The Hartford 2010 Annual Report Download - page 137

Download and view the complete annual report

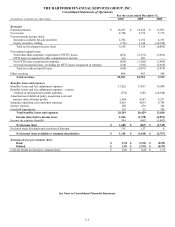

Please find page 137 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-9

1. Basis of Presentation and Accounting Policies (continued)

Adoption of New Accounting Standards

Variable Interest Entities

In June 2009, the Financial Accounting Standards Board (“FASB”) updated the guidance which amends the consolidation requirements

applicable to variable interest entities (“VIE”). Under this new guidance, an entity would consolidate a VIE when the entity has both (a)

the power to direct the activities of a VIE that most significantly impact the entity’ s economic performance and (b) the obligation to

absorb losses of the entity that could potentially be significant to the VIE or the right to receive benefits from the entity that could

potentially be significant to the VIE. The FASB also issued an amendment to this guidance in February 2010 which defers application

of this guidance to certain entities that apply specialized accounting guidance for investment companies. The Company adopted this

guidance on January 1, 2010. As a result of adoption, in addition to those VIEs the Company consolidates under the previous guidance,

the Company consolidated a Company sponsored Collateralized Debt Obligation (“CDO”), electing the fair value option, and a

Company sponsored Collateralized Loan Obligation, at carrying values carried forward as if the Company had been the primary

beneficiary from the date the Company entered into the VIE arrangement. The impact on the Company’ s Consolidated Balance Sheet

as a result of adopting this guidance was an increase in assets of $432, an increase in liabilities of $406, and an increase in January 1,

2010 retained earnings, net of tax, of $26. The Company has investments in mutual funds, limited partnerships and other alternative

investments, including hedge funds, mortgage and real estate funds, mezzanine debt funds, and private equity and other funds which

may be VIEs. The accounting for these investments will remain unchanged as they fall within the scope of the deferral of this new

consolidation guidance. See Note 5 for further discussion.

Embedded Credit Derivatives

In March 2010, the FASB issued guidance clarifying the scope exception for certain credit derivatives embedded within structured

securities which may result in bifurcation of these credit derivatives. Embedded credit derivatives resulting only from subordination of

one financial instrument to another continue to qualify for the exemption. As a result, investments with an embedded credit derivative in

a form other than the above mentioned subordination may need to be separately accounted for as an embedded credit derivative

resulting in recognition of the change in the fair value of the embedded credit derivative in current period earnings. Upon adoption, an

entity may elect the fair value option prospectively, with changes in fair value of the investment in its entirety recognized in earnings,

rather than bifurcate the embedded credit derivative. The guidance is effective, on a prospective basis only, for fiscal years and interim

periods within those fiscal years, beginning on or after June 15, 2010. The Company adopted this guidance on July 1, 2010 and

identified securities with an amortized cost and fair value of $971 and $639, respectively, which were impacted by the scope of this

standard. Upon adoption, the Company elected the fair value option for securities having an amortized cost and fair value of $447 and

$214, respectively. For further discussion of fair value option, see Note 4. For the remainder of securities that were impacted by the

scope of this standard, upon adoption, the embedded credit derivatives were bifurcated but are reported with the host instrument in the

consolidated balance sheets. As of July 1, 2010, these securities had an amortized cost and fair value of $524 and $425, respectively,

with an associated embedded derivative notional value of $525. For further discussion of embedded derivatives, see Note 5. The

adoption, on July 1, 2010 resulted in the reclassification of $194, after-tax and after deferred policy acquisition costs (“DAC”), net

unrealized losses from accumulated other comprehensive loss to retained earnings, including $211 of unrealized capital losses and $17

of unrealized capital gains.

Future Adoption of New Accounting Standards

Accounting for Costs Associated with Acquiring or Renewing Insurance Contracts

In October 2010, the FASB issued guidance clarifying the definition of acquisition costs that are eligible for deferral. Acquisition costs

are to include only those costs that are directly related to the successful acquisition or renewal of insurance contracts; incremental direct

costs of contract acquisition that are incurred in transactions with either independent third parties or employees; and advertising costs

meeting the capitalization criteria for direct-response advertising.

This guidance will be effective for fiscal years beginning after December 15, 2011, and interim periods within those years. This

guidance may be applied prospectively upon the date of adoption, with retrospective application permitted, but not required. Early

adoption is permitted.

The Company will adopt this guidance on January 1, 2012. The Company has not yet determined if it will apply the guidance on a

prospective or retrospective basis or the effect of the adoption on the Company’ s Consolidated Financial Statements. If retrospective

application is elected, the adoption could have a material impact on stockholders’ equity. If prospective application is elected, there

could be a material impact to the Company’ s Consolidated Statement of Operations as non-deferrable acquisition costs will increase

while amortization would continue on the existing DAC balance.