Rosetta Stone 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

The total amount of cash that was held by foreign subsidiaries as of December 31, 2012 was $18.6 million. If we were to repatriate the cash from

our foreign subsidiaries, a significant tax liability may result.

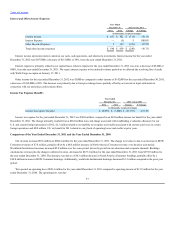

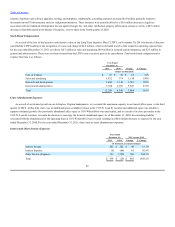

Net cash provided by operating activities was $34.9 million for the year ended December 31, 2012 compared to $3.4 million for the year ended

December 31, 2011, an increase of $31.5 million. Net cash provided by operating activities was primarily due to an increase in deferred revenue of

$11.5 million as a result of increased online subscription revenue, an increase in accrued compensation of $5.1 million related to an increase in our

accrued bonus, and a decrease in our net loss after adjusted for depreciation, amortization, stock compensation, and valuation allowance. The net loss

totaled $35.8 million for the year ended December 31, 2012 compared to net loss of $20.0 million for the year ended December 31, 2011. For the year

ended December 31, 2012, we incurred depreciation, amortization, stock compensation expense, and tax expenses incurred as a result of the valuation

allowance of $43.1 million, compared to $19.8 million for the year ended December 31, 2011.

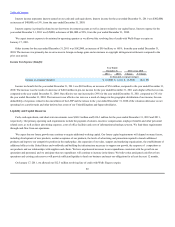

Net cash provided by investing activities was $5.5 million for the year ended December 31, 2012, compared to net cash used of $13.3 million for

the year ended December 31, 2011, an increase of $18.8 million. This increase is primarily related to less spending on property and equipment

associated with the expansion of our technology infrastructure and our facilities in the prior year period as well as the expiry of our short-term

investments that were not reinvested.

Net cash provided by financing activities was $0.6 million for the year ended December 31, 2012 compared to $0.9 million for the year ended

December 31, 2011. Net cash provided by financing activities during the year ended December 31, 2012 primarily related to the decrease in tax benefit

of stock options exercised.

We believe our current cash and cash equivalents, short term investments and funds generated from our operations will be sufficient to meet our

working capital and capital expenditure requirements through the foreseeable future, including at least the next 12 months. Thereafter, we may need to

raise additional funds through public or private financings or borrowings to develop or enhance products, to fund expansion, to respond to competitive

pressures or to acquire complementary products, businesses or technologies. If required, additional financing may not be available on terms that are

favorable to us, if at all. If we raise additional funds through the issuance of equity or convertible debt securities, the percentage ownership of our

stockholders will be reduced and these securities might have rights, preferences and privileges senior to those of our current stockholders. No assurance

can be given that additional financing will be available or that, if available, such financing can be obtained on terms favorable to our stockholders and us.

During the last three years, inflation has not had a material effect on our business and we do not expect that inflation or changing prices will

materially affect our business in the foreseeable future.

We do not engage in any off-balance sheet financing arrangements. We do not have any interest in entities referred to as variable interest entities,

which include special purpose entities and other structured finance entities.

64