The Hartford 2010 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-52

5. Investments and Derivative Instruments (continued)

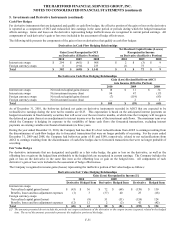

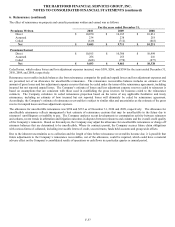

Non-qualifying Strategies

For non-qualifying strategies, including embedded derivatives that are required to be bifurcated from their host contracts and accounted

for as derivatives, the gain or loss on the derivative is recognized currently in earnings within net realized capital gains or losses. The

following table presents the gain or loss recognized in income on non-qualifying strategies:

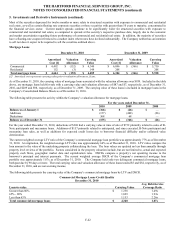

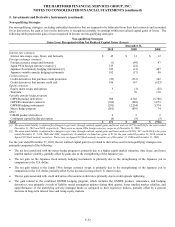

Non-qualifying Strategies

Gain (Loss) Recognized within Net Realized Capital Gains (Losses)

December 31,

2010 2009 2008

Interest rate contracts

Interest rate swaps, caps, floors, and forwards $ 45 $ 31 $ 12

Foreign exchange contracts

Foreign currency swaps and forwards (1) (49) 47

Japan 3Win foreign currency swaps [1] 215 (22) —

Japanese fixed annuity hedging instruments [2] 385 (12) 487

Japanese variable annuity hedging instruments 102 (17) 40

Credit contracts

Credit derivatives that purchase credit protection (23) (533) 302

Credit derivatives that assume credit risk 196 167 (623)

Equity contracts

Equity index swaps and options 5 (3) (25)

Warrants — 70 110

Variable annuity hedge program

GMWB product derivatives 508 4,748 (5,786)

GMWB reinsurance contracts (102) (988) 1,073

GMWB hedging instruments (295) (2,234) 3,374

Macro hedge program (562) (895) 74

Other

GMAB product derivatives 4 5 2

Contingent capital facility put option (6) (8) (3)

Total $ 471 $ 260 $ (916)

[1] The associated liability is adjusted for changes in spot rates through realized capital gains and losses and was $(273) and $64 for the years ended

December 31, 2010 and 2009, respectively. There were no Japan 3Win foreign currency swaps as of December 31, 2008.

[2] The associated liability is adjusted for changes in spot rates through realized capital gains and losses and was $(332), $67, and $450 for the years

ended December 31, 2010, 2009 and 2008, respectively. In addition, included are gains of $1 for the year ended December 31, 2010 related to

Japan FVO fixed maturity securities. There were no Japan FVO fixed maturity securities as of December 31, 2009 and December 31, 2008.

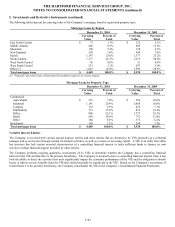

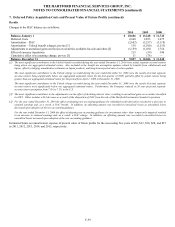

For the year ended December 31, 2010, the net realized capital gain (loss) related to derivatives used in non-qualifying strategies was

primarily comprised of the following:

• The net loss associated with the macro hedge program is primarily due to a higher equity market valuation, time decay, and lower

implied market volatility, partially offset by gains due to the strengthening of the Japanese yen.

• The net gain on the Japanese fixed annuity hedging instruments is primarily due to the strengthening of the Japanese yen in

comparison to the U.S. dollar.

• The net gain related to the Japan 3Win foreign currency swaps is primarily due to the strengthening of the Japanese yen in

comparison to the U.S. dollar, partially offset by the decrease in long-term U.S. interest rates.

• The net gain associated with credit derivatives that assume credit risk is primarily due to credit spreads tightening.

• The gain related to the combined GMWB hedging program, which includes the GMWB product, reinsurance, and hedging

derivatives, was primarily a result of liability model assumption updates during third quarter, lower implied market volatility, and

outperformance of the underlying actively managed funds as compared to their respective indices, partially offset by a general

decrease in long-term interest rates and rising equity markets.