Rosetta Stone 2012 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

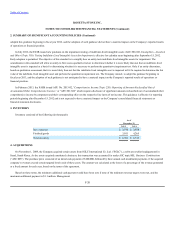

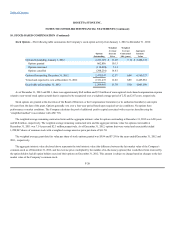

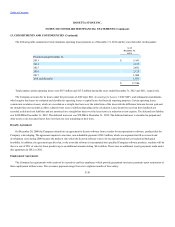

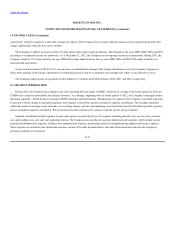

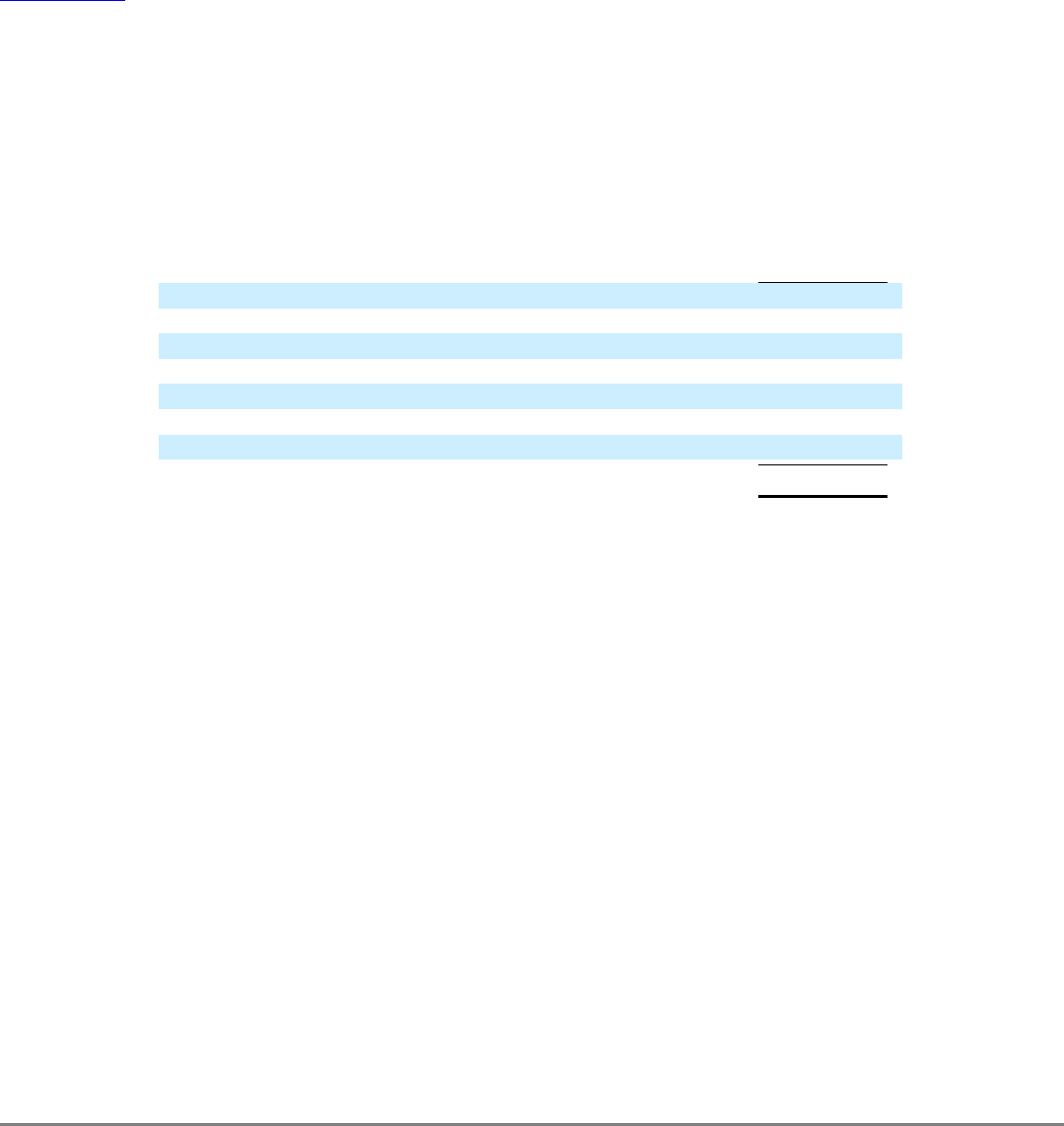

The following table summarizes future minimum operating lease payments as of December 31, 2012 and the years thereafter (in thousands):

Total expenses under operating leases were $9.5 million and $13.5 million during the years ended December 31, 2012 and 2011, respectively.

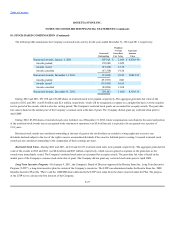

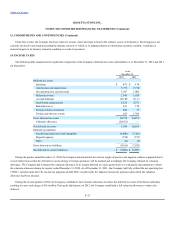

The Company accounts for its leases under the provisions of ASC topic 840, ("ASC 840"), and subsequent amendments,

which require that leases be evaluated and classified as operating leases or capital leases for financial reporting purposes. Certain operating leases

contain rent escalation clauses, which are recorded on a straight-line basis over the initial term of the lease with the difference between the rent paid and

the straight-line rent recorded as either a deferred rent asset or liability depending on the calculation. Lease incentives received from landlords are

recorded as deferred rent liabilities and are amortized on a straight-line basis over the lease term as a reduction to rent expense. The deferred rent liability

was $439,000 at December 31, 2012. The deferred rent asset was $78,000 at December 31, 2012. The deferred rent asset is classified in prepaid and

other assets as all associated leases have less than one year remaining on their term.

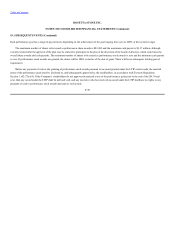

On December 28, 2006 the Company entered into an agreement to license software from a vendor for incorporation in software products that the

Company is developing. The agreement required a one-time, non-refundable payment of $0.3 million, which was expensed in full as research and

development costs during 2006 because the products into which the licensed software were to be incorporated had not yet reached technological

feasibility. In addition, the agreement specifies that, in the event the software is incorporated into specified Company software products, royalties will be

due at a rate of 20% of sales for those products up to an additional amount totaling $0.4 million. There were no additional royalty payments made under

this agreement in 2012 or 2011.

The Company has agreements with certain of its executives and key employees which provide guaranteed severance payments upon termination of

their employment without cause. The severance payments range from six to eighteen months of base salary.

F-30

Periods Ending December 31,

2013 $ 5,441

2014 3,725

2015 2,402

2016 2,125

2017 1,960

2018 and thereafter 1,933

$ 17,586