The Hartford 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

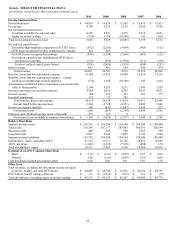

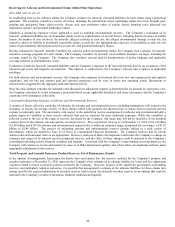

Wealth Management

The partial equity market recovery over the last eighteen months has driven an increase in deposits and assets under management;

however profitability rates are not consistent with historical levels. The current market conditions and market volatility have increased

the cost and volatility of hedging programs, and the level of capital needed to support living benefit guarantees when compared to

historical levels. Management is committed to the U.S. variable annuity marketplace and will continue to evaluate the benefits offered

within its variable annuities, and ensure the product portfolio meets customer needs within the risk tolerances of The Hartford. Wealth

Management seeks to achieve scale through increased deposits and market improvements along with a focus on expense reductions.

Wealth Management will focus on product development to increase sales of its products and services to the “baby boomer” generation.

The Company expects that many “baby boomers” will be looking to provide more stability to the value of their accumulated wealth and

will focus more on identifying and creating dependable and certain income streams that can provide known payments throughout their

retirement. As the mutual fund business continues to evolve, success will be driven by diversifying net sales across the mutual fund

platform, delivering superior investment performance and creating new investment solutions for current and future mutual fund

shareholders. Wealth Management will increase future sales of its Life Insurance products by implementing strategies to expand

distribution capabilities, including utilizing independent agents and continuing to build on the strong relationships within the financial

institution marketplace. Retirement Plans looks to continue to focus on our clients' increasing needs for retirement income security given

the recent volatility in the financial markets and to provide products that respond to the needs of plan sponsors to manage risk and

stretch their benefit dollars.

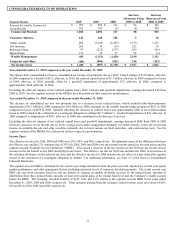

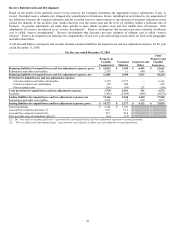

CRITICAL ACCOUNTING ESTIMATES

The preparation of financial statements, in conformity with accounting principles generally accepted in the United States of America

(“U.S. GAAP”), requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses

during the reporting period. Actual results could differ, and in the past has differed, from those estimates.

The Company has identified the following estimates as critical in that they involve a higher degree of judgment and are subject to a

significant degree of variability:

• property and casualty insurance product reserves, net of reinsurance;

• estimated gross profits used in the valuation and amortization of assets and liabilities associated with variable annuity and other

universal life-type contracts;

• evaluation of other-than-temporary impairments on available-for-sale securities and valuation allowances on investments;

• living benefits required to be fair valued (in other policyholder funds and benefits payable);

• goodwill impairment;

• valuation of investments and derivative instruments;

• pension and other postretirement benefit obligations;

• valuation allowance on deferred tax assets; and

• contingencies relating to corporate litigation and regulatory matters.

Certain of these estimates are particularly sensitive to market conditions, and deterioration and/or volatility in the worldwide debt or

equity markets could have a material impact on the Consolidated Financial Statements. In developing these estimates management

makes subjective and complex judgments that are inherently uncertain and subject to material change as facts and circumstances

develop. Although variability is inherent in these estimates, management believes the amounts provided are appropriate based upon the

facts available upon compilation of the financial statements.