial Statements

for additional information regarding goodwill impairments.

The effective tax rate in 2009 differed from the U.S. Federal statutory rate due to nondeductible costs associated with the contingency

payment to Allianz and goodwill impairments.

Year ended December 31, 2009 compared to the year ended December 31, 2008

The net loss in Corporate and Other increased primarily due to higher net realized capital losses and increases in interest expense and

benefits, losses and loss adjustment expenses, partially offset by a decrease in goodwill impairments.

The net realized capital loss increased primarily due to approximately $300 in net realized losses a result of a contingency payment

made to Allianz due to the Company’ s participation in the Capital Purchase Program. Additionally, 2008 included realized gains of

$110 on the change in fair value of the liability related to warrants issued to Allianz. See Note 21 of the Notes to Consolidated

Financial Statements for a further discussion on Allianz.

Interest expense increased primarily due to the issuance of $1.75 billion of 10.0% junior subordinated debentures on October 17, 2008

partially offset by a reduction from debt repayments of $955 in 2008.

Benefits, losses and loss adjustment expenses increased as the unfavorable prior year loss development in 2009 was higher than 2008.

The 2009 reserve development included asbestos and environmental reserve strengthening of $138 and $75, respectively, while the

2008 reserve development included asbestos and environmental reserve strengthening of $50 and $53, respectively.

Goodwill impairments were recorded for the Institutional reporting unit in 2009 of $32, after-tax, compared to impairments for the

Individual Annuity and International reporting units in 2008 of $323, after-tax, see Note 8 of the Notes to Consolidated Financial

Statements for additional information regarding goodwill impairments.

The effective tax rate differs from the U.S. Federal statutory rate due to nondeductible costs associated with the contingency payment to

Allianz in 2009, and with goodwill impairments in both 2009 and 2008. Also 2008 included tax exemption for the realized gains on the

change in fair value of the liability related to warrants issued to Allianz.