The Hartford 2010 Annual Report Download - page 141

Download and view the complete annual report

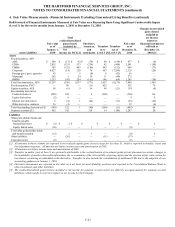

Please find page 141 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-13

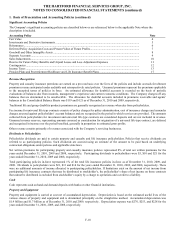

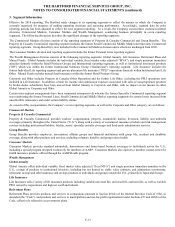

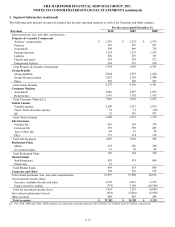

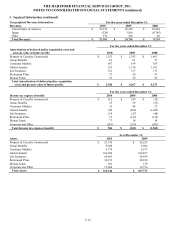

3. Segment Information

Effective for 2010 reporting, The Hartford made changes to its reporting segments to reflect the manner in which the Company is

currently organized for purposes of making operating decisions and assessing performance. Accordingly, segment data for prior

reporting periods has been adjusted to reflect the new segment reporting. As a result, the Company created three customer-oriented

divisions, Commercial Markets, Consumer Markets and Wealth Management, conducting business principally in seven reporting

segments. The following discussion describes the significant changes to the reporting segments:

The Commercial Markets division consists of the reporting segments of Property & Casualty Commercial and Group Benefits. The

Property & Casualty Commercial reporting segment includes the former Small Commercial, Middle Market and Specialty Commercial

reporting segments. Group Benefits is now included in the Commercial Markets division and is otherwise unchanged from 2009.

The Consumer Markets division and reporting segment includes the former Personal Lines reporting segment.

The Wealth Management division consists of the following reporting segments: Global Annuity, Life Insurance, Retirement Plans and

Mutual Funds. Global Annuity includes the individual variable, fixed market value adjusted (“MVA”), and single premium immediate

annuities formerly within the Retail Products Groups and International reporting segments, as well as institutional investment products

(“IIP”) which was within the former Institutional Solutions Group (“Institutional”) reporting segment. Life Insurance includes the

former Individual Life reporting segment and private placement life insurance (“PPLI”) operations formerly within Institutional and Life

Other. Mutual Funds includes mutual fund businesses within the former Retail Products Group.

Corporate and Other includes Property & Casualty Other Operations and the former Life Other, excluding the PPLI operations now

included in Life Insurance. In addition, certain fee income and commission expenses associated with sales of non-proprietary products

by broker-dealer subsidiaries have been moved from Global Annuity to Corporate and Other, with no impact on net income in either

Global Annuity or Corporate and Other.

Certain inter-segment arrangements have been terminated retrospectively whereby the former Specialty Commercial reporting segment

was reimbursing the former Personal Lines, Small Commercial and Middle Market reporting segments for certain losses incurred from

uncollectible reinsurance and under certain liability claims.

As a result of this reorganization, the Company’ s seven reporting segments, as well as the Corporate and Other category, are as follows:

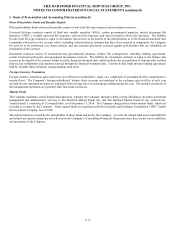

Commercial Markets

Property & Casualty Commercial

Property & Casualty Commercial provides workers’ compensation, property, automobile, marine, livestock, liability and umbrella

coverages primarily throughout the United States (“U.S.”), along with a variety of customized insurance products and risk management

services including professional liability, fidelity, surety, specialty casualty coverages and third-party administrator services.

Group Benefits

Group Benefits provides employers, associations, affinity groups and financial institutions with group life, accident and disability

coverage, along with other products and services, including voluntary benefits, and group retiree health.

Consumer Markets

Consumer Markets provides standard automobile, homeowners and home-based business coverages to individuals across the U.S.,

including a special program designed exclusively for members of AARP. Consumer Markets also operates a member contact center for

health insurance products offered through the AARP Health program.

Wealth Management

Global Annuity

Global Annuity offers individual variable, fixed market value adjusted (“fixed MVA”) and single premium immediate annuities in the

U.S., a range of products to institutional investors, including but not limited to, stable value contracts, and administers investments,

retirement savings and other insurance and savings products to individuals and groups outside the U.S., primarily in Japan and Europe.

Life Insurance

Life Insurance sells a variety of life insurance products, including variable universal life, universal life, and term life, as well as variable

PPLI owned by corporations and high net worth individuals.

Retirement Plans

Retirement Plans provides products and services to corporations pursuant to Section 401(k) of the Internal Revenue Code of 1986, as

amended (the “Code”), and products and services to municipalities and not-for-profit organizations under Sections 457 and 403(b) of the

Code, collectively referred to as government plans.