The Hartford 2010 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

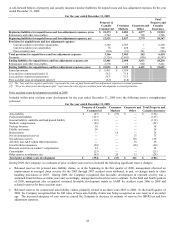

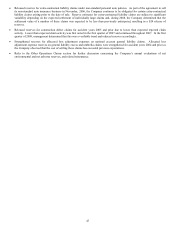

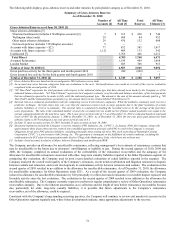

The table above shows the cumulative deficiency (redundancy) of the Company’ s reserves, net of reinsurance, as now estimated with the

benefit of additional information. Those amounts are comprised of changes in estimates of gross losses and changes in estimates of

related reinsurance recoveries.

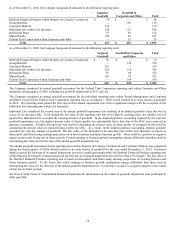

The table below, for the periods presented, reconciles the net reserves to the gross reserves, as initially estimated and recorded, and as

currently estimated and recorded, and computes the cumulative deficiency (redundancy) of the Company’ s reserves before reinsurance.

Loss And Loss Adjustment Expense Liability Development - Gross

For the Years Ended December 31, [1]

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

Net reserve, as initially estimated $ 12,860 $ 13,141 $16,218 $16,191 $16,863 $17,604 $18,231 $ 18,347 $18,210 $17,948

Reinsurance and other recoverables, as

initially estimated 4,176 3,950 5,497 5,138 5,403 4,387 3,922 3,586 3,441 3,077

Gross reserve, as initially estimated $ 17,036 $ 17,091 $21,715 $21,329 $22,266 $21,991 $22,153 $ 21,933 $21,651 $21,025

Net re-estimated reserve $ 19,452 $ 19,373 $19,063 $17,777 $17,613 $17,439 $17,700 $ 18,004 $18,014

Re-estimated and other reinsurance

recoverables 5,908 5,511 5,423 5,311 5,646 4,069 3,785 3,459 2,959

Gross re-estimated reserve $ 25,360 $ 24,884 $24,486 $23,088 $23,259 $21,508 $21,485 $ 21,463 $20,973

Gross deficiency (redundancy) $ 8,324 $ 7,793 $2,771 $1,759 $ 993 $ (483) $(668) $ (470) $(678)

[1] The above table excludes Hartford Insurance, Singapore as a result of its sale in September 2001; Hartford Seguros as a result of its sale in

February 2001.

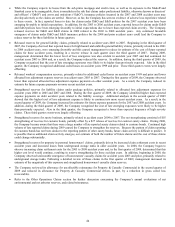

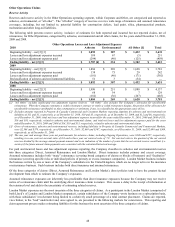

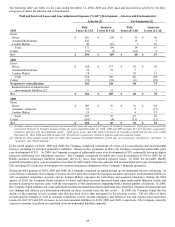

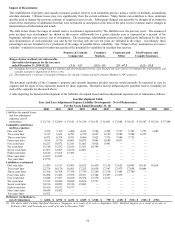

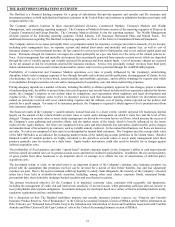

The following table is derived from the Loss Development table and summarizes the effect of reserve re-estimates, net of reinsurance,

on calendar year operations for the ten-year period ended December 31, 2010. The total of each column details the amount of reserve

re-estimates made in the indicated calendar year and shows the accident years to which the re-estimates are applicable. The amounts in

the total accident year column on the far right represent the cumulative reserve re-estimates during the ten year period ended December

31, 2010 for the indicated accident year(s).

Effect of Net Reserve Re-estimates on Calendar Year Operations

Calendar Year

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Total

By Accident year

2000 & Prior $ 143 $ 317 $ 2,984 $ 824 $ 464 $ 464 $ 704 $ 194 $ 239 $ 273 $ 6,606

2001 — (24) 39 (232) 193 38 55 12 61 (13) 129

2002 — — (199) (56) 180 36 (5) 2 (12) (13) (67)

2003 — — — (122) (237) (31) (126) (21) (6) (20) (563)

2004 — — — — (352) (108) (226) (83) (56) (20) (845)

2005 — — — — — (103) (214) (133) (47) (91) (588)

2006 — — — — — — (140) (148) (213) (118) (619)

2007 — — — — — — — (49) (113) (156) (318)

2008 — — — — — — — — (39) 1 (38)

2009 — — — — — — — — — (39) (39)

Total $ 143 $ 293 $ 2,824 $ 414 $ 248 $ 296 $ 48 $ (226) $ (186) $(196) $3,658

During the 2007 calendar year, the Company refined its processes for allocating incurred but not reported (“IBNR”) reserves by accident

year, resulting in a reclassification of $347 of IBNR reserves from the 2003 to 2006 accident years to the 2002 and prior accident years.

This reclassification of reserves by accident year had no effect on total recorded reserves within any segment or on total recorded

reserves for any line of business within a segment.

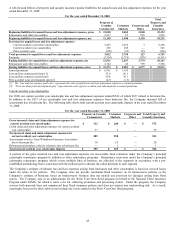

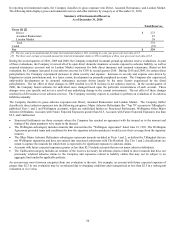

Reserve changes for accident years 2000 & Prior

The largest impacts of net reserve re-estimates are shown in the “2000 & Prior” accident years. Reserve deterioration was related to

calendar years, driven, in part, by deterioration of reserves for assumed casualty reinsurance and workers’ compensation claims.

Numerous actuarial assumptions on assumed casualty reinsurance turned out to be low, including loss cost trends, particularly on excess

of loss business, and the impact of deteriorating terms and conditions. Workers’ compensation reserves also deteriorated, as medical

inflation trends were above initial expectations.

The reserve re-estimates in calendar year 2003 include an increase in reserves of $2.6 billion related to reserve strengthening based on

the Company’ s evaluation of its asbestos reserves. The reserve evaluation that led to the strengthening in calendar year 2003 confirmed

the Company’ s view of the existence of a substantial long-term deterioration in the asbestos litigation environment. The reserve re-

estimates in calendar years 2004 and 2006 were largely attributable to reductions in the reinsurance recoverable asset associated with

older, long-term casualty liabilities.