The Hartford 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 64

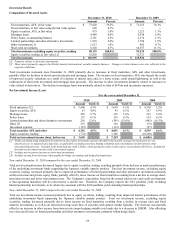

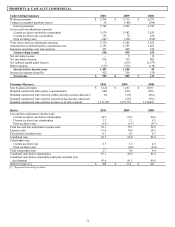

Mutual Fund Assets

Mutual fund assets include retail, investment-only and college savings plan assets under Section 529 of the Code, collectively referred to

as non-proprietary, and proprietary mutual funds. Non-proprietary mutual fund assets are owned by the shareholders of those funds and

not by the Company. Proprietary mutual funds include mutual funds sponsored by the Company which are owned by the separate

accounts of the Company to support insurance and investment products sold by the Company. The non-proprietary mutual fund assets

are not reflected in the Company’ s consolidated financial statements. Mutual fund assets are a measure used by the Company because a

significant portion of the Company’ s revenues are based upon asset values. These revenues increase or decrease with a rise or fall in the

amount of account value whether caused by changes in the market or through net flows.

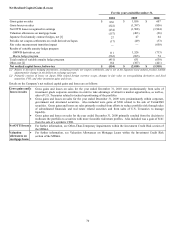

Net Investment Spread

Management evaluates performance of certain products based on net investment spread. These products include those that have

insignificant mortality risk, such as fixed annuities, certain general account universal life contracts and certain institutional contracts.

Net investment spread is determined by taking the difference between the earned rate, (excluding the effects of realized capital gains and

losses, including those related to the Company’ s GMWB product and related reinsurance and hedging programs), and the related

crediting rates on average general account assets under management. The net investment spreads are for the total portfolio of relevant

contracts in each segment and reflect business written at different times. When pricing products, the Company considers current

investment yields and not the portfolio average. The determination of credited rates is based upon consideration of current market rates

for similar products, portfolio yields and contractually guaranteed minimum credited rates. Net investment spread can be volatile period

over period, which can have a significant positive or negative effect on the operating results of each segment. The volatile nature of net

investment spread is driven primarily by earnings on limited partnership and other alternative investments and prepayment premiums on

securities. Investment earnings can also be influenced by factors such as changes in interest rates, credit spreads and decisions to hold

higher levels of short-term investments. Net investment spread is calculated by dividing net investment earnings by average reserves

using a 13-point average, less interest credited divided by average account value using a 13-point average.

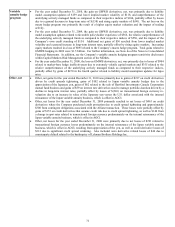

New business written premium

New business written premium represents the amount of premiums charged for policies issues to customers who were not insured with

the Company in the previous policy term. New business written premium plus renewal policy written premium equals total written

premium.

Policies in force

Policies in force represent the number of policies with coverage in effect as of the end of the period. The number of policies in force is a

growth measure used for Consumer Markets and standard commercial lines within Property & Casualty Commercial and is affected by

both new business growth and premium renewal retention.

Policy count retention

Policy count retention represents the ratio of the number of policies renewed during the period divided by the number of policies from

the previous policy term period. The number of policies available to renew from the previous policy term represents the number of

policies written in the previous policy term net of any cancellations of those policies. Policy count retention is affected by a number of

factors, including the percentage of renewal policy quotes accepted and decisions by the Company to non-renew policies because of

specific policy underwriting concerns or because of a decision to reduce premium writings in certain classes of business or states.

Policy count retention is also affected by advertising and rate actions taken by competitors.

Policyholder dividend ratio

The policyholder dividend ratio is the ratio of policyholder dividends to earned premium.

Prior accident year loss and loss adjustment expense ratio

The prior year loss and loss adjustment expense ratio represents the increase (decrease) in the estimated cost of settling catastrophe and

non-catastrophe claims incurred in prior accident years as recorded in the current calendar year divided by earned premiums.

Reinstatement premiums

Reinstatement premium represents additional ceded premium paid for the reinstatement of the amount of reinsurance coverage that was

reduced as a result of a reinsurance loss payment.

Renewal earned pricing increase (decrease)

Written premiums are earned over the policy term, which is six months for certain personal lines auto business and 12 months for

substantially all of the remainder of the Company’ s business. Because the Company earns premiums over the 6 to 12 month term of the

policies, renewal earned pricing increases (decreases) lag renewal written pricing increases (decreases) by 6 to 12 months.