Rosetta Stone 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Rosetta Stone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

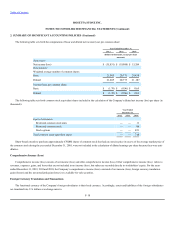

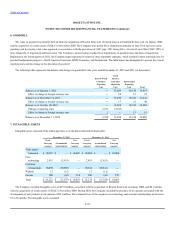

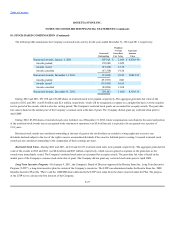

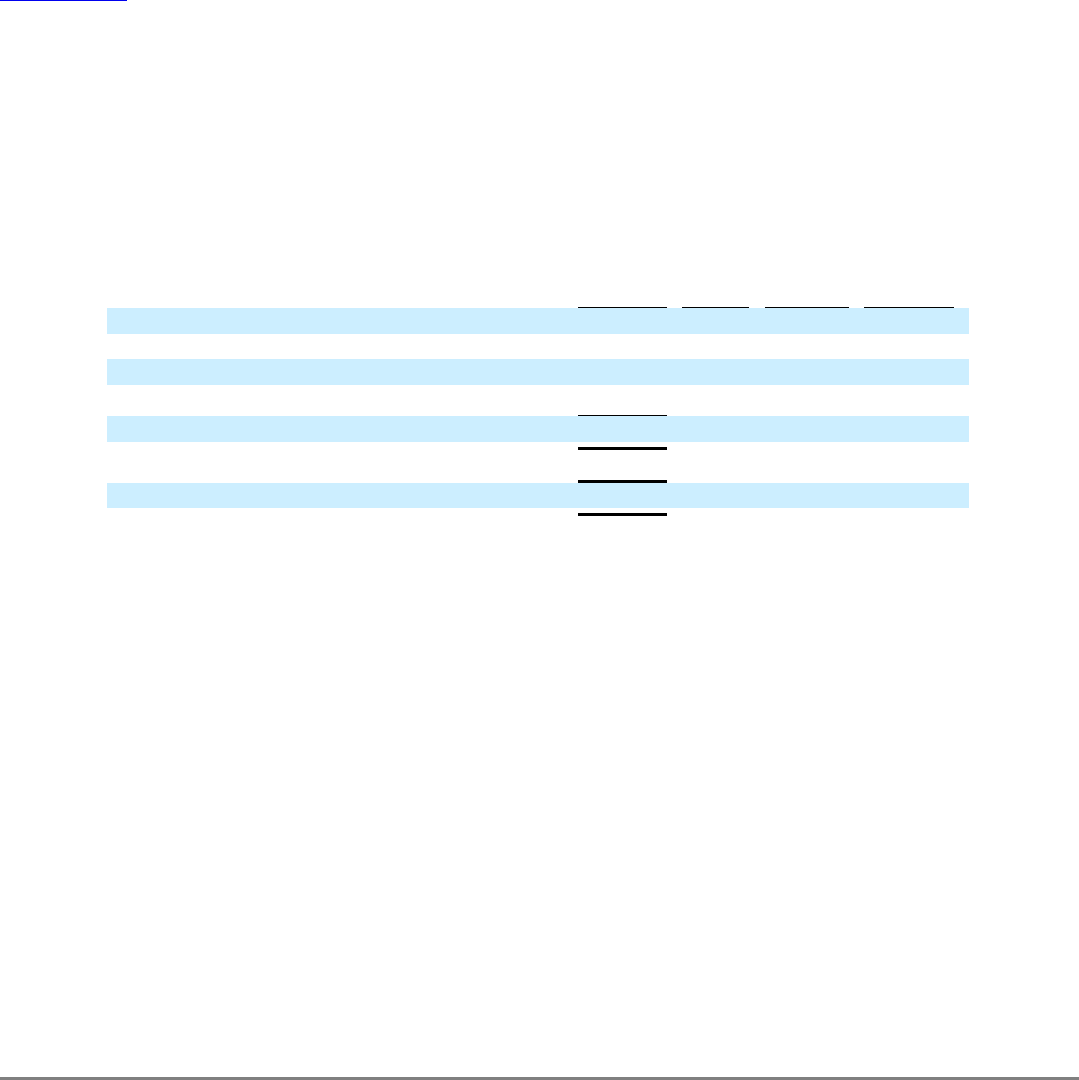

—The following table summarizes the Company's stock option activity from January 1, 2012 to December 31, 2012:

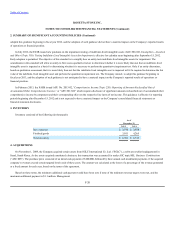

As of December 31, 2012 and 2011, there was approximately $6.8 million and $7.9 million of unrecognized stock-based compensation expense

related to non-vested stock option awards that is expected to be recognized over a weighted average period of 2.52 and 2.67 years, respectively.

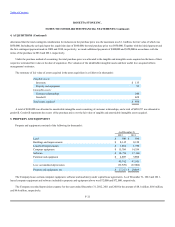

Stock options are granted at the discretion of the Board of Directors or the Compensation Committee (or its authorized member(s) and expire

10 years from the date of the grant. Options generally vest over a four-year period based upon required service conditions. No options have

performance or market conditions. The Company calculates the pool of additional paid-in capital associated with excess tax benefits using the

"simplified method" in accordance with ASC 718.

The weighted average remaining contractual term and the aggregate intrinsic value for options outstanding at December 31, 2012 was 6.98 years

and $6.8 million, respectively. The weighted average remaining contractual term and the aggregate intrinsic value for options exercisable at

December 31, 2011 was 7.14 years and $2.3 million, respectively. As of December 31, 2012, options that were vested and exercisable totaled

1,299,947 shares of common stock with a weighted average exercise price per share of $11.70.

The weighted average grant-date fair value per share of stock options granted was $5.94 and $7.35 for the years ended December 31, 2012 and

2011, respectively.

The aggregate intrinsic value disclosed above represents the total intrinsic value (the difference between the fair market value of the Company's

common stock as of December 31, 2012, and the exercise price, multiplied by the number of in-the-money options) that would have been received by

the option holders had all option holders exercised their options on December 31, 2012. This amount is subject to change based on changes to the fair

market value of the Company's common stock.

F-26

Options Outstanding, January 1, 2012 2,223,749 $ 13.29 7.14 $ 2,288,131

Options granted 662,856 10.13

Options exercised (118,024) 7.31

Options cancelled (298,234) 14.61

Options Outstanding, December 31, 2012 2,470,347 12.57 6.98 6,760,327

Vested and expected to vest at December 31, 2012 2,321,437 12.63 6.85 6,465,961

Exercisable at December 31, 2012 1,299,947 11.70 5.50 4,965,104