Rosetta Stone 2012 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

There were no changes in the valuation techniques or inputs used as the basis to calculate the contingent purchase price accrual.

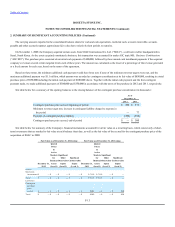

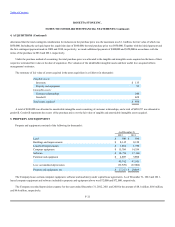

Property and equipment are stated at cost, less accumulated depreciation and amortization. Depreciation on property, leasehold improvements,

equipment, and software is computed on a straight-line basis over the estimated useful lives of the assets, as follows:

Expenses for repairs and maintenance that do not extend the life of equipment are charged to expense as incurred. Expenses for major renewals and

betterments, which significantly extend the useful lives of existing property and equipment, are capitalized and depreciated. Upon retirement or

disposition of property and equipment, the cost and related accumulated depreciation are removed from the accounts and any resulting gain or loss is

recognized.

Intangible assets consist of acquired technology, including developed and core technology, customer related assets, trade name and trademark, and

other intangible assets. Those intangible assets with finite lives are recorded at cost and amortized on a straight line basis over their expected lives in

accordance with ASC topic 350, ("ASC 350"). Annually, as of December 31, the Company reviews its indefinite

lived intangible assets for impairment based on the fair value of indefinite lived intangible assets as compared to the carrying value in accordance with

ASC 350. In the event the carrying value exceeds the fair value of the assets, the assets are written down to their fair value. There has been no

impairment of intangible assets during any of the periods presented.

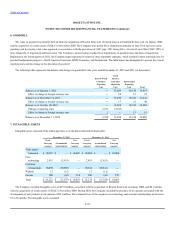

The value of goodwill is primarily derived from the acquisition of Rosetta Stone Ltd. (formerly known as Fairfield & Sons, Ltd.) in January 2006

and the acquisition of certain assets of SGLC in November 2009. The Company tests goodwill for impairment annually on June 30 of each year at the

reporting unit level using a fair value approach, in accordance with the provisions of ASC topic 350, ("ASC 350") or

more frequently, if impairment indicators arise. The Company's annual testing resulted in no impairments of goodwill since the dates of acquisition.

Beginning in the fourth quarter of 2012, the Company began reporting its results in three reportable segments, which resulted in three reporting

units for goodwill impairment purposes—North America Consumer, ROW Consumer, and Institutional. Accordingly, the Company allocated goodwill

from our former Consumer reporting unit to the new reporting units, North America Consumer and

F-14

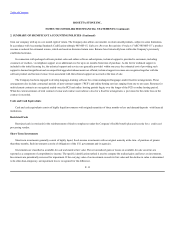

Software 3 years

Computer equipment 3-5 years

Automobiles 5 years

Furniture and equipment 5-7 years

Building 39 years

Building improvements 15 years

Leasehold improvements lesser of lease term or economic life

Assets under capital leases lesser of lease term or economic life