The Hartford 2010 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

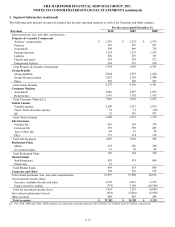

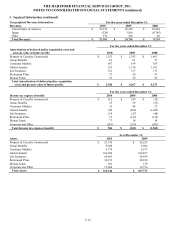

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-19

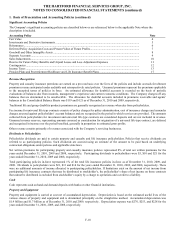

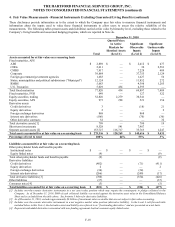

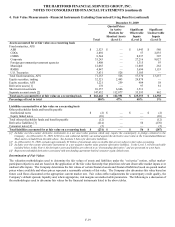

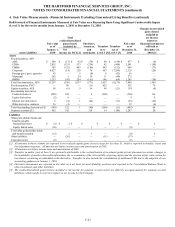

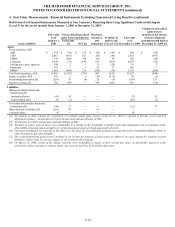

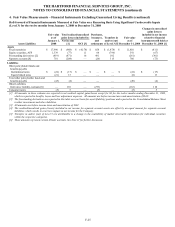

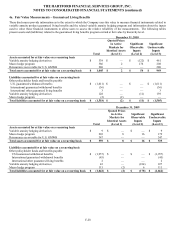

4. Fair Value Measurements –Financial Instruments Excluding Guaranteed Living Benefits (continued)

December 31, 2009

Total

Quoted Prices

in Active

Markets for

Identical Assets

(Level 1)

Significant

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets accounted for at fair value on a recurring basis

Fixed maturities, AFS

ABS $ 2,523 $ — $ 1,943 $ 580

CDOs 2,892 — 57 2,835

CMBS 8,544 — 8,237 307

Corporate 35,243 — 27,216 8,027

Foreign government/government agencies 1,408 — 1,315 93

Municipal 12,065 — 11,803 262

RMBS 4,847 — 3,694 1,153

U.S. Treasuries 3,631 526 3,105 —

Total fixed maturities, AFS 71,153 526 57,370 13,257

Equity securities, trading 32,321 2,443 29,878 —

Equity securities, AFS 1,221 259 904 58

Derivative assets [1] 178 — 97 81

Short-term investments 10,357 6,846 3,511 —

Separate account assets [2] 147,432 112,877 33,593 962

Total assets accounted for at fair value on a recurring basis $ 262,662 $ 122,951 $ 125,353 $ 14,358

Percentage of level to total 100% 47% 48% 5%

Liabilities accounted for at fair value on a recurring basis

Other policyholder funds and benefits payable

Institutional notes $ (2) $ — $ — $ (2)

Equity linked notes (10) — — (10)

Total other policyholder funds and benefits payable (12) — — (12)

Derivative liabilities [3] (214) — 56 (270)

Consumer notes [4] (5) — — (5)

Total liabilities accounted for at fair value on a recurring basis $ (231) $ — $ 56 $ (287)

[1] Includes over-the-counter derivative instruments in a net asset value position which may require the counterparty to pledge collateral to the

Company. As of December 31, 2009, $149 of a cash collateral liability was netted against the derivative asset value in the Consolidated Balance

Sheet and is excluded from the table above. See footnote 3 below for derivative liabilities.

[2] As of December 31, 2009, excludes approximately $3 billion of investment sales receivable that are not subject to fair value accounting.

[3] Includes over-the-counter derivative instruments in a net negative market value position (derivative liability). In the Level 3 roll-forward table

included below in this Note 4, the derivative asset and liability are referred to as “freestanding derivatives” and are presented on a net basis.

[4] Represents embedded derivatives associated with non-funding agreement-backed consumer equity linked notes.

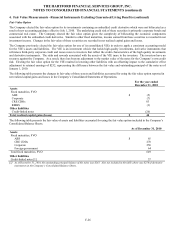

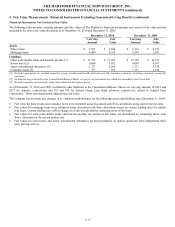

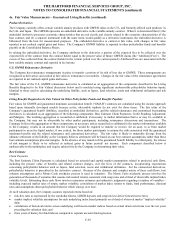

Determination of Fair Values

The valuation methodologies used to determine the fair values of assets and liabilities under the “exit price” notion, reflect market-

participant objectives and are based on the application of the fair value hierarchy that prioritizes relevant observable market inputs over

unobservable inputs. The Company determines the fair values of certain financial assets and financial liabilities based on quoted market

prices where available and where prices represent a reasonable estimate of fair value. The Company also determines fair value based on

future cash flows discounted at the appropriate current market rate. Fair values reflect adjustments for counterparty credit quality, the

Company’ s default spreads, liquidity and, where appropriate, risk margins on unobservable parameters. The following is a discussion of

the methodologies used to determine fair values for the financial instruments listed in the above tables.