The Hartford 2010 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-38

5. Investments and Derivative Instruments (continued)

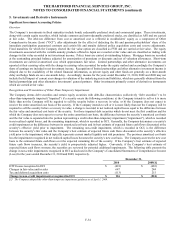

Discontinuance of Hedge Accounting

The Company discontinues hedge accounting prospectively when (1) it is determined that the derivative is no longer highly effective in

offsetting changes in the fair value or cash flows of a hedged item; (2) the derivative is de-designated as a hedging instrument; or (3) the

derivative expires or is sold, terminated or exercised.

When hedge accounting is discontinued because it is determined that the derivative no longer qualifies as an effective fair-value hedge,

the derivative continues to be carried at fair value on the balance sheet with changes in its fair value recognized in current period

earnings.

When hedge accounting is discontinued because the Company becomes aware that it is not probable that the forecasted transaction will

occur, the derivative continues to be carried on the balance sheet at its fair value, and gains and losses that were accumulated in AOCI

are recognized immediately in earnings.

In other situations in which hedge accounting is discontinued on a cash-flow hedge, including those where the derivative is sold,

terminated or exercised, amounts previously deferred in AOCI are reclassified into earnings when earnings are impacted by the

variability of the cash flow of the hedged item.

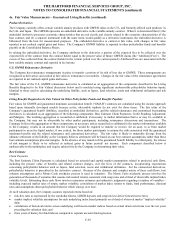

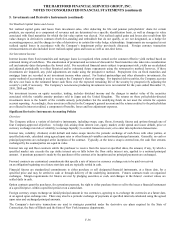

Embedded Derivatives

The Company purchases and issues financial instruments and products that contain embedded derivative instruments. When it is

determined that (1) the embedded derivative possesses economic characteristics that are not clearly and closely related to the economic

characteristics of the host contract, and (2) a separate instrument with the same terms would qualify as a derivative instrument, the

embedded derivative is bifurcated from the host for measurement purposes. The embedded derivative, which is reported with the host

instrument in the consolidated balance sheets, is carried at fair value with changes in fair value reported in net realized capital gains and

losses.

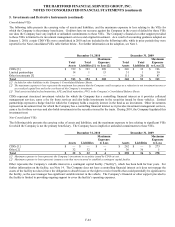

Credit Risk

The Company’ s derivative counterparty exposure policy establishes market-based credit limits, favors long-term financial stability and

creditworthiness of the counterparty and typically requires credit enhancement/credit risk reducing agreements. Credit risk is measured

as the amount owed to the Company based on current market conditions and potential payment obligations between the Company and

its counterparties. For each legal entity of the Company, credit exposures are generally quantified daily based on the prior business

day’ s market value and collateral is pledged to and held by, or on behalf of, the Company to the extent the current value of derivatives

exceeds the contractual thresholds for every counterparty. The maximum uncollateralized threshold for a derivative counterparty for a

single level entity is $10. The Company also minimizes the credit risk of derivative instruments by entering into transactions with high

quality counterparties rated A2/A or better, which are monitored and evaluated by the Company’ s risk management team and reviewed

by senior management. In addition, the Company monitors counterparty credit exposure on a monthly basis to ensure compliance with

Company policies and statutory limitations. The Company generally requires that derivative contracts, other than exchange traded

contracts, certain forward contracts, and certain embedded and reinsurance derivatives, be governed by an International Swaps and

Derivatives Association Master Agreement which is structured by legal entity and by counterparty and permits right of offset.