The Hartford 2010 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

Macro Hedging

The Company’ s macro hedging program uses derivative instruments such as options, futures, swaps, and forwards on equities, interest

rates, and currencies to provide protection against the statutory tail scenario risk arising from U.S., U.K. and Japan GMWB, GMDB,

GMIB and GMAB liabilities, on the Company’ s statutory surplus and the associated target RBC ratios (see Capital Resources and

Liquidity). These macro hedges cover some of the residual risks not otherwise covered by specific dynamic hedging programs.

Management assesses this residual risk under various scenarios in designing and executing the macro hedge program. During the year,

the Company increased its equity macro hedge coverage including currency protection. The macro hedge program will result in

additional U.S. GAAP earnings volatility as changes in the value of the macro hedge derivatives, which are designed to reduce statutory

reserve and capital volatility, may not be closely aligned to changes in U.S. GAAP liabilities.

Based on the construction of the Company’ s derivative hedging program (both dynamic and macro hedge), which can change based on

capital market conditions, and changes in the hedging program, underlying exposures and other factors, an independent change in the

following capital market factors is likely to have the following impacts. These sensitivities do not capture the impact of elapsed time on

liabilities or hedge assets. Each of the sensitivities set forth below is estimated individually under the indicated level of market

movement and from the market levels at September 30, 2010 and December 31, 2010, and without consideration of any correlation

among the key assumptions. In addition, there are other factors, including changes to the underlying hedging program, policyholder

behavior and variation in underlying fund performance relative to the hedged index, which could materially impact the GMWB liability.

As a result, these sensitivities do not necessarily reflect the financial impact from large shifts in the underlying indices or when multiple

risk factors are impacted. Actual net changes in the value of the GMWB liability, the related dynamic hedging program derivative assets

and the macro hedge program derivative assets may vary materially from those calculated using only the sensitivities disclosed below:

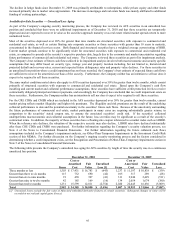

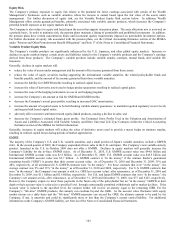

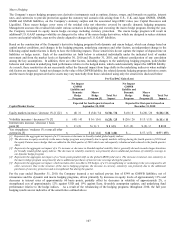

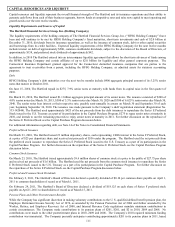

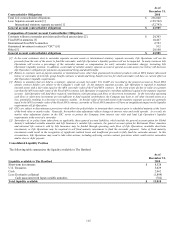

Pre-Tax/DAC Gain (Loss)

Net Impact

GMWB

Liability and

Dynamic

Hedge

Program

Macro

Hedge

Program [5]

Total Net

Impact

Net Impact

GMWB

Liability and

Dynamic

Hedge

Program

Macro

Hedge

Program [5]

Total Net

Impact

Capital Market Factor

Expected for fourth quarter based on

September 30, 2010

Expected for first quarter based on

December 31, 2010

Equity markets increase / decrease 1% [1] [2] $ (0) / 0 $ (34) / 34

$ (34) / 34 $ (0) / 0 $ (26) / 26

$ (26) / 26

Volatility increases / decreases 1% [3] $ (41) / 41 $ 16 / (16)

$ (25) / 25 $ (26) / 26 $ 15 / (15)

$ (11) / 11

Interest rates increase / decrease 1 basis

point [4] $ 2 / (2) $ (1) / 1

$ 1 / (1) $ 2 / (2) $ (2) / 2

$ 0 / 0

Yen strengthens / weakens 1% versus all other

currencies [5] $ — $ 44 / (44)

$ 44 / (44) $ — $ 57 / (57)

$ 57 / (57)

[1] Represents the aggregate net impact of a 1% increase or decrease in broadly traded global equity indices.

[2] The decrease in equity sensitivity in the macro hedge program was primarily due to equity markets rallying during the fourth quarter of 2010 and

the equity Futures macro hedge that was added in the third quarter of 2010 which was subsequently rebalanced and reduced in the fourth quarter

2010.

[3] Represents the aggregate net impact of a 1% increase or decrease in blended implied volatility that is generally skewed towards longer durations

for broadly traded global equity indices. The decrease in volatility sensitivity was primarily due to additional purchases of volatility coverage in

our dynamic hedge program.

[4] Represents the aggregate net impact of a 1 basis point parallel shift on the global LIBOR yield curve. The increase in interest rate sensitivity in

the macro hedge program was primarily due to additional purchases of interest rate coverage during the quarter.

[5] Represents the aggregate net impact, which includes other non-Macro FX hedges, of a 1% strengthening or weakening in the yen compared to all

other currencies. Due to the structure of the macro hedging program, the increase in currency sensitivity was primarily due to the additional

purchases of currency protection and a strengthened Yen during the quarter.

For the year ended December 31, 2010, the Company incurred a net realized pre-tax loss of $349 on GMWB liabilities, net of

reinsurance and the dynamic and macro hedging programs, driven primarily by increases in equity levels of approximately 13% and

decreases in interest rates of approximately 60 basis points, partially offset by decreases in volatility of approximately 2%, a

strengthened yen of approximately 12% against USD and 19% against Euro, favorable assumption updates, and underlying fund

performance relative to the hedge indices. As a result of the rebalancing of the hedging programs throughout 2010, the full year

hedging results are not indicative of the sensitivities outlined above.