The Hartford 2010 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248

|

|

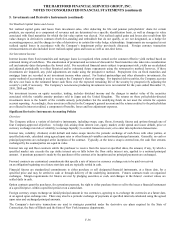

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-27

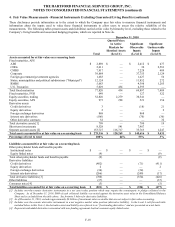

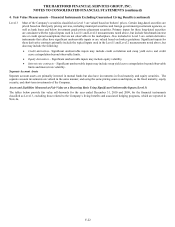

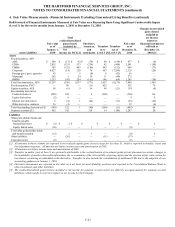

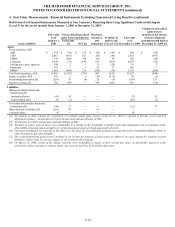

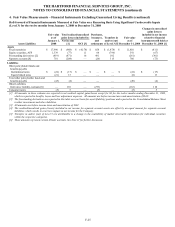

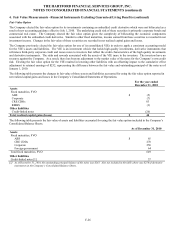

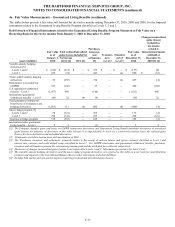

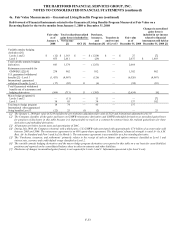

4. Fair Value Measurements –Financial Instruments Excluding Guaranteed Living Benefits (continued)

Financial Instruments Not Carried at Fair Value

The following table presents carrying amounts and fair values of The Hartford’ s financial instruments not carried at fair value and not

included in the above fair value discussion as of December 31, 2010 and December 31, 2009.

December 31, 2010 December 31, 2009

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Assets

Policy loans $2,181 $ 2,294 $ 2,174 $ 2,321

Mortgage loans 4,489 4,524 5,938 5,091

Liabilities

Other policyholder funds and benefits payable [1] $ 11,155 $ 11,383 $ 12,330 $ 12,513

Senior notes [2] 4,880 5,072 4,054 4,037

Junior subordinated debentures [2] 1,727 2,596 1,717 2,338

Consumer notes [3] 377 392 1,131 1,194

[1] Excludes guarantees on variable annuities, group accident and health and universal life insurance contracts, including corporate owned life

insurance.

[2] Included in long-term debt in the Consolidated Balance Sheets, except for current maturities, which are included in short-term debt.

[3] Excludes amounts carried at fair value and included in disclosures above.

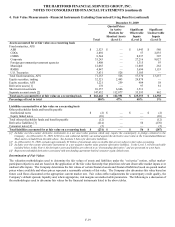

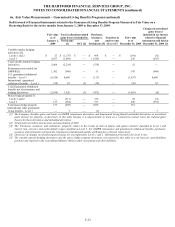

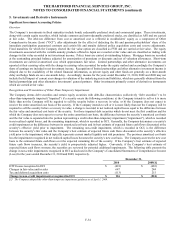

As of December 31, 2010 and 2009, included in other liabilities in the Consolidated Balance Sheets are carrying amounts of $233 and

$273 for deposits, respectively, and $25 and $78 for Federal Home Loan Bank advances, respectively, related to Federal Trust

Corporation. These carrying amounts approximate fair value.

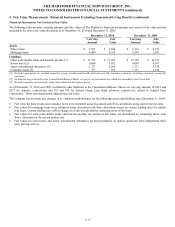

The Company has not made any changes in its valuation methodologies for the following assets and liabilities since December 31, 2009.

• Fair value for policy loans and consumer notes were estimated using discounted cash flow calculations using current interest rates.

• Fair values for mortgage loans were estimated using discounted cash flow calculations based on current lending rates for similar

type loans. Current lending rates reflect changes in credit spreads and the remaining terms of the loans.

• Fair values for other policyholder funds and benefits payable, not carried at fair value, are determined by estimating future cash

flows, discounted at the current market rate.

• Fair values for senior notes and junior subordinated debentures are based primarily on market quotations from independent third

party pricing services.