The Hartford 2010 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248

|

|

70

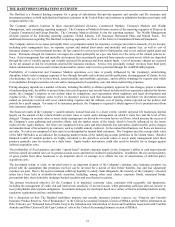

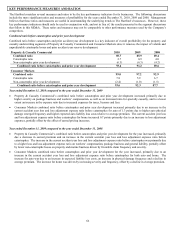

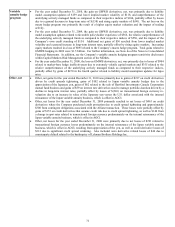

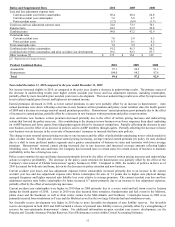

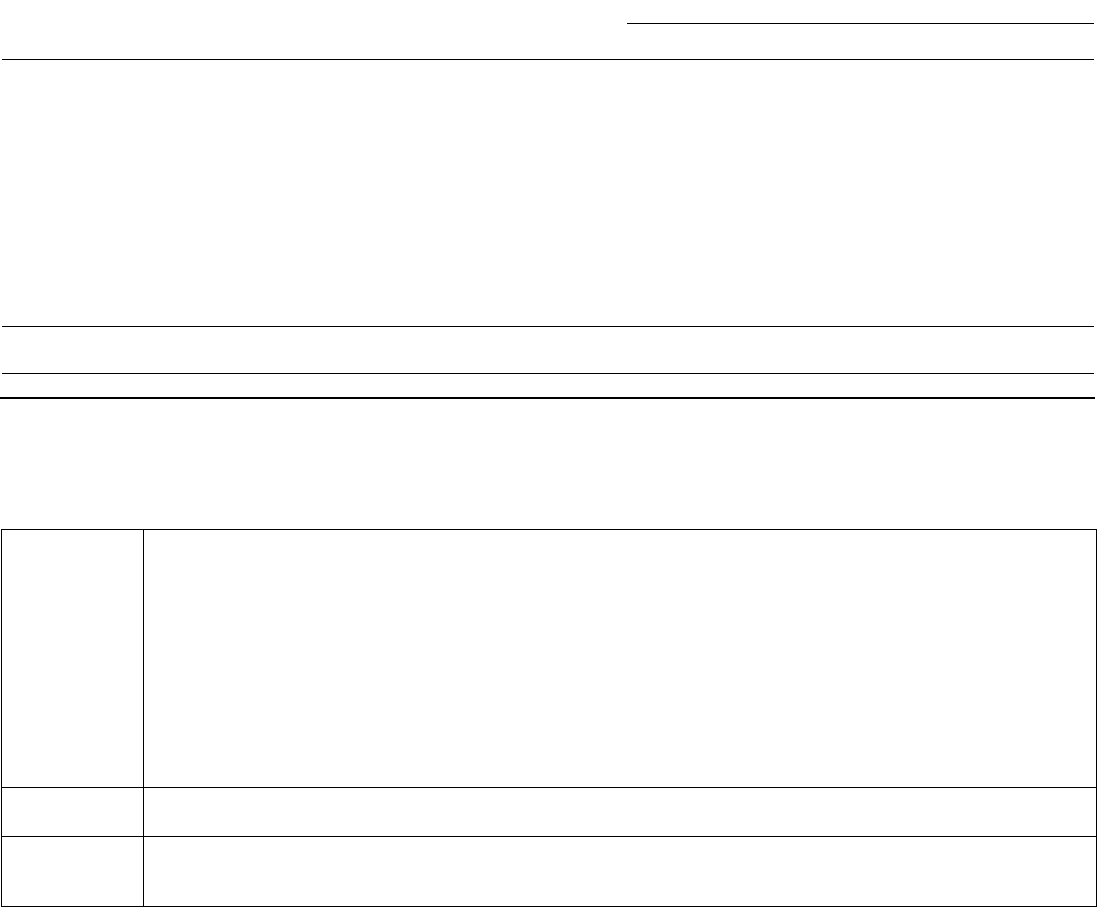

Net Realized Capital Gains (Losses)

For the years ended December 31,

2010 2009 2008

Gross gains on sales $836 $ 1,056 $607

Gross losses on sales (522) (1,397) (856)

Net OTTI losses recognized in earnings (434) (1,508) (3,964)

Valuation allowances on mortgage loans (157) (403) (26)

Japanese fixed annuity contract hedges, net [1] 27 47 64

Periodic net coupon settlements on credit derivatives/Japan (17) (49) (33)

Fair value measurement transition impact — — (650)

Results of variable annuity hedge program

GMWB derivatives, net 111 1,526 (713)

Macro hedge program (562) (895) 74

Total results of variable annuity hedge program (451) 631 (639)

Other, net [2] 164 (387) (421)

Net realized capital losses, before-tax $(554) $ (2,010) $(5,918)

[1] Relates to derivative hedging instruments, excluding periodic net coupon settlements, and is net of the Japanese fixed annuity product liability

adjustment for changes in the dollar/yen exchange spot rate.

[2] Primarily consists of losses on Japan 3Win related foreign currency swaps, changes in fair value on non-qualifying derivatives and fixed

maturities, FVO, and other investment gains and losses.

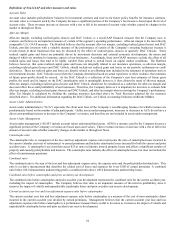

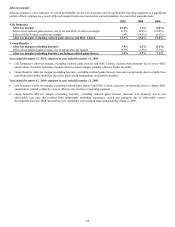

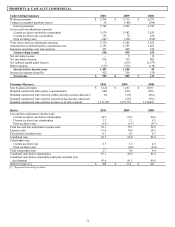

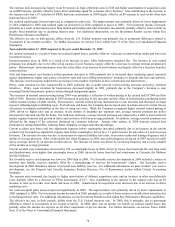

Details on the Company’ s net realized capital gains and losses are as follows:

Gross

g

ains and

losses on sales

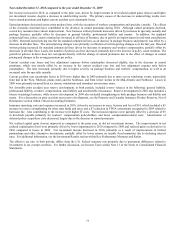

• Gross gains and losses on sales for the year ended December 31, 2010 were predominantly from sales of

investment grade corporate securities in order to take advantage of attractive market opportunities, as well as,

sales of U.S. Treasuries related to tactical repositioning of the portfolio.

• Gross gains and losses on sales for the year ended December 31, 2009 were predominantly within corporate,

government and structured securities. Also included were gains of $360 related to the sale of Verisk/ISO

securities. Gross gains and losses on sales primarily resulted from efforts to reduce portfolio risk through sales

of subordinated financials and real estate related securities and from sales of U.S. Treasuries to manage

liquidity.

• Gross gains and losses on sales for the year ended December 31, 2008 primarily resulted from the decision to

reallocate the portfolio to securities with more favorable risk/return profiles. Also included was a gain of $141

from the sale of a synthetic CDO.

Net OTTI losses • For further information, see Other-Than-Temporary Impairments within the Investment Credit Risk section of

the MD&A.

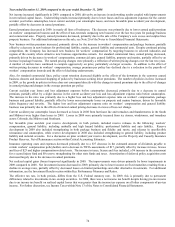

Valuation

allowances on

mortgage loans

• For further information, see Valuation Allowances on Mortgage Loans within the Investment Credit Risk

section of the MD&A.