The Hartford 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

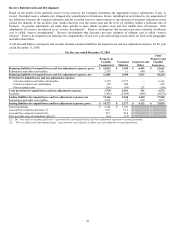

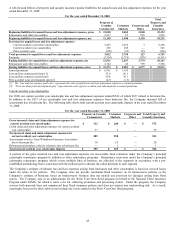

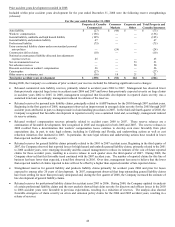

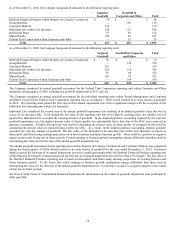

Other Operations Claims

Reserve Activity

Reserves and reserve activity in the Other Operations operating segment, within Corporate and Other, are categorized and reported as

asbestos, environmental, or “all other”. The “all other” category of reserves covers a wide range of insurance and assumed reinsurance

coverages, including, but not limited to, potential liability for construction defects, lead paint, silica, pharmaceutical products,

molestation and other long-tail liabilities.

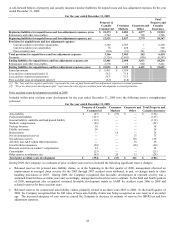

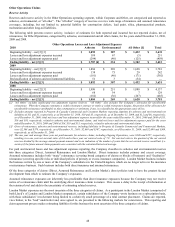

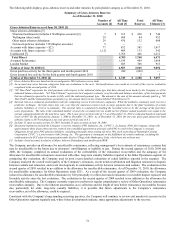

The following table presents reserve activity, inclusive of estimates for both reported and incurred but not reported claims, net of

reinsurance, for Other Operations, categorized by asbestos, environmental and all other claims, for the years ended December 31, 2010,

2009 and 2008.

Other Operations Losses and Loss Adjustment Expenses

2010 Asbestos Environmental All Other [1] Total

Beginning liability – net [2] [3] $ 1,892 $307 $ 1,432 $3,631

Losses and loss adjustment expenses incurred 189 67 (5) 251

Losses and loss adjustment expenses paid (294) (40) (125) (459)

Ending liability – net [2] [3] $ 1,787 [4] $ 334 $ 1,302 $ 3,423

2009

Beginning liability – net [2] [3] $ 1,884 $ 269 $ 1,628 $ 3,781

Losses and loss adjustment expenses incurred 138 75 29 242

Losses and loss adjustment expenses paid (181) (40) (171) (392)

Reclassification of asbestos and environmental liabilities 51 3 (54) —

Ending liability – net [2] [3] $ 1,892 $ 307 $ 1,432 $ 3,631

2008

Beginning liability – net [2] [3] $ 1,998 $ 251 $ 1,888 $ 4,137

Losses and loss adjustment expenses incurred 68 54 7 129

Losses and loss adjustment expenses paid (182) (36) (267) (485)

Ending liability – net [2] [3] $ 1,884 $ 269 $ 1,628 $ 3,781

[1] “All Other” includes unallocated loss adjustment expense reserves. “All Other” also includes The Company’s allowance for uncollectible

reinsurance. When the Company commutes a ceded reinsurance contract or settles a ceded reinsurance dispute, the portion of the allowance for

uncollectible reinsurance attributable to that commutation or settlement, if any, is reclassified to the appropriate cause of loss.

[2] Excludes amounts reported in Property & Casualty Commercial and Consumer Markets reporting segments for asbestos and environmental net

liabilities of $11 and $5, respectively, as of December 31, 2010, $10 and $5, respectively, as of December 31, 2009, and $12 and $6, respectively,

as of December 31, 2008; total net losses and loss adjustment expenses incurred for the years ended December 31, 2010, 2009 and 2008 of $15,

$16 and $16, respectively, related to asbestos and environmental claims; and total net losses and loss adjustment expenses paid for the years

ended December 31, 2010, 2009 and 2008 of $14, $19 and $13, respectively, related to asbestos and environmental claims.

[3] Gross of reinsurance, asbestos and environmental reserves, including liabilities in Property & Casualty Commercial and Commercial Markets,

were $2,308 and $378, respectively, as of December 31, 2010; $2,484 and $367, respectively, as of December 31, 2009; and $2,498 and $309,

respectively, as of December 31, 2008.

[4] The one year and average three year net paid amounts for asbestos claims, including Ongoing Operations, were $300 and $227, respectively,

resulting in a one year net survival ratio of 6.0 and a three year net survival ratio of 7.9. Net survival ratio is the quotient of the net carried

reserves divided by the average annual payment amount and is an indication of the number of years that the net carried reserve would last (i.e.

survive) if the future annual claim payments were consistent with the calculated historical average.

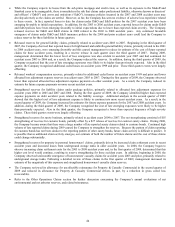

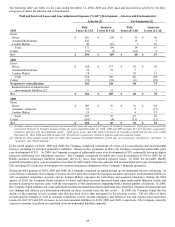

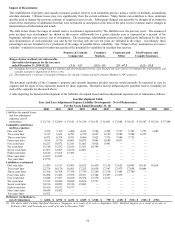

For paid and incurred losses and loss adjustment expenses reporting, the Company classifies its asbestos and environmental reserves

into three categories: Direct, Assumed Reinsurance and London Market. Direct insurance includes primary and excess coverage.

Assumed reinsurance includes both “treaty” reinsurance (covering broad categories of claims or blocks of business) and “facultative”

reinsurance (covering specific risks or individual policies of primary or excess insurance companies). London Market business includes

the business written by one or more of the Company’ s subsidiaries in the United Kingdom, which are no longer active in the insurance

or reinsurance business. Such business includes both direct insurance and assumed reinsurance.

Of the three categories of claims (Direct, Assumed Reinsurance and London Market), direct policies tend to have the greatest factual

development from which to estimate the Company’ s exposures.

Assumed reinsurance exposures are inherently less predictable than direct insurance exposures because the Company may not receive

notice of a reinsurance claim until the underlying direct insurance claim is mature. This causes a delay in the receipt of information at

the reinsurer level and adds to the uncertainty of estimating related reserves.

London Market exposures are the most uncertain of the three categories of claims. As a participant in the London Market (comprised of

both Lloyd’ s of London and London Market companies), certain subsidiaries of the Company wrote business on a subscription basis,

with those subsidiaries’ involvement being limited to a relatively small percentage of a total contract placement. Claims are reported,

via a broker, to the “lead” underwriter and, once agreed to, are presented to the following markets for concurrence. This reporting and

claim agreement process makes estimating liabilities for this business the most uncertain of the three categories of claims.