Rosetta Stone 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

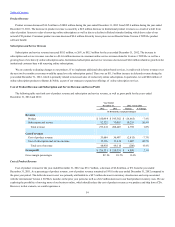

we have concluded that the valuation allowance established as of September 30, 2012 for the U.S. deferred tax assets remained at December 31, 2012.

The analysis of the need for a valuation allowance on Brazil deferred tax assets as of December 31, 2012 considers that while we anticipate future

taxable income in Brazil, and there is no expiration period for net operating loss carryforwards, the recovery of the carryforwards is limited to a portion

of taxable income each year making the length of time to recover the asset difficult to predict. As a result we have concluded that the valuation allowance

established as of September 30, 2012 for the Brazil deferred tax assets remained at December 31, 2012.

The analysis of the need for a valuation allowance on Japan deferred tax assets as of December 31, 2012 considers anticipated future taxable

income in Japan against evidence of recent losses and the expectation that the Japan subsidiary will be in a three-year cumulative loss with no ability to

carryback net operating losses and limited time to utilize net operating loss carryforwards. As a result we have concluded that the valuation allowance

established as of September 30, 2012 for the Japan deferred tax assets remained at December 31, 2012.

Our evaluation of the Korea subsidiary as of December 31, 2012 has resulted in no change to our assessment from June 30, 2012, and the

valuation allowance established as of June 30, 2012 remained at December 31, 2012.

Our evaluation of the remaining jurisdictions as of December 31, 2012 resulted in the determination that no valuation allowances were necessary at

this time. However, we will continue to assess the need for a valuation allowance against its deferred tax assets in the future.

In 2010, we recognized a tax benefit of $2.4 million due to the release of the valuation allowance on deferred tax assets of non-U.S. subsidiaries

which we believe are more likely than not to be realized. Our effective income tax rate in 2010 benefited from the availability of previously unrealized

deferred tax assets which we utilized to reduce tax expense for United Kingdom and Japanese income tax purposes. A MLTN assessment of deferred

tax assets is required on a jurisdiction by jurisdiction basis. Historical operating income and continuing projected income represented sufficient positive

evidence that we used to conclude that it is more likely than not that our deferred tax assets will be realized and accordingly, a release of our valuation

allowance was recorded in the fourth quarter of 2010.

50