Rosetta Stone 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

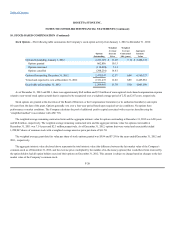

determined that the total contingent consideration for inclusion in the purchase price was the maximum was $1.1 million, the fair value of which was

$850,000. Including the cash paid upon the acquisition date of $100,000, the total purchase price was $950,000. Together with the initial payment and

the first contingent payment made in 2009 and 2010, respectively, we made additional payments of $300,000 and $350,000 in accordance with the

terms of the purchase in 2012 and 2011, respectively.

Under the purchase method of accounting, the total purchase price was allocated to the tangible and intangible assets acquired on the basis of their

respective estimated fair values at the date of acquisition. The valuation of the identifiable intangible assets and their useful lives acquired reflects

management's estimates.

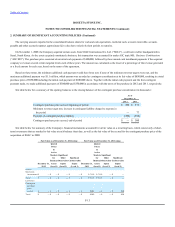

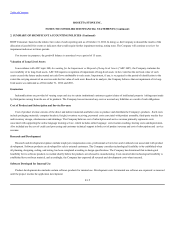

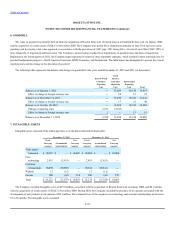

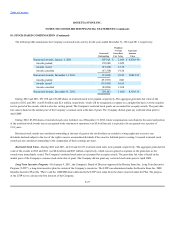

The summary of fair value of assets acquired in the asset acquisition is as follows (in thousands):

A total of $100,000 was allocated to amortizable intangible assets consisting of customer relationships, and a total of $620,257 was allocated to

goodwill. Goodwill represents the excess of the purchase price over the fair value of tangible and amortizable intangible assets acquired.

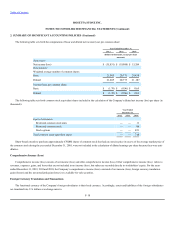

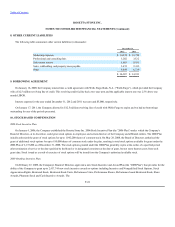

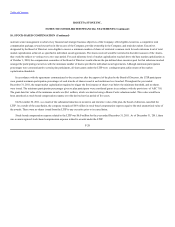

Property and equipment consisted of the following (in thousands):

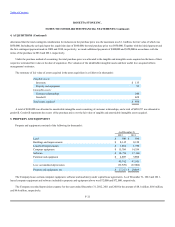

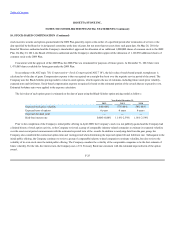

The Company leases certain computer equipment, software and machinery under capital lease agreements. As of December 31, 2012 and 2011,

leased computer equipment and software included in property and equipment above was $72,000 and $72,000, respectively.

The Company recorded depreciation expense for the years ended December 31, 2012, 2011 and 2010 in the amount of $8.1 million, $8.6 million,

and $6.6 million, respectively.

F-21

Inventory $ 135

Property and equipment 95

Customer relationships 100

Goodwill 620

Total assets acquired $ 950

Land $ 390 $ 390

Buildings and improvements $ 8,145 8,120

Leasehold improvements $ 1,854 1,739

Computer equipment $ 15,704 14,534

Software $ 18,754 17,168

Furniture and equipment $ 4,895 5,980

49,742 47,931

Less: accumulated depreciation (32,529) (27,062)

Property and equipment, net $ 17,213 $ 20,869