The Hartford 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

127

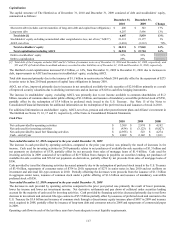

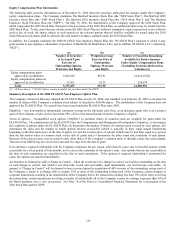

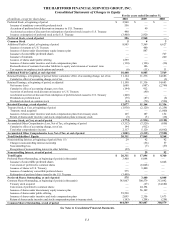

Equity Compensation Plan Information

The following table provides information as of December 31, 2010 about the securities authorized for issuance under the Company’ s

equity compensation plans. The Company maintains The Hartford Incentive Stock Plan (the “2000 Stock Plan”), The Hartford 2005

Incentive Stock Plan (the “2005 Stock Plan”), The Hartford 2010 Incentive Stock Plan (the “2010 Stock Plan”), and The Hartford

Employee Stock Purchase Plan (the “ESPP”). On May 19, 2010, the shareholders of the Company approved the 2010 Stock Plan,

which superseded the 2005 Stock Plan. Pursuant to the provisions of the 2010 Stock Plan, no additional shares may be issued from the

2005 Stock Plan. To the extent that any awards under the 2005 Stock Plan are forfeited, terminated, expire unexercised or are settled in

cash in lieu of stock, the shares subject to such awards (or the relevant portion thereof) shall be available for award under the 2010

Stock Plan and such shares shall be added to the total number of shares available under the 2010 Stock Plan.

In addition, the Company maintains the 2000 PLANCO Non-employee Option Plan (the “PLANCO Plan”) pursuant to which it may

grant awards to non-employee wholesalers of products of Hartford Life Distributors, LLC, and its affiliate, PLANCO, LLC (collectively

“HLD”).

(a) (b) (c)

Number of Securities

to be Issued Upon

Exercise of

Outstanding Options,

Warrants and Rights

Weighted-average

Exercise Price of

Outstanding

Options, Warrants

and Rights

Number of Securities Remaining

Available for Future Issuance

Under Equity Compensation Plans

(Excluding Securities Reflected in

Column (a))

Equity compensation plans

approved by stockholders 5,266,634 $52.91 24,624,318[1]

Equity compensation plans not

approved by stockholders 12,821 50.23 256,676

Total 5,279,455 $52.90 24,880,994

[1] Of these shares, 7,240,661 shares remain available for purchase under the ESPP.

Summary Description of the 2000 PLANCO Non-Employee Option Plan

The Company’ s Board of Directors adopted the PLANCO Plan on July 20, 2000, and amended it on February 20, 2003 to increase the

number of shares of the Company’ s common stock subject to the plan to 450,000 shares. The stockholders of the Company have not

approved the PLANCO Plan. No awards have been issued under the PLANCO Plan since 2003.

Eligibility – Any non-employee independent contractor serving on the wholesale sales force as an insurance agent who is an exclusive

agent of the Company or who derives more than 50% of his or her annual income from the Company is eligible.

Terms of options – Nonqualified stock options (“NQSOs”) to purchase shares of common stock are available for grant under the

PLANCO Plan. The administrator of the PLANCO Plan, the Compensation and Management Development Committee, (i) determines

the recipients of options under the PLANCO Plan, (ii) determines the number of shares of common stock covered by such options, (iii)

determines the dates and the manner in which options become exercisable (which is typically in three equal annual installments

beginning on the first anniversary of the date of grant), (iv) sets the exercise price of options (which may be less than, equal to or greater

than the fair market value of common stock on the date of grant) and (v) determines the other terms and conditions of each option.

Payment of the exercise price may be made in cash, other shares of the Company’ s common stock or through a same day sale program.

The term of an NQSO may not exceed ten years and two days from the date of grant.

If an optionee’ s required relationship with the Company terminates for any reason, other than for cause, any exercisable options remain

exercisable for a fixed period of four months, not to exceed the remainder of the option’ s term. Any options that are not exercisable at

the time of such termination are cancelled on the date of such termination. If the optionee’ s required relationship is terminated for

cause, the options are canceled immediately.

Acceleration in Connection with a Change in Control – Upon the occurrence of a change in control, each option outstanding on the date

of such change in control, and which is not then fully vested and exercisable, shall immediately vest and become exercisable. In

general, a “Change in Control” will be deemed to have occurred upon the acquisition of 40% or more of the outstanding voting stock of

the Company, a tender or exchange offer to acquire 15% or more of the outstanding voting stock of the Company, certain mergers or

corporate transactions resulting in the shareholders of the Company before the transactions owning less than 55% of the entity surviving

the transactions, certain transactions involving a transfer of substantially all of the Company’ s assets or a change in greater than 50% of

the Board members over a two year period. See Note 18 of the Notes to Consolidated Financial Statements for a description of the

2010 Stock Plan and the ESPP.