The Hartford 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-10

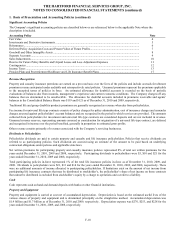

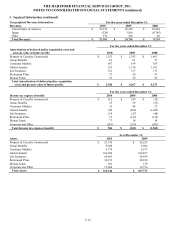

1. Basis of Presentation and Accounting Policies (continued)

Significant Accounting Policies

The Company’ s significant accounting policies are described below or are referenced below to the applicable Note where the

description is included.

Accounting Policy Note

Fair Value 4

Investments and Derivative Instruments .................................................................................................................... 5

Reinsurance ................................................................................................................................................................ 6

Deferred Policy Acquisition Costs and Present Value of Future Profits .................................................................... 7

Goodwill and Other Intangible Assets ....................................................................................................................... 8

Separate Accounts...................................................................................................................................................... 9

Sales Inducements ...................................................................................................................................................... 10

Reserve for Future Policy Benefits and Unpaid Losses and Loss Adjustment Expenses 11

Contingencies............................................................................................................................................................. 12

Income Taxes ............................................................................................................................................................. 13

Pension Plans and Postretirement Healthcare and Life Insurance Benefit Plans ....................................................... 17

Revenue Recognition

Property and casualty insurance premiums are earned on a pro rata basis over the lives of the policies and include accruals for ultimate

premium revenue anticipated under auditable and retrospectively rated policies. Unearned premiums represent the premiums applicable

to the unexpired terms of policies in force. An estimated allowance for doubtful accounts is recorded on the basis of periodic

evaluations of balances due from insureds, management’ s experience and current economic conditions. The Company charges off any

balances that are determined to be uncollectible. The allowance for doubtful accounts included in premiums receivable and agents’

balances in the Consolidated Balance Sheets was $119 and $121 as of December 31, 2010 and 2009, respectively.

Traditional life and group disability products premiums are generally recognized as revenue when due from policyholders.

Fee income for universal life-type contracts consists of policy charges for policy administration, cost of insurance charges and surrender

charges assessed against policyholders’ account balances and are recognized in the period in which services are provided. The amounts

collected from policyholders for investment and universal life-type contracts are considered deposits and are not included in revenue.

Unearned revenue reserves, representing amounts assessed as consideration for origination of a universal life-type contract, are deferred

and recognized in income over the period benefited, generally in proportion to estimated gross profits.

Other revenue consists primarily of revenues associated with the Company’ s servicing businesses.

Dividends to Policyholders

Policyholder dividends are paid to certain property and casualty and life insurance policyholders. Policies that receive dividends are

referred to as participating policies. Such dividends are accrued using an estimate of the amount to be paid based on underlying

contractual obligations under policies and applicable state laws.

Net written premiums for participating property and casualty insurance policies represented 8% of total net written premiums for the

years ended December 31, 2010, 2009 and 2008, respectively. Participating dividends to policyholders were $5, $10 and $21 for the

years ended December 31, 2010, 2009 and 2008, respectively.

Total participating policies in-force represented 1% of the total life insurance policies in-force as of December 31, 2010, 2009, and

2008. Dividends to policyholders were $21, $13 and $14 for the years ended December 31, 2010, 2009, and 2008, respectively. There

were no additional amounts of income allocated to participating policyholders. If limitations exist on the amount of net income from

participating life insurance contracts that may be distributed to stockholder’ s, the policyholder’ s share of net income on those contracts

that cannot be distributed is excluded from stockholder’ s equity by a charge to operations and a credit to a liability.

Cash

Cash represents cash on hand and demand deposits with banks or other financial institutions.

Property and Equipment

Property and equipment is carried at cost net of accumulated depreciation. Depreciation is based on the estimated useful lives of the

various classes of property and equipment and is determined principally on the straight-line method. Accumulated depreciation was

$1.9 billion and $1.7 billion as of December 31, 2010 and 2009, respectively. Depreciation expense was $276, $253, and $228 for the

years ended December 31, 2010, 2009, and 2008, respectively.