Rosetta Stone 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

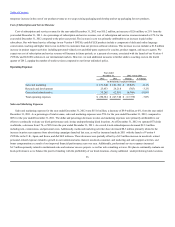

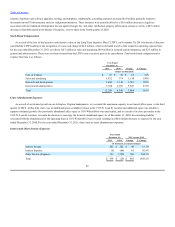

Interest income represents interest earned on our cash and cash equivalents. Interest income for the year ended December 31, 2011 was $302,000,

an increase of $40,000, or 15%, from the year ended December 31, 2010.

Interest expense is primarily related to our short-term investment account as well as interest related to our capital leases. Interest expense for the

year ended December 31, 2011 was $5,000, a decrease of $61,000 or 92%, from the year ended December 31, 2010.

We expect interest expense to be minimal in upcoming quarters as we allowed the revolving line of credit with Wells Fargo to expire on

January 17, 2011.

Other income for the year ended December 31, 2011 was $142,000, an increase of $0.4 million, or 165%, from the year ended December 31,

2010. The increase was primarily due to an increase in foreign exchange gains and an increase in copyright infringement settlements compared to the

prior year period.

Income tax benefit for the year ended December 31, 2011 was $8.0 million, an increase of $7.6 million, compared to the year ended December 31,

2010. The increase was the result of a decrease of $40.8 million in pre-tax income for the year ended December 31, 2011 and a higher effective tax rate,

compared to the year ended December 31, 2010. Our effective tax rate increased to 29% for the year ended December 31, 2011 compared to (3%) for

the year ended December 31, 2010. The increase in our effective tax rate was a result of changes in the geographic distribution of our income, the non-

deductibility of expenses related to the cancellation of the LTIP and the release in the year ended December 31, 2010 of the valuation allowance on net

operating loss carryforwards and other deferred tax assets of our United Kingdom and Japan subsidiaries.

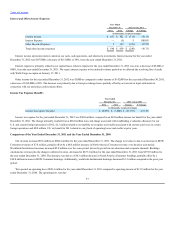

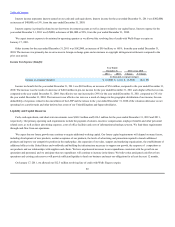

Cash, cash equivalents, and short-term investments were $148.3 million and $116.3 million for the years ended December 31, 2012 and 2011,

respectively. Our primary operating cash requirements include the payment of salaries, incentive compensation, employee benefits and other personnel

related costs, as well as direct advertising expenses, costs of office facilities and costs of information technology systems. We fund these requirements

through cash flow from our operations.

We expect that our future growth may continue to require additional working capital. Our future capital requirements will depend on many factors,

including development of new products, market acceptance of our products, the levels of advertising and promotion required to launch additional

products and improve our competitive position in the marketplace, the expansion of our sales, support and marketing organizations, the establishment of

additional offices in the United States and worldwide and building the infrastructure necessary to support our growth, the response of competitors to

our products and our relationships with suppliers and clients. We have experienced increases in our expenditures consistent with the growth in our

operations and personnel, and we anticipate that our expenditures will continue to increase in the future. We believe that anticipated cash flows from

operations and existing cash reserves will provide sufficient liquidity to fund our business and meet our obligations for at least the next 12 months.

On January 17, 2011, we allowed our $12.5 million revolving line of credit with Wells Fargo to expire.

63

Income tax expense (benefit) $ (7,980) $ (411) $ (7,569) 1841.6%