The Hartford 2010 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-67

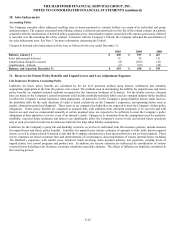

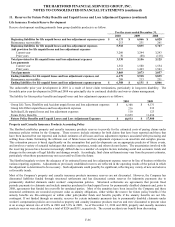

11. Reserves for Future Policy Benefits and Unpaid Losses and Loss Adjustment Expenses (continued)

property and casualty insurance products reserves was $46 in 2010, $40 in 2009 and $38 in 2008. Contributing to the decrease in the

benefit from discounting over the past three years has been a reduction in the discount rate, reflecting a lower risk-free rate of return

over that period. Accretion of discounts for prior accident years totaled $26 in 2010, $24 in 2009, and $26 in 2008. For annuities issued

by the Company to fund certain workers’ compensation indemnity payments where the claimant has not released the Company of its

obligation, the Company has recorded annuity obligations totaling $896 as of December 31, 2010 and $924 as of December 31, 2009.

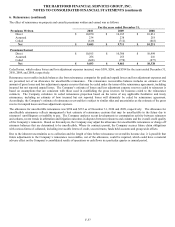

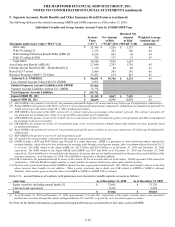

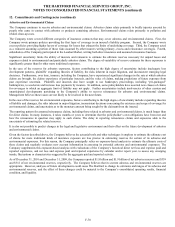

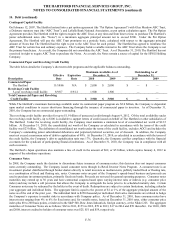

Property and Casualty Insurance products Unpaid Losses and Loss Adjustment Expenses

A rollforward of liabilities for unpaid losses and loss adjustment expenses follows:

For the years ended December 31,

2010 2009 2008

Beginning liabilities for unpaid losses and loss adjustment expenses, gross $21,651 $ 21,933 $ 22,153

Reinsurance and other recoverables 3,441 3,586 3,922

Beginning liabilities for unpaid losses and loss adjustment expenses, net 18,210 18,347 18,231

Add provision for unpaid losses and loss adjustment expenses

Current year 6,768 6,596 6,933

Prior years (196) (186) (226)

Total provision for unpaid losses and loss adjustment expenses 6,572 6,410 6,707

Less payments

Current year 2,952 2,776 2,888

Prior years 3,882 3,771 3,703

Total payments 6,834 6,547 6,591

Ending liabilities for unpaid losses and loss adjustment expenses, net 17,948 18,210 18,347

Reinsurance and other recoverables 3,077 3,441 3,586

Ending liabilities for unpaid losses and loss adjustment expenses, gross $21,025 $ 21,651 $ 21,933

In the opinion of management, based upon the known facts and current law, the reserves recorded for The Hartford’ s property and

casualty insurance products at December 31, 2010 represent the Company’ s best estimate of its ultimate liability for losses and loss

adjustment expenses related to losses covered by policies written by the Company. Based on information or trends that are not presently

known, future reserve re-estimates may result in adjustments to these reserves. Such adjustments could possibly be significant,

reflecting any variety of new and adverse or favorable trends. Because of the significant uncertainties surrounding environmental and

particularly asbestos exposures, it is possible that management’ s estimate of the ultimate liabilities for these claims may change and that

the required adjustment to recorded reserves could exceed the currently recorded reserves by an amount that could be material to The

Hartford’ s results of operations, financial condition and liquidity. For a further discussion, see Note 12.

Examples of current trends affecting frequency and severity include increases in medical cost inflation rates, the changing use of

medical care procedures, the introduction of new products and changes in internal claim practices. Other trends include changes in the

legislative and regulatory environment over workers’ compensation claims and evolving exposures to claims relating to molestation or

abuse and other mass torts. In the case of the reserves for asbestos exposures, factors contributing to the high degree of uncertainty

include inadequate loss development patterns, plaintiffs’ expanding theories of liability, the risks inherent in major litigation, and

inconsistent emerging legal doctrines. In the case of the reserves for environmental exposures, factors contributing to the high degree of

uncertainty include expanding theories of liabilities and damages, the risks inherent in major litigation, inconsistent decisions

concerning the existence and scope of coverage for environmental claims, and uncertainty as to the monetary amount being sought by

the claimant from the insured.

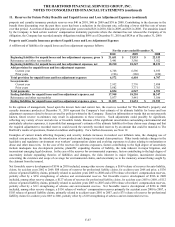

Net favorable reserve development of $196 in 2010 included, among other reserve changes, a $169 release of reserves for auto liability,

claims, for accident years 2002 to 2009, $88 release of reserves for professional liability claims, for accident years 2008 and prior, a $136

release of general liability claims, primarily related to accident years 2005 to 2008 and a $70 release of workers’ compensation reserves,

partially offset by a $256 strengthening of asbestos and environmental reserves. Net favorable reserve development of $186 in 2009

included, among other reserve changes, a $127 release of reserves for professional liability claims, for accident years 2003 to 2008, a $112

release of general liability claims, primarily related to accident years 2003 to 2007 and a $92 release of workers’ compensation reserves,

partially offset by a $213 strengthening of asbestos and environmental reserves. Net favorable reserve development of $226 in 2008

included, among other reserve changes, a $156 release of workers’ compensation reserves primarily for accident years 2000 to 2007, a

$105 release of general liability claims, primarily related to accident years 2001 to 2007, and a $75 release of reserves for professional

liability claims for accident years 2003 to 2006, partially offset by a $103 strengthening of asbestos and environmental reserves.