The Hartford 2010 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 101

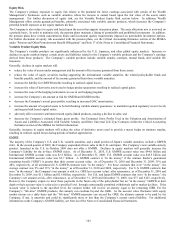

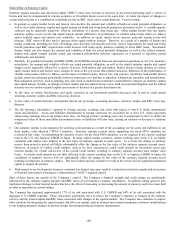

An increase in interest rates from the current levels is generally a favorable development for the Company. Rate increases are expected

to provide additional net investment income, increase sales of fixed rate Wealth Management investment products, reduce the cost of

the variable annuity hedging program, limit the potential risk of margin erosion due to minimum guaranteed crediting rates in certain

Wealth Management products and, if sustained, could reduce the Company’ s prospective pension expense. Conversely, a rise in interest

rates will reduce the fair value of the investment portfolio, increase interest expense on the Company’ s variable rate debt obligations

and, if long-term interest rates rise dramatically within a six to twelve month time period, certain Wealth Management businesses may

be exposed to disintermediation risk. Disintermediation risk refers to the risk that policyholders will surrender their contracts in a rising

interest rate environment requiring the Company to liquidate assets in an unrealized loss position. In conjunction with the interest rate

risk measurement and management techniques, certain of Wealth Management’ s fixed income product offerings have market value

adjustment provisions at contract surrender. An increase in interest rates may also impact the Company’ s tax planning strategies and in

particular its ability to utilize tax benefits to offset certain previously recognized realized capital losses.

A decline in interest rates results in certain mortgage-backed securities being more susceptible to paydowns and prepayments. During

such periods, the Company generally will not be able to reinvest the proceeds at comparable yields. Lower interest rates will also likely

result in lower net investment income, increased hedging cost associated with variable annuities and, if declines are sustained for a long

period of time, it may subject the Company to reinvestment risks, higher pension costs expense and possibly reduced profit margins

associated with guaranteed crediting rates on certain Wealth Management products. Conversely, the fair value of the investment

portfolio will increase when interest rates decline and the Company’ s interest expense will be lower on its variable rate debt obligations.

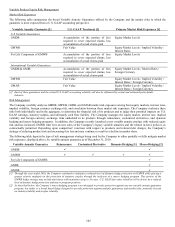

The investments and liabilities primarily associated with interest rate risk are included in the following discussion. Certain product

liabilities, including those containing GMWB, GMIB, GMAB, or GMDB, expose the Company to interest rate risk but also have

significant equity risk. These liabilities are discussed as part of the Equity Risk section below.

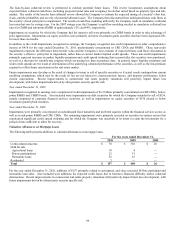

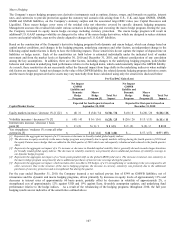

Fixed Maturity Investments

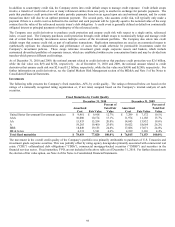

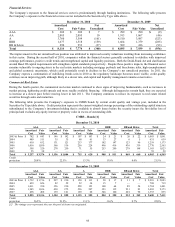

The Company’ s investment portfolios primarily consist of investment grade fixed maturity securities. The fair value of these

investments was $78.4 billion and $71.2 billion at December 31, 2010 and 2009, respectively. The fair value of these and other invested

assets fluctuates depending on the interest rate environment and other general economic conditions. The weighted average duration of

the fixed maturity portfolio was approximately 5.4 and 4.9 years as of December 31, 2010 and 2009, respectively.

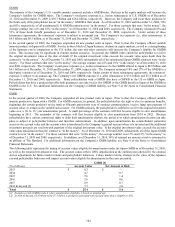

Liabilities

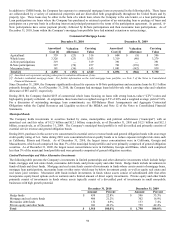

The Company’ s investment contracts and certain insurance product liabilities, other than non-guaranteed separate accounts, include

asset accumulation vehicles such as fixed annuities, guaranteed investment contracts, other investment and universal life-type contracts

and certain insurance products such as long-term disability.

Asset accumulation vehicles primarily require a fixed rate payment, often for a specified period of time. Product examples include fixed

rate annuities with a market value adjustment feature and fixed rate guaranteed investment contracts. The term to maturity of these

contracts generally range from less than one year to ten years. In addition, certain products such as universal life contracts and the

general account portion of Wealth Management’ s variable annuity products, credit interest to policyholders subject to market conditions

and minimum interest rate guarantees. The term to maturity of the asset portfolio supporting these products may range from short to

intermediate.

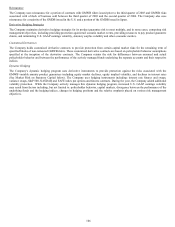

While interest rate risk associated with many of these products has been reduced through the use of market value adjustment features

and surrender charges, the primary risk associated with these products is that the spread between investment return and credited rate

may not be sufficient to earn targeted returns.

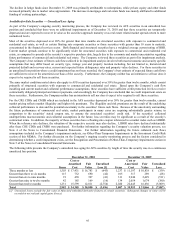

The Company also manages the risk of certain insurance liabilities similarly to investment type products due to the relative

predictability of the aggregate cash flow payment streams. Products in this category may contain significant reliance upon actuarial

(including mortality and morbidity) pricing assumptions and do have some element of cash flow uncertainty. Product examples include

structured settlement contracts, on-benefit annuities (i.e., the annuitant is currently receiving benefits thereon) and short-term and long-

term disability contracts. The cash outflows associated with these policy liabilities are not interest rate sensitive but do vary based on

the timing and amount of benefit payments. The primary risks associated with these products are that the benefits will exceed expected

actuarial pricing and/or that the actual timing of the cash flows will differ from those anticipated, or interest rate levels may deviate

from those assumed in product pricing, ultimately resulting in an investment return lower than that assumed in pricing. The average

duration of the liability cash flow payments can range from less than one year to in excess of fifteen years.

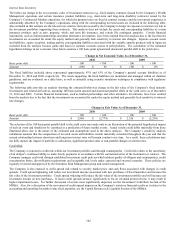

Derivatives

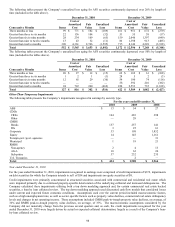

The Company utilizes a variety of derivative instruments to mitigate interest rate risk associated with its investment portfolio. Interest

rate swaps are primarily used to convert interest receipts or payments to a fixed or variable rate. The use of such swaps enables the

Company to customize contract terms and conditions to customer objectives and satisfies its asset/liability duration matching policy.

Interest rate swaps are also used to hedge the variability in the cash flow of a forecasted purchase or sale of fixed rate securities due to

changes in interest rates. Forward rate agreements are used to convert interest receipts on floating-rate securities to fixed rates. These

derivatives are used to lock in the forward interest rate curve and reduce income volatility that results from changes in interest rates.

Interest rate caps, floors, swaptions, and futures may be used to manage portfolio duration.

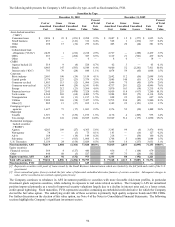

At December 31, 2010 and 2009, notional amounts pertaining to derivatives utilized to manage interest rate risk totaled $19.3 billion

and $21.3 billion, respectively ($18.9 billion and $19.7 billion, respectively, related to investments and $0.4 billion and $1.6 billion,

respectively, related to Wealth Management liabilities). The fair value of these derivatives was $(372) and $18 as of December 31,

2010 and 2009, respectively.