The Hartford 2010 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-50

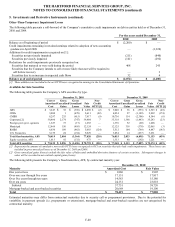

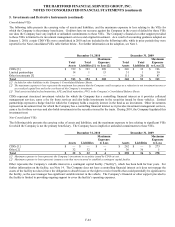

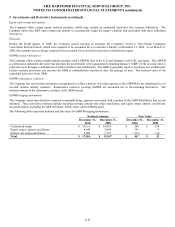

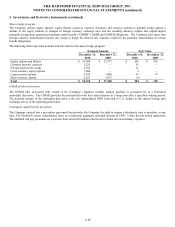

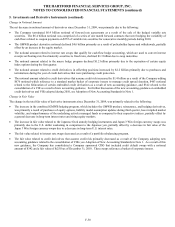

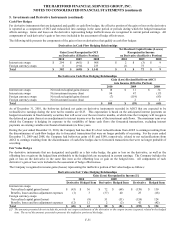

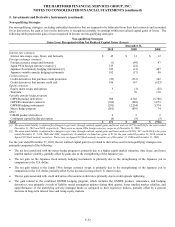

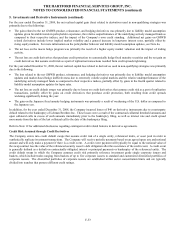

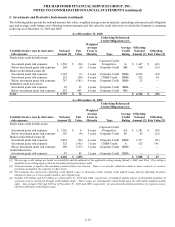

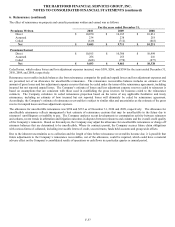

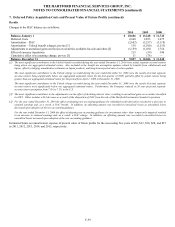

5. Investments and Derivative Instruments (continued)

Change in Notional Amount

The net decrease in notional amount of derivatives since December 31, 2009, was primarily due to the following:

• The Company terminated $6.4 billion notional of forward rate agreements as a result of the sale of the hedged variable rate

securities. The $6.4 billion notional was comprised of a series of one month forward contracts that were hedging the variability of

cash flows related to coupon payments on $555 of variable rate securities for consecutive monthly periods during 2010.

• The GMWB product derivative notional declined $4.6 billion primarily as a result of policyholder lapses and withdrawals, partially

offset by an increase in the equity market.

• The notional amount related to interest rate swaps that qualify for cash flow hedge accounting, which are used to convert interest

receipts on floating-rate fixed maturity securities to fixed rates, declined $1.3 billion due to swap maturities.

• The notional amount related to the macro hedge program declined $1.2 billion primarily due to the expiration of certain equity

index options during the first quarter.

• The notional amount related to credit derivatives in offsetting positions increased by $2.2 billion primarily due to purchases and

terminations during the year of credit derivatives that were purchasing credit protection.

• The notional amount related to credit derivatives that assume credit risk increased by $1.4 billion as a result of the Company adding

$676 notional which reference to a standard market basket of corporate issuers to manage credit spread duration, $463 notional

related to the bifurcation of certain embedded credit derivatives as a result of new accounting guidance, and $342 related to the

consolidation of a VIE as a result of new accounting guidance. For further discussion of the new accounting guidance on embedded

credit derivatives and VIEs adopted during 2010, see Adoption of New Accounting Standards in Note 1.

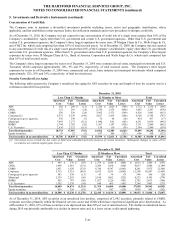

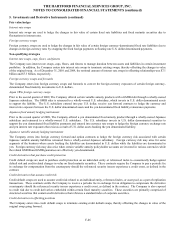

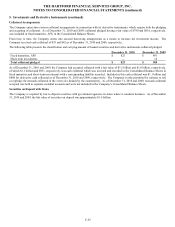

Change in Fair Value

The change in the total fair value of derivative instruments since December 31, 2009, was primarily related to the following:

• The increase in the combined GMWB hedging program, which includes the GMWB product, reinsurance, and hedging derivatives,

was primarily a result of purchases of equity options, liability model assumption updates during third quarter, lower implied market

volatility, and outperformance of the underlying actively managed funds as compared to their respective indices, partially offset by

a general decrease in long-term interest rates and rising equity markets.

• The increase in fair value related to the Japanese fixed annuity hedging instruments and Japan 3 Win foreign currency swaps was

primarily due to the U.S. dollar weakening in comparison to the Japanese yen, partially offset by a decrease in fair value of the

Japan 3 Win foreign currency swaps due to a decrease in long-term U.S. interest rates.

• The fair value related to interest rate swaps decreased as a result of a portfolio rebalancing program.

• The fair value related to credit derivatives that assume credit risk primarily decreased as a result of the Company adopting new

accounting guidance related to the consolidation of VIEs; see Adoption of New Accounting Standards in Note 1. As a result of this

new guidance, the Company has consolidated a Company sponsored CDO that included credit default swaps with a notional

amount of $342 and a fair value of $(250) as of December 31, 2010. These swaps reference a basket of corporate issuers.