The Hartford 2010 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

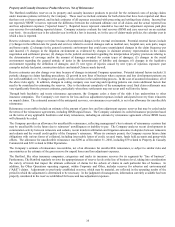

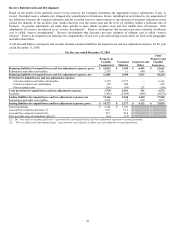

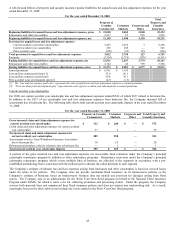

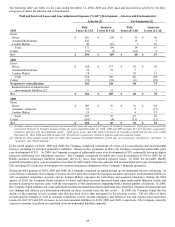

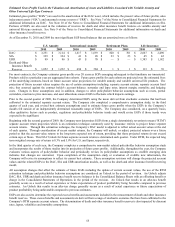

A roll-forward follows of property and casualty insurance product liabilities for unpaid losses and loss adjustment expenses for the year

ended December 31, 2008:

For the year ended December 31, 2008

Property &

Casualty

Commercial

Consumer

Markets

Corporate and

Other

Total

Property and

Casualty

Insurance

Beginning liabilities for unpaid losses and loss adjustment expenses, gross $15,020 2,065 5,068 22,153

Reinsurance and other recoverables 2,917 67 938 3,922

Beginning liabilities for unpaid losses and loss adjustment expenses, net 12,103 1,998 4,130 18,231

Provision for unpaid losses and loss adjustment expenses

Current accident year before catastrophes 3,835 2,552 3 6,390

Current accident year catastrophes 285 258 — 543

Prior accident years (298) (52) 124 (226)

Total provision for unpaid losses and loss adjustment expenses 3,822 2,758 127 6,707

Payments (3,394) (2,719) (478) (6,591)

Ending liabilities for unpaid losses and loss adjustment expenses, net 12,531 2,037 3,779 18,347

Reinsurance and other recoverables 2,742 46 798 3,586

Ending liabilities for unpaid losses and loss adjustment expenses, gross $15,273 $2,083 $ 4,577 $ 21,933

Earned premiums $6,395 $3,935

Loss and loss expense paid ratio [1] 53.0 69.1

Loss and loss expense incurred ratio 59.8 70.1

Prior accident years development (pts) [2] (4.7) (1.3)

[1] The “loss and loss expense paid ratio” represents the ratio of paid losses and loss adjustment expenses to earned premiums.

[2] “Prior accident years development (pts)” represents the ratio of prior accident years development to earned premiums.

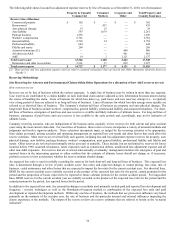

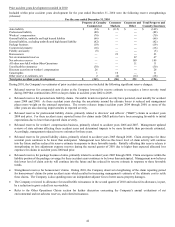

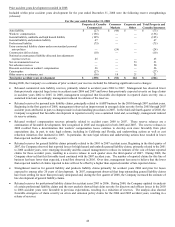

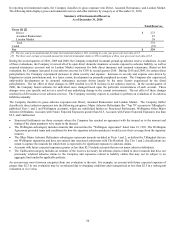

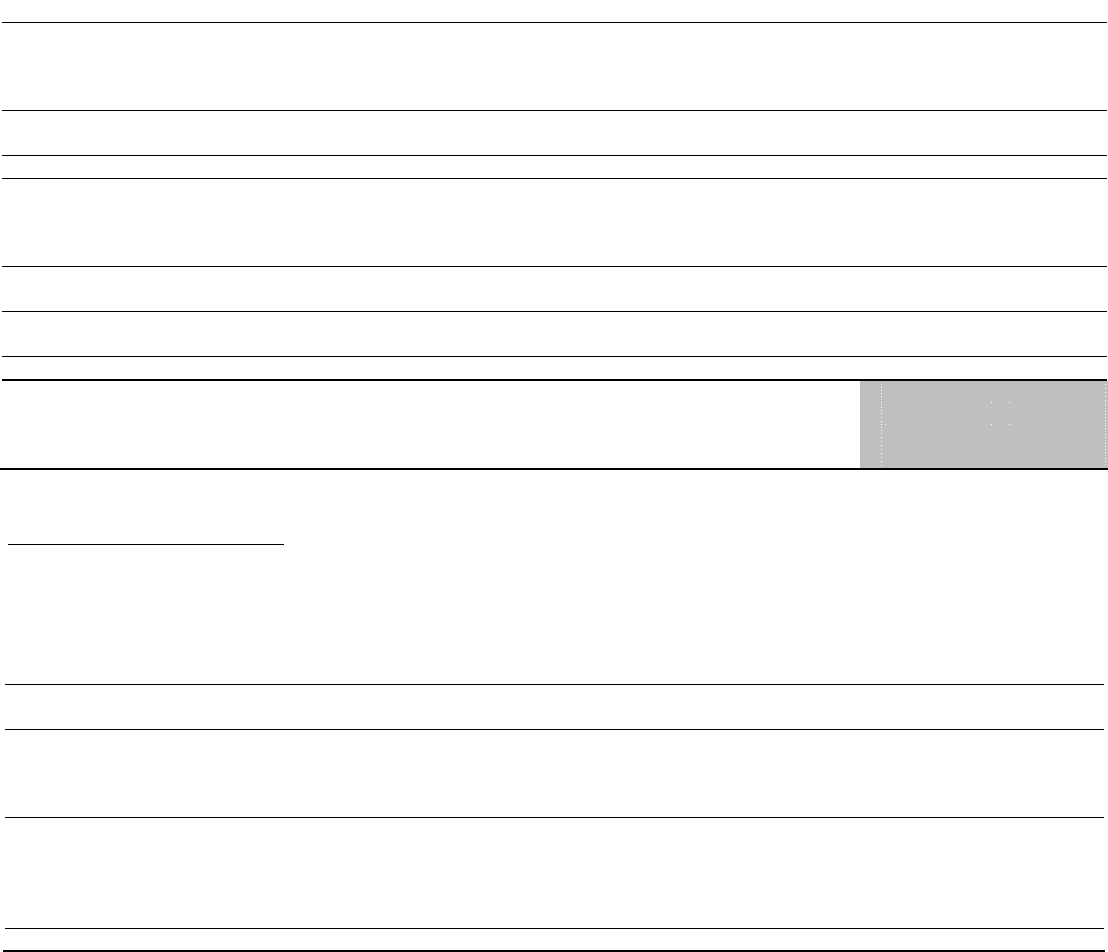

Current accident year catastrophes

For 2008, net current accident year catastrophe loss and loss adjustment expenses totaled $543, of which $237 related to hurricane Ike.

In addition to the $237 of net catastrophe loss and loss adjustment expenses from hurricane Ike, the Company incurred $20 of

assessments due to hurricane Ike. The following table shows total current accident year catastrophe impacts in the year ended December

31, 2008:

For the year ended December 31, 2008

Propert

y

& Casualt

y

Commercial

Consumer

Markets

Corporate and

Other

Total Property and

Casualty Insurance

Gross incurred claim and claim adjustment expenses for

current accident year catastrophes $ 312 $ 260 $ — $ 572

Ceded claim and claim adjustment expenses for current accident

year catastrophes 27 2 — 29

Net incurred claim and claim adjustment expenses for

current accident year catastrophes 285 258 — 543

Assessments owed to Texas Windstorm Insurance Association

due to hurricane Ike 10 10 — 20

Reinstatement premium ceded to reinsurers due to hurricane Ike — 1 — 1

Total current accident year catastrophe impacts $ 295 $ 269 $ — $ 564

A portion of the gross incurred loss and loss adjustment expenses are recoverable from reinsurers under the Company’ s principal

catastrophe reinsurance program in addition to other reinsurance programs. Reinsurance recoveries under the Company’ s principal

catastrophe reinsurance program, which covers multiple lines of business, are allocated to the segments in accordance with a pre-

established methodology that is consistent with the method used to allocate the ceded premium to each segment.

The Company’ s estimate of ultimate loss and loss expenses arising from hurricanes and other catastrophes is based on covered losses

under the terms of the policies. The Company does not provide residential flood insurance on its homeowners policies so the

Company’ s estimate of hurricane losses on homeowners’ business does not include any provision for damages arising from flood

waters. The Company acts as an administrator for the Write Your Own flood program on behalf of the National Flood Insurance

Program under FEMA, for which it earns a fee for collecting premiums and processing claims. Under the program, the Company

services both personal lines and commercial lines flood insurance policies and does not assume any underwriting risk. As a result,

catastrophe losses in the above table do not include any losses related to the Write Your Own flood program.