The Hartford 2010 Annual Report Download - page 206

Download and view the complete annual report

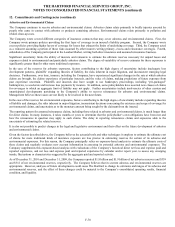

Please find page 206 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-78

15. Equity (continued)

On March 31, 2010, the Company repurchased all 3.4 million shares of Series E preferred stock issued to the Treasury for an aggregate

purchase price of $3.4 billion and made a final dividend payment of $22 on the Series E preferred stock. The Company recorded a $440

charge to retained earnings representing the acceleration of the accretion of the remaining discount on the Series E preferred stock.

On September 27, 2010, the Treasury sold its warrants to purchase approximately 52 million shares of The Hartford’ s common stock in

a secondary public offering for net proceeds of approximately $706. The Hartford did not receive any proceeds from this sale. The

warrants are exercisable, in whole or in part, at any time and from time to time until June 26, 2019 at an initial exercise price of $9.79.

The exercise price will be paid by the withholding by The Hartford of a number of shares of common stock issuable upon exercise of the

warrants equal to the value of the aggregate exercise price of the warrants so exercised determined by reference to the closing price of

The Hartford's common stock on the trading day on which the warrants are exercised and notice is delivered to the warrant agent. The

Hartford did not purchase any of the warrants sold by the Treasury.

Discretionary Equity Issuance Program

On June 12, 2009, the Company announced that it had commenced a discretionary equity issuance program, and in accordance with that

program entered into an equity distribution agreement pursuant to which it would offer up to 60 million shares of its common stock from

time to time for aggregate sales proceeds of up to $750.

On August 5, 2009, the Company increased the aggregate sales proceeds from $750 to $900.

On August 6, 2009, the Company announced the completion of the discretionary equity issuance program. The Hartford issued 56.1

million shares of common stock and received net proceeds of $887 under this program.

Stock Repurchase Program

The Hartford’ s Board of Directors has authorized a $1 billion stock repurchase program. The Company’ s repurchase authorization

permits purchases of common stock, which may be in the open market or through privately negotiated transactions. The Company also

may enter into derivative transactions to facilitate future repurchases of common stock. The timing of any future repurchases will be

dependent upon several factors, including the market price of the Company’ s securities, the Company’ s capital position, consideration

of the effect of any repurchases on the Company’ s financial strength or credit ratings, and other corporate considerations. The

repurchase program may be modified, extended or terminated by the Board of Directors at any time. The Company has $807 remaining

under this stock repurchase program.

Noncontrolling Interests

Noncontrolling interest includes VIEs in which the Company has concluded that it is the primary beneficiary, see Note 5 for further

discussion of the Company’ s involvement in VIEs, and general account mutual funds where the Company holds the majority interest

due to seed money investments.

In 2009, the Company recorded noncontrolling interest as a component of equity. The noncontrolling interest within these entities is

likely to change, as these entities represent investment vehicles whereby investors may frequently redeem or contribute to these

investments. As such, the change in noncontrolling ownership interest represented in the Company’ s Consolidated Statement of

Changes in Equity will primarily represent redemptions and additional subscriptions within these investment vehicles.

In 2010, the Company recognized the noncontrolling interest in these entities in other liabilities since these entities represent investment

vehicles whereby the noncontrolling interests may redeem these investments at any time.